Value Hiding in Plain Sight: Undervalued Opportunities Within the S&P 500

Validea

JUNE 9, 2025

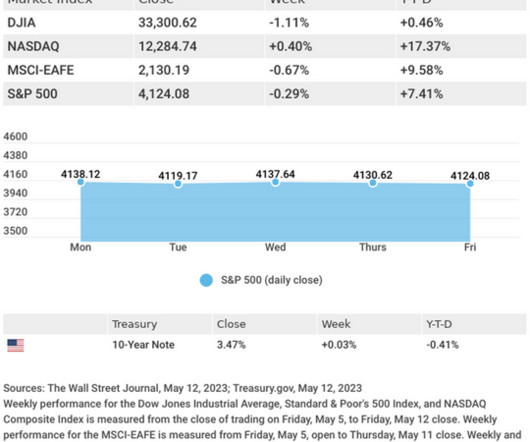

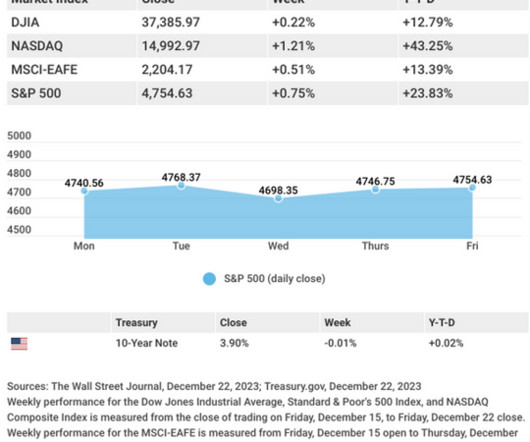

Their dominance has fueled strong index-level returns – but also led to stretched valuation multiples across the broader market. Other valuation metrics tell a similar story: Price-to-Sales and Price-to-Book ratios for the index are elevated. 5% UAL United Airlines 7.7 4.2 – 0.0% 3% LEN Lennar Corp 7.9 4% GM General Motors 6.8

Let's personalize your content