Tap Into Your Clients’ Interest in Charitable Planning

Wealth Management

JUNE 9, 2025

Financial advisors should prioritize charitable giving discussions to meet growing client interest and strengthen relationships with younger generations.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 9, 2025

Financial advisors should prioritize charitable giving discussions to meet growing client interest and strengthen relationships with younger generations.

Nerd's Eye View

DECEMBER 18, 2024

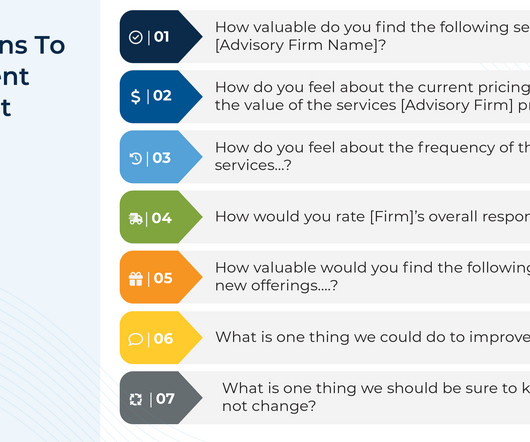

While state and Federal regulations clearly outline recordkeeping requirements for areas like financials, advertisements, and trading records, there is a notable gap when it comes to documenting the delivery of services – especially financial planning services – necessary to justify the fees charged for those services.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

NOVEMBER 19, 2024

Anjali is the Founder of FIT Advisors, an RIA based in Torrance, California (but works virtually with clients nationwide) and oversees $65 million in assets under management for 45 client households.

Nerd's Eye View

MAY 28, 2025

But as more individuals confront the emotional realities of this life transition, many find that the absence of structure, socialization, and identity once provided by work can create a gap that traditional retirement planning doesn't fully address. While the core elements of traditional retirement planning remain (e.g.,

Nerd's Eye View

DECEMBER 26, 2024

Just a few decades ago, giving financial advice was largely a manual process – printing lengthy financial plans, processing physical checks, and managing paper files. Many client concerns are deeply personal, requiring empathy, trust, and a nuanced understanding of complex emotional and financial situations.

Nerd's Eye View

NOVEMBER 25, 2024

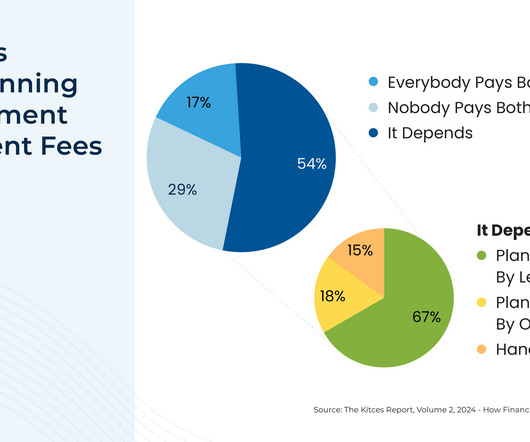

Over the past decade, a growing number of advisors have expanded into offering comprehensive financial planning services, reflecting a shift that not only helps them stand out from (increasingly commoditized) portfolio management offerings but also supports clients' broader financial goals.

Nerd's Eye View

NOVEMBER 27, 2024

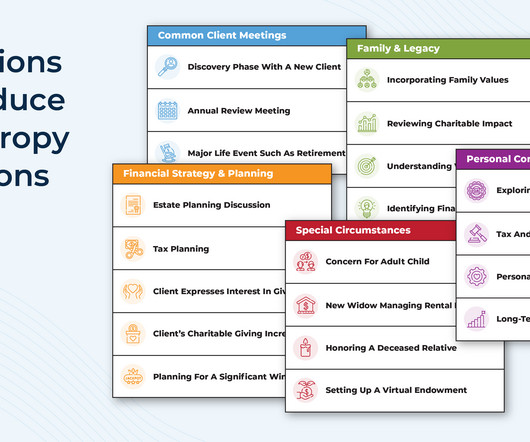

Yet, despite the important role that charitable giving can play, studies show that many advisors hesitate to bring up the topic with clients. Advisors may worry about overstepping boundaries or feel uncertain about a client's interest in philanthropy. These statements often stem from clients' life stories and core values.,

Nerd's Eye View

DECEMBER 11, 2024

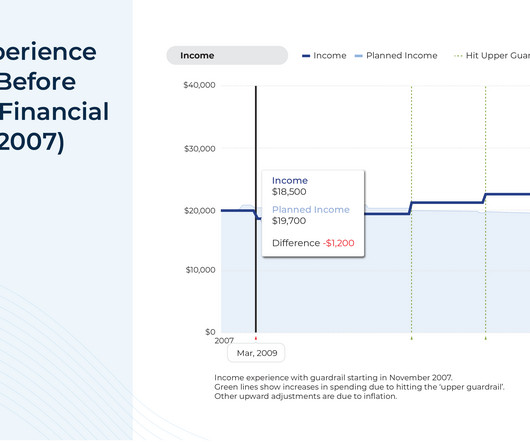

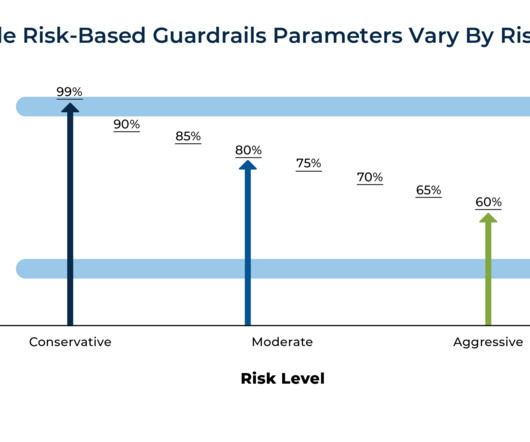

is perhaps the most fundamental question a client brings to their advisor. Advisors want to help clients set a secure, reliable retirement plan, yet even the most comprehensive assumptions will inevitably deviate from reality at least to some degree. "How much can I spend in retirement?"

Nerd's Eye View

APRIL 23, 2025

During periods of market volatility, it's common for financial advisors to receive calls from clients who are nervous about what a steep market decline might mean for their portfolio and long-term financial goals. But even when a client agrees with the reasoning in the moment, the anxiety often lingers.

Nerd's Eye View

MARCH 10, 2025

These services may range from 'standard' offerings like retirement planning to less traditional areas like credit card consulting. In a firm's early years, there tends to be more room for experimentation, with advisors adding new services to provide value and attract clients.

Nerd's Eye View

OCTOBER 29, 2024

Travis is the founder of Student Loan Planner, an RIA and student loan consulting company based in Chapel Hill, North Carolina that serves nearly 1,400 households with ongoing financial planning (as well as consulting with over 15,000 clients on student loan debt).

Nerd's Eye View

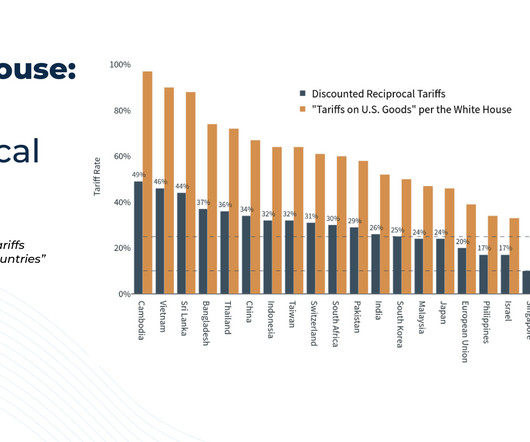

APRIL 23, 2025

During periods of market volatility, it's common for financial advisors to receive calls from clients who are nervous about what a steep market decline might mean for their portfolio and long-term financial goals. But even when a client agrees with the reasoning in the moment, the anxiety often lingers.

Nerd's Eye View

NOVEMBER 28, 2024

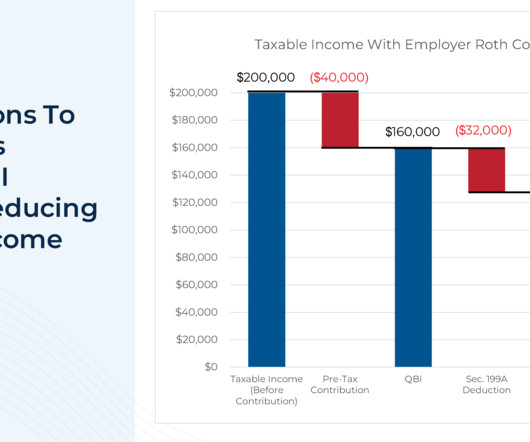

Still others may choose a hybrid model, combining AUM fees with additional charges for other services like tax planning. They also suggest how advisors with unsustainably low fees can shift their mindset, embrace their value, and realign their pricing to reflect both the tangible and intangible value they actually provide to clients.

Nerd's Eye View

JUNE 4, 2025

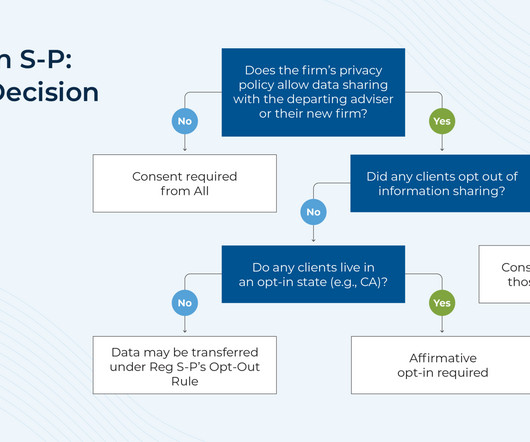

When a financial advisor transitions from one firm to another, they're often offered incentives by the new firm based on how much client revenue they bring with them. The challenge, however, is that advisors generally don't have the legal authority to simply transfer clients to a new firm.

Nerd's Eye View

DECEMBER 12, 2024

There's an old joke in the financial planning industry that the ideal client is "anyone with a pulse". However, as their firms mature, advisors often notice a divide manifesting between newer clients paying higher fees and 'legacy clients' from the early days paying discounted rates. take a physical and emotional toll.

Nerd's Eye View

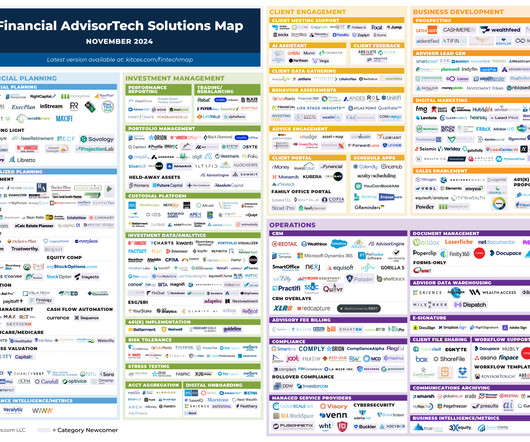

NOVEMBER 4, 2024

Welcome to the November 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Wealth Management

JUNE 16, 2025

Explore how 401(k) plan advisors can build trust with clients through transparency, consistency, and independent due diligence in the face of potential conflicts.

Nerd's Eye View

APRIL 9, 2025

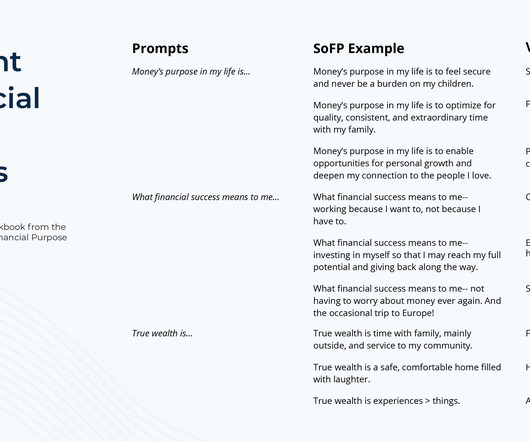

It's natural for advisors to begin discovery meetings by asking questions about a client's current financial situation – understanding cash flow, debt, investments, risk tolerance, or even the burning tax concern that brought them to the advisor's door in the first place is crucial for financial planning.

Nerd's Eye View

JUNE 3, 2025

Nina is a partner of Stratos CA, a hybrid advisory firm affiliated with Stratos Wealth Partners and based in Los Angeles, California, that oversees approximately $500 million in assets under management for 300 client households.

Nerd's Eye View

MAY 15, 2025

Young advisors may feel – and face – an extra burden to prove their expertise to clients. After all, it can feel odd to create an estate plan that will impact a client’s grandchildren… when those grandchildren may be older than the advisor themselves!

Nerd's Eye View

APRIL 16, 2025

In these moments, the conversations that advisors have with their clients play a crucial role in helping clients maintain perspective, avoid emotional decisions, and stay committed to their long-term financial plans. Using mirroring language (e.g., Read More.

Nerd's Eye View

MAY 7, 2025

For many financial advisors, an early planning conversation often includes asking clients to identify financial goals. Which can leave both client and advisor feeling stuck: The client doesn't have the motivation to act, and the advisor struggles to guide the plan forward in a way that connects.

Nerd's Eye View

FEBRUARY 24, 2025

Early in a firm's life cycle, a founder might take on nearly any client (and their fees) just to generate enough revenue to 'keep the lights on'. However, as the firm grows, some of those early clients may no longer be profitable to serve – especially if they generate lower fees than newly onboarded clients.

Nerd's Eye View

APRIL 21, 2025

When onboarding new clients, financial advisors often use a three-meeting cadence: a Discovery Meeting to gather information, a Presentation Meeting to discuss the plan, and an Implementation Meeting to finalize it. while also setting the tone for a long-term planning relationship built on trust and deeper client engagement.

Nerd's Eye View

APRIL 21, 2025

When onboarding new clients, financial advisors often use a three-meeting cadence: a Discovery Meeting to gather information, a Presentation Meeting to discuss the plan, and an Implementation Meeting to finalize it. while also setting the tone for a long-term planning relationship built on trust and deeper client engagement.

Nerd's Eye View

JANUARY 15, 2025

This lack of clarity made retirement planning significantly more challenging. As a result, it's important for advisors to first identify which clients are currently subject to WEP or GPO and ensure that those who may need to file for benefits do so as soon as possible. Read More.

Nerd's Eye View

JUNE 16, 2025

While many firms have historically relied on commission-based compensation methods – reflecting a sales-driven approach – financial advice has evolved with technological advancements and a greater focus on financial planning, with the Assets Under Management (AUM) fee emerging as the primary compensation model.

Nerd's Eye View

FEBRUARY 19, 2025

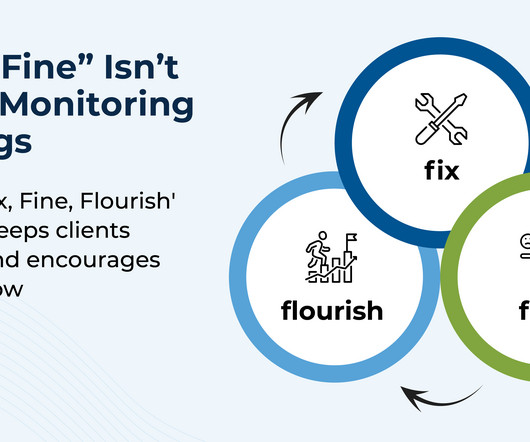

When a client first begins working with an advisor, the relationship is often marked with a flurry of onboarding tasks, immediate issues to resolve, and long-term planning goals to establish. And as clients come into monitoring meetings, they may increasingly describe their situation as "fine", with no pressing issues to address.

Nerd's Eye View

FEBRUARY 18, 2025

Sebastian is the President of Guerra Wealth Advisors, a hybrid advisory firm based in Miami, Florida, with nearly $15M of revenue and almost 60 team members, supporting over 1,700 client households.

Nerd's Eye View

NOVEMBER 6, 2024

In the early days of financial planning, serving clients often meant developing transactional relationships focused on facilitating trades and selling insurance. Over time, advisors shifted toward more analytical approaches, such as investment management and retirement planning.

Nerd's Eye View

APRIL 2, 2025

For many financial advisors, a core part of the retirement planning process involves simulating whether the client's assets will last through retirement. Yet while these tools offer mathematical metrics, they often fall short in helping clients connect the numbers to their real lives.

Nerd's Eye View

APRIL 8, 2025

Seth is the founder of Heartwood Financial Planning, an advisory firm affiliated with PlanMember Securities Corporation that is based in Fresno, California, and oversees approximately $100 million in assets under management for 850 client households. My guest on today's podcast is Seth Scott.

Nerd's Eye View

JANUARY 7, 2025

Pete is the Director of Sustainable Investing of Earth Equity Advisors, an RIA based in Asheville, North Carolina, that oversees approximately $200 million in assets under management for 250 client households. Read More.

Nerd's Eye View

JANUARY 14, 2025

Michelle is the Founding Principal of Paradigm Advisors, an RIA based in Dallas, Texas, that oversees approximately $110 million in assets under management for 80 client households.

Nerd's Eye View

FEBRUARY 5, 2025

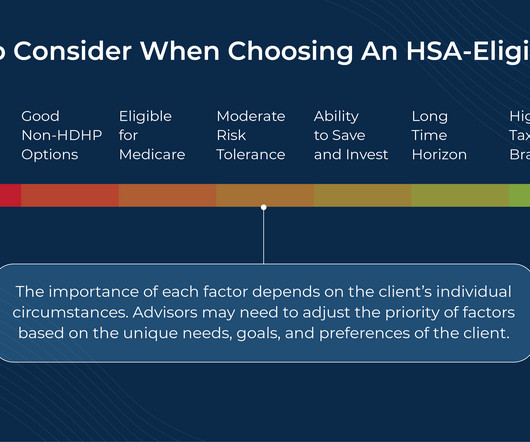

Health Savings Accounts (HSAs) have become an increasingly popular tool for financial advisors and their clients due in part to the 'triple tax savings' they offer: tax-deductible contributions, tax-free growth, and non-taxable distributions for qualifying expenses.

Wealth Management

APRIL 9, 2025

The former TDAI and Altruist executive has been in stealth mode building Wing, a digital financial planning app meant to help next-gen clients build personalized, goals-based plans, and advisors capture money in motion.

Wealth Management

JUNE 6, 2025

During Pride month, an advisor specializing in LGBTQ+ clients suggests how to meet the needs of this underserved, but “opportunity-rich” client group.

Nerd's Eye View

JANUARY 8, 2025

Solo 401(k) plans are a popular retirement savings vehicle for self-employed business owners. By maximizing both the employee employer contributions, solo 401(k) plan owners can often save significantly more than is possible with other types of retirement plans available to self-employed workers, like SEPs and standard IRAs.

Nerd's Eye View

MARCH 6, 2025

New financial advisors often start with below-market fees – sometimes to build confidence that prospects will actually pay, other times to attract clients quickly and establish a base. And while new clients often come in at higher fees, early clients may still be paying well below the firm's current rates.

Nerd's Eye View

JUNE 6, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a recent report finds that the number of SEC-registered RIAs, the assets that they manage, and the number of clients they serve all increased between 2023 and 2024 and suggests the industry is robust across the size spectrum, (..)

Million Dollar Round Table (MDRT)

JANUARY 5, 2025

By Antoinette Tuscano, MDRT senior content specialist When clients dont understand what you can offer them and object, theyre not saying no to you. As a financial advisor, you can ask clients questions and discover the bias behind their objections. Not thinking big enough I focus on clients who are self-made business owners.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Nerd's Eye View

FEBRUARY 25, 2025

Jennifer is the CEO of The Mather Group, an RIA based in Chicago, Illinois, that oversees $15 billion in combined assets under management and advisement for approximately 4,400 client households. Read More.

The Big Picture

MAY 3, 2025

Fun conversation in Barron’s about Steering Clients Away From Bad Investing Mistakes. Source : How Next-Generation Advisors Steer Clients Away From Bad Investing Mistakes A key role of a financial advisor is to prevent clients from making rash decisions during volatile markets. billion in assets under management.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content