Firms Not Offering Tax, Retirement Planning Are Getting it Wrong

Wealth Management

OCTOBER 4, 2023

Advisors are overdelivering services such as health care, estate and business planning, while falling short in the areas their clients most desire.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

OCTOBER 4, 2023

Advisors are overdelivering services such as health care, estate and business planning, while falling short in the areas their clients most desire.

Nerd's Eye View

NOVEMBER 25, 2024

To start, Taylor refined his ideal client profile to focus on those he could best serve: diligent savers over age 50 with a retirement nest egg between $2M and $10M. These clients, typically in or near retirement, face key challenges like reducing taxes, managing investment risk, and maximizing income.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

JANUARY 22, 2025

Some prospects approach an advisor with an immediate 'problem to be solved', such as a fast-approaching retirement date. I help clients in retirement by doing X, Y, and Z."). These situations often narrow the focus of the prospecting conversation, giving the advisor a clear opportunity to affirm their value (e.g., "I

Wealth Management

JUNE 10, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all Wealth Management EDGE 2025 Industry News & Trends Scenes From Day 1 of Wealth Management EDGE 2025 Scenes From Day 1 of Wealth Management EDGE (..)

Wealth Management

JUNE 23, 2025

Sponsored Content Alternative Investments Summit: Navigating the New Frontier Alternative Investments Summit: Navigating the New Frontier Apr 11, 2025 bitcoin alternative investments Alternative Investments Young Investor Demand for Alternative Assets Is Reshaping Wall Streets Playbook Young Investor Demand for Alternative Assets Is Reshaping Wall (..)

Nerd's Eye View

JANUARY 4, 2023

Financial advisors have a wide range of strategies at their disposal to create financial plans for their clients. And when it comes to retirement planning, one popular technique is the use of ‘guardrails’, which set an initial monthly withdrawal rate that can be later adjusted as the size of the client’s portfolio changes.

Nerd's Eye View

AUGUST 24, 2023

However, when these aspirations are delayed or blocked by senior advisory firm partners who choose to delay their retirement plans, it can leave younger advisors frustrated and in a place of uncertainty about their futures with their firm.

Wealth Management

JUNE 11, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all Joey Corsica & SpotMyPhotos Industry News & Trends Scenes from Day 2 of Wealth Management EDGE Scenes from Day 2 of Wealth Management EDGE (..)

Wealth Management

JUNE 26, 2025

The Diamond Podcast for Financial Advisors: 10 Ways Top Advisors Are Growing Their Businesses The Diamond Podcast for Financial Advisors: 10 Ways Top Advisors Are Growing Their Businesses A “Top 10” list of firm-level innovations and grassroots methodologies from some of the most successful advisors, teams and firms in the business.

Nerd's Eye View

MAY 15, 2024

On April 25, 2024, the Department of Labor (DoL) issued the final version of its Retirement Security Rule (the "Final Rule"), which imposes an ERISA fiduciary standard "that applies uniformly to all investments that retirement investors may make with respect to their retirement accounts ".

Nerd's Eye View

MARCH 10, 2025

These services may range from 'standard' offerings like retirement planning to less traditional areas like credit card consulting. Financial advicers often market their comprehensive financial services as a way to differentiate themselves from other advisory firms and to stand out in the broader landscape of financial advice.

Wealth Management

JUNE 26, 2025

Sponsored Content Alternative Investments Summit: Navigating the New Frontier Alternative Investments Summit: Navigating the New Frontier Apr 11, 2025 Carlyle Group Alternative Investments Carlyle Makes New Retail Fund Push to Buy and Sell PE Stakes Carlyle Makes New Retail Fund Push to Buy and Sell PE Stakes by Dawn Lim Jun 26, 2025 2 Min Read Wealth (..)

Wealth Management

JUNE 27, 2025

Q&A: What Was Behind Schechter’s Decision to Sell to Arax?

Nerd's Eye View

OCTOBER 29, 2024

We also talk about how Travis built the onboarding and compensation plans for his own (contracted) student loan consultants to scale the business while incentivizing them to take on a greater volume of meetings (and still ensuring that they could give high-quality student loan advice), how Travis decided to diversify his business's income streams when (..)

Wealth Management

JUNE 20, 2025

Sponsored Content Alternative Investments Summit: Navigating the New Frontier Alternative Investments Summit: Navigating the New Frontier Apr 11, 2025 stock market chart hand finger pointing Alternative Investments Advisors Say Liquidity, Limited Options Block Greater Alts Adoption Advisors Say Liquidity, Limited Options Block Greater Alts Adoption (..)

Wealth Management

JUNE 17, 2025

Sponsored Content Alternative Investment Summit: Navigating the New Frontier Alternative Investment Summit: Navigating the New Frontier Apr 11, 2025 Advisor Sentiment Index May 2025 RIA Edge Advisor Sentiment Index: Advisors’ Market Outlook Improves Advisor Sentiment Index: Advisors’ Market Outlook Improves by WealthManagement.com Staff Jun 17, 2025 (..)

Wealth Management

JUNE 10, 2025

RIA Bluespring Merges Two Texas-Based Firms to Create $1.4B RIA SilverStar Wealth moves from being a Kestra-affiliated firm to being part of Bluespring’s Texas-based LifeBridge Financial Group. RIA Bluespring Merges Two Texas-Based Firms to Create $1.4B

Nerd's Eye View

APRIL 9, 2025

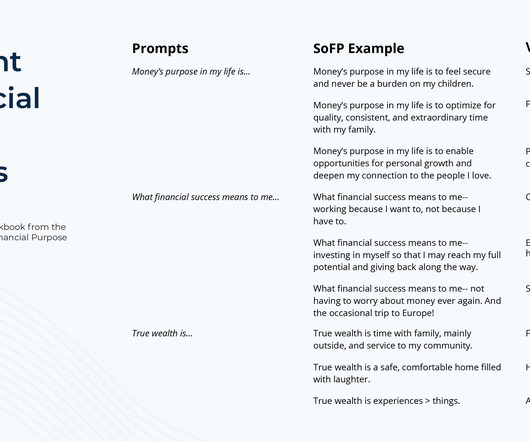

For instance, rather than starting a conversation by asking, "How much do you need for retirement?" which focuses a client on numbers and the possibility that they might not have saved enough), an advisor might instead ask, "What does an ideal retirement look like for you?"

Nerd's Eye View

FEBRUARY 25, 2025

In this episode, we talk in-depth about why Jennifer’s firm has taken an approach to grant equity rather than require buy-ins (and intends for every employee to either have equity, or at least a path to equity if they’re still new), how Jennifer’s firm sets individual performance targets for its client-facing wealth advisors to earn (..)

Nerd's Eye View

NOVEMBER 26, 2024

What's unique about Kevin, though, is how his firm has built a systematized internal advisor training program to efficiently onboard young new talent straight out of college, maintaining a strong advisory talent pipeline as his firm has grown to $4 billion in AUM through both organic growth and acquisitions of retiring advisors (whose clients can be (..)

Wealth Management

JUNE 20, 2025

Each discussed how providing a more holistic approach to distribution-phase planning in their practices can amp up organic growth for advisory firms. I cannot say enough about how well received this last session was by advisors, several of whom came up later to say thanks.

Wealth Management

JUNE 27, 2025

Q&A: What Was Behind Schechter’s Decision to Sell to Arax?

Wealth Management

JUNE 11, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all Brett Brodeski Savant Wealth Management WealthTech The Future of Wealth Management: Transformation and Innovation The Future of Wealth Management: (..)

Wealth Management

JUNE 10, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all Wealth Management EDGE 2025 Industry News & Trends Scenes From Day 1 of Wealth Management EDGE 2025 Scenes From Day 1 of Wealth Management EDGE (..)

Nerd's Eye View

APRIL 8, 2025

We also talk about Seth's journey to financial planning as a career changer (after finding that previous jobs in urban planning and real estate either took too much time away from his family or weren't compatible with his values), how Seth's connection with a family friend eventually led him to assume the books of business of three retiring advisors (..)

Darrow Wealth Management

APRIL 15, 2024

It goes by many different names: semi-retirement, partial or phased retirement, second career, and so on. But typically, it means the same thing: working in some capacity after retiring early. As more workers consider the growing appeal of semi-retirement, some ask — is working part-time in retirement a good idea?

Wealth Management

JUNE 10, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all Wealth Management EDGE 2025 Industry News & Trends Scenes From Day 1 of Wealth Management EDGE 2025 Scenes From Day 1 of Wealth Management EDGE (..)

Wealth Management

JUNE 27, 2025

Q&A: What Was Behind Schechter’s Decision to Sell to Arax?

Wealth Management

JUNE 12, 2025

Sponsored Content Alternative Investment Summit: Navigating the New Frontier Alternative Investment Summit: Navigating the New Frontier Apr 11, 2025 thumbnail Sponsored Content Boost Impact With Equity Awards Boost Impact With Equity Awards Jun 13, 2025 1 Min Read Wealth Planning Related Topics Estate Planning Financial Planning High Net Worth Insurance (..)

Nerd's Eye View

JANUARY 21, 2025

We also talk about how Daniel has used a subscription-based model for financial planning fees for 30 years (now setting the monthly subscription fee based on each client's unique needs, including the complexity of their tax situation), why Daniel finds that the vast majority of clients also decide to have his firm manage their assets (paying a separate (..)

Nerd's Eye View

MAY 7, 2025

Because these conversations aren't just about uncovering what matters to the client – they're about co-creating that vision together, so the financial plan becomes a true reflection of the client's values and priorities – with the advisor playing an essential role in helping bring that vision to life.

Wealth Management

JUNE 25, 2025

Sponsored Content Alternative Investments Summit: Navigating the New Frontier Alternative Investments Summit: Navigating the New Frontier Apr 11, 2025 thumbnail Sponsored Content ETF Surge Explained: Key Drivers and Future Trends with Dave Abner, Northern Trust Investments ETF Surge Explained: Key Drivers and Future Trends with Dave Abner, Northern (..)

Nerd's Eye View

OCTOBER 15, 2024

What's unique about Mark, though, is how he uses a liability-driven-investing approach to build retirement portfolios and manage sequence of return risk, with a particular focus on using closed end bond funds to generate income needed to cover his client's expenses during the early (and most financially dangerous) years of retirement.

Nerd's Eye View

JULY 10, 2023

As owners of financial planning firms approach retirement, some may decide to sell to an external buyer, while others may plan for an internal succession. Sometimes, this succession plan can include the owner's child, providing an opportunity to keep the business in the family.

Nerd's Eye View

SEPTEMBER 2, 2022

We also have a number of articles on retirement planning: New research suggests that while the average senior will amass hundreds of thousands of dollars in health care expenses in retirement, the net cost they have to pay is not nearly as high.

Nerd's Eye View

DECEMBER 16, 2022

We also have a number of articles on retirement planning: While weak stock and bond market performance has challenged advisors and their clients this year, these trends have likely increased the ‘safe’ withdrawal rate for new retirees.

Nerd's Eye View

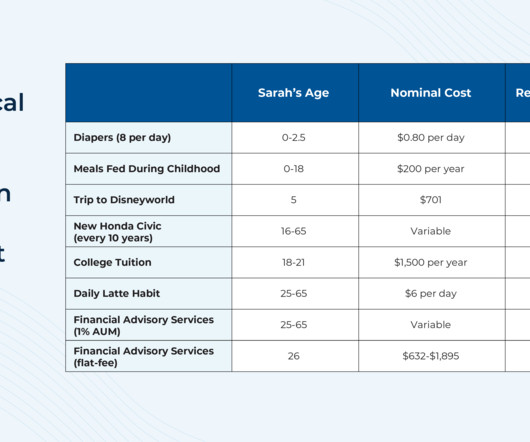

OCTOBER 23, 2024

AUM detractors like Sethi often present a calculation that compares the performance of 2 identical portfolios – one managed by an advisor who charges a 1% AUM fee for 20+ years, and one without an advisor – illustrating how the fee can significantly erode the cumulative value of their portfolio by the time they reach retirement.

Nerd's Eye View

JUNE 5, 2023

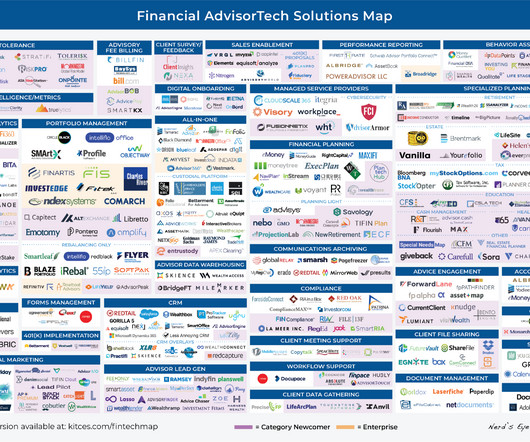

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: InvestCloud, a TAMP and all-in-one advisory technology platform which has undergone rapid growth in recent years through the acquisition of numerous disparate technology tools in order to compete with its more-established competitor (..)

Nerd's Eye View

SEPTEMBER 6, 2022

Andy is the owner of Tenon Financial, a virtual independent RIA that oversees $70 million in assets under management for 43 retired client households. Welcome back to the 297th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Andy Panko.

Nerd's Eye View

NOVEMBER 6, 2024

In the early days of financial planning, serving clients often meant developing transactional relationships focused on facilitating trades and selling insurance. Over time, advisors shifted toward more analytical approaches, such as investment management and retirement planning.

Nerd's Eye View

NOVEMBER 11, 2022

We also have a number of articles on retirement planning: How the recent increase in interest rates has made TIPS a more viable option to increase a retired client’s safe withdrawal rate. The most effective question advisors can use to end initial prospect meetings.

Nerd's Eye View

JANUARY 6, 2023

How planning specializations can help firms and their advisors stand out from the pack. From there, we have several articles on retirement planning: Why an individual’s portfolio of relationships could be just as important as their investment portfolio when it comes to happiness in retirement.

Nerd's Eye View

APRIL 29, 2025

In this episode, we talk in-depth about how Gideon shaped his firm's staffing to have a higher ratio of advisors to operations staff to serve clients on the Wealth Builder side (given the often extensive planning needs of mid-career professionals) compared to the firm's retired clients (whose plans often stay relatively stable but who need regular (..)

Nerd's Eye View

DECEMBER 9, 2022

Also in industry news this week: A recent survey indicates that retirement plan sponsors currently using financial advisors to support their plan are overwhelmingly satisfied with the service they receive, which also leads to improved retirement savings for their employees.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content