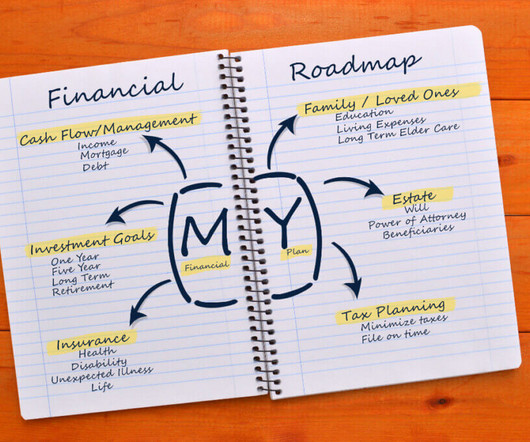

Understanding the Four Phases of Your Retirement Budget Strategy

Integrity Financial Planning

NOVEMBER 20, 2023

One way of thinking about retirement is that it happens in phases. We’re going to break down each one of the phases and explain some important financial moments in each. When you are 20 years old, it can be hard to picture what retirement might look like for you.

Let's personalize your content