Crisis Management Financial Planning: Preparing for Unexpected Events

Carson Wealth

JUNE 27, 2025

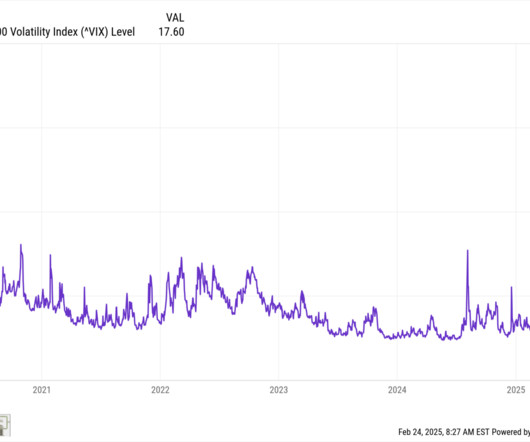

Unexpected events can derail your progress toward your goals and even your financial security if you don’t have a plan for managing them. To prepare for these events, you must have enough assets—or access to enough assets—to survive, recover, and move on. Budget for emergencies. Set up systems to monitor your cash flow.

Let's personalize your content