Seeking Best Execution: Understanding The SEC’s Expectations For Advisors To Deliver Best Outcomes For Clients

Nerd's Eye View

NOVEMBER 20, 2024

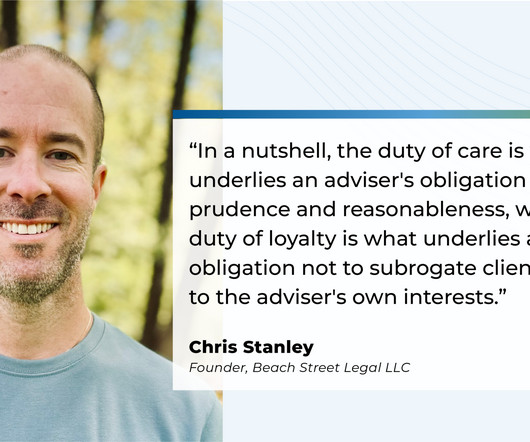

While this requirement might sound relatively straightforward, the lack of a single definition for what this duty actually requires can make it challenging for advisers seeking to understand precisely what it means to comply with this responsibility.

Let's personalize your content