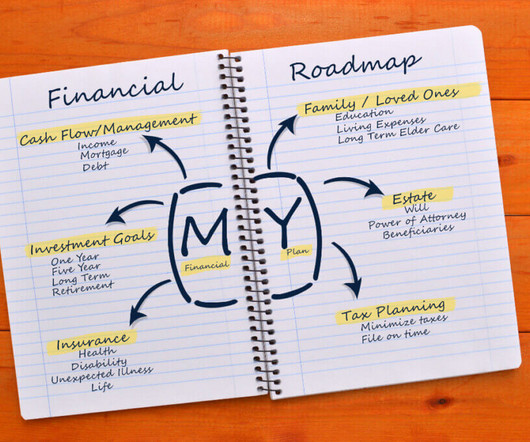

4 Pitfalls of Not Having a Financial Plan

Carson Wealth

APRIL 25, 2024

There are some things in life you just can’t plan for: an unexpected illness, job loss, death of spouse, disability. And while experiencing one of these major events can drastically impact your life, having an effective financial plan can help ensure that it doesn’t ruin your financial well-being.

Let's personalize your content