Tax Advice Restrictions For Financial Advisors: How To Offer Tax Planning And Remain In Compliance

Nerd's Eye View

NOVEMBER 30, 2022

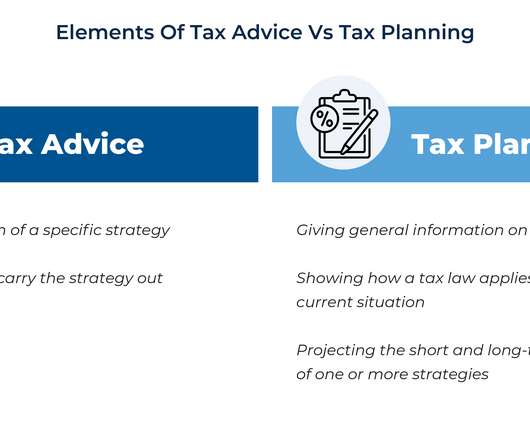

Almost every financial planning issue – whether it is retirement, investments, cash flow, insurance, or estate planning – has tax considerations, and advisors provide a great deal of value in helping clients minimize their overall tax burden.

Let's personalize your content