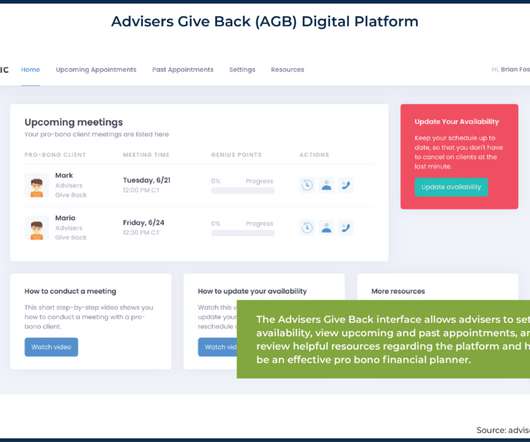

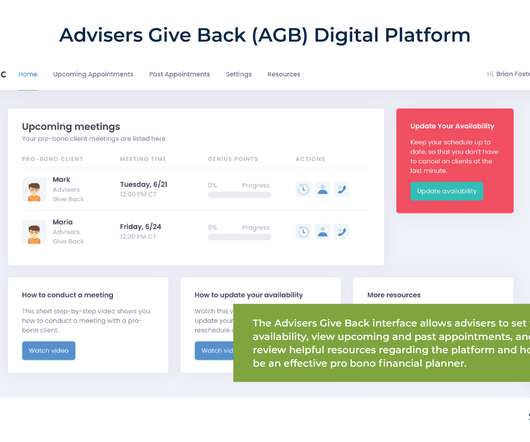

Serving Pro Bono Clients As A Busy Advisor: How Advisers Give Back Makes Volunteering Easy

Nerd's Eye View

AUGUST 15, 2022

By helping clients develop financial goals, creating a financial plan, and supporting the implementation and monitoring of the plan, advisors help clients live their best lives. Pro bono financial planning refers to free, no-strings-attached financial advice and planning for underserved people. Read More.

Let's personalize your content