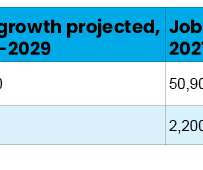

A Promising Picture for Financial Planner Job Growth

eMoney Advisor

DECEMBER 15, 2022

In an era of uncertainty, the value Americans place on professional advice from a financial planner has increased. adults said their most trusted source of financial advice was a financial advisor. 1 Market volatility was found to be a major factor in spurring people to seek advice.

Let's personalize your content