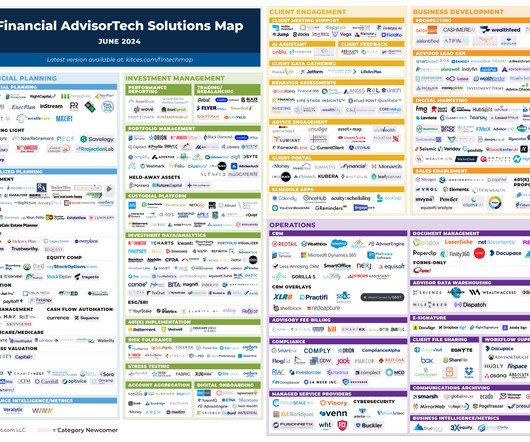

The Latest In Financial #AdvisorTech (June 2024)

Nerd's Eye View

JUNE 3, 2024

Welcome to the June 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Let's personalize your content