The Market For “Lemons” In Financial Advice: How Higher Standards Can Lower Costs And Increase Access To Advice

Nerd's Eye View

SEPTEMBER 26, 2022

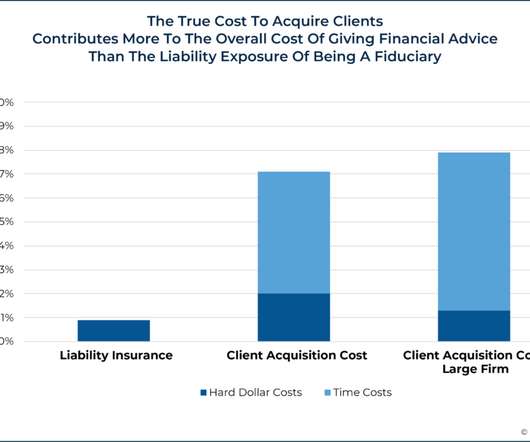

In fact, even a relatively modest shift to a higher-trust environment (which may be achieved by enacting higher standards) that just partially reduces the incredibly high client acquisition costs of financial advisors could more than offset the entire cost of fiduciary liability insurance from those higher standards!

Let's personalize your content