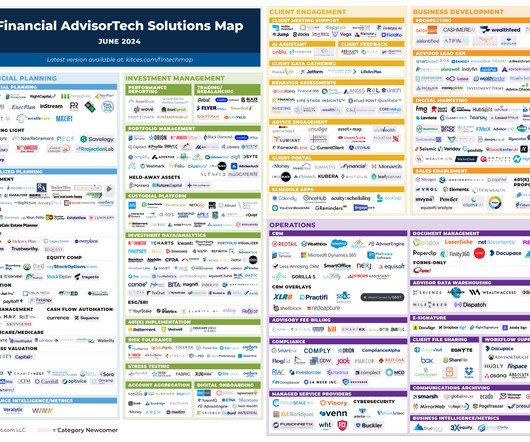

The Latest In Financial #AdvisorTech (June 2024)

Nerd's Eye View

JUNE 3, 2024

This month's edition kicks off with the news that 'startup' custodian Altruist has completed a $169 million fundraising round as it continues to rebuild the RIA custodial tech stack layer-by-layer while positioning itself as the biggest RIA custodian built from scratch and solely for advisors – which, while making it the clear #3 custodian behind (..)

Let's personalize your content