Top Senate Taxwriters Seek Input on Digital Asset Tax Rules

Wealth Management

AUGUST 16, 2023

The call for feedback touches on policies that, if changed, would likely impact the flow of crypto gifts to nonprofits.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

AUGUST 16, 2023

The call for feedback touches on policies that, if changed, would likely impact the flow of crypto gifts to nonprofits.

Cordant Wealth Partners

NOVEMBER 18, 2024

We also get you up to speed on the tax benefits of using a DAF. If you've heard of a DAF and are curious about incorporating it into your giving and tax planning strategy, this article is for you. Key Takeaways: Contributions to a donor-advised fund reduce your tax bill in the year your contribution is made.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Carson Wealth

NOVEMBER 3, 2022

And while the holidays are traditionally a time to reflect on our blessings and help those less fortunate than ourselves, there’s another factor influencing the timing of these donations — and that’s the goal of minimizing a tax bill. Three Tax-Advantaged Donation Strategies to Consider. Create a donor-advised fund (DAF).

Carson Wealth

MAY 7, 2025

Positioning Philanthropy as a Cornerstone of Legacy There are many reasons for giving during your lifetime, including supporting causes you care about, making a positive impact on the world, and accessing certain tax advantages. There are overall limits on charitable donation tax deductions, however.

Carson Wealth

MARCH 21, 2025

An endowment is a portfolio of assets that is invested to provide support for a cause. Theyre established to benefit charitable organizations, including educational or cultural institutions, community organizations, service organizations such as hospitals, and other nonprofits. What Is an Endowment?

Walkner Condon Financial Advisors

FEBRUARY 15, 2024

The nonprofit sector has a path forward, but it needs the help of individuals, institutions, and government to get there. Whichever way you look at it, 2024 will bring uncertainty for a vast swath of the nonprofit sector, making planning and charitable spending more conservative and less dependable. A Look at 2024’s Hunt for Revenue.

Brown Advisory

MAY 4, 2020

Beyond Investing: Strategic Advice for Nonprofits ajackson Mon, 05/04/2020 - 14:54 Running a nonprofit is a tall order. And in parallel with their program work, nonprofit leaders must also build the financial and organizational infrastructure to sustain those programs.

Brown Advisory

SEPTEMBER 4, 2019

Beyond Investing: Strategic Advice for Nonprofits. Running a nonprofit is a tall order. And in parallel with their program work, nonprofit leaders must also build the financial and organizational infrastructure to sustain those programs. Wed, 09/04/2019 - 14:54. client: SMALL PRIVATE REGIONAL COLLEGE.

MainStreet Financial Planning

MAY 10, 2023

A few weeks ago, I had the pleasure of attending a gala fundraiser for one of my favorite nonprofit organizations, Junior Achievement. You may not be aware, but I worked for this same nonprofit for about 5 years before joining MainStreet. Here is a great way to value those items if you are eligible to take a tax deduction.

The Big Picture

APRIL 29, 2025

This is Masters in business with Barry Ritholtz on Bloomberg Radio 00:00:17 [Speaker Changed] This week on the podcast, Jeff Becker, chairman and CEO of Jenison Associates, they’re part of the PG Im family of Asset Managements. Jenison manages over $200 billion in assets. Each of these asset managers had A-A-C-E-O.

Harness Wealth

APRIL 26, 2022

No-one loves paying taxes. But when it comes to your crypto assets, there are some strategies you can employ to make sure you don’t pay any more than you have to. Did you know you can buy crypto through an IRA and receive the same tax benefits? You can see the crypto advisor tax webinar replay here. Manage your timing.

Carson Wealth

MAY 30, 2025

Although sophisticated tech solutions have been slower to reach the nonprofit world than some other sectors, their arrival was inevitable. Transparency is critical in the nonprofit world: Charities with greater transparency have been shown to attract 53% more contributions. Plus transparency can help nonprofits operate better.

Brown Advisory

APRIL 28, 2020

The CARES Act Supplement: New Relief Funds Authorized eberkwits Tue, 04/28/2020 - 08:44 On April 23rd, Congress approved a second emergency package to expand funding for small businesses, nonprofits, hospitals and money for COVID-19 testing. Business and nonprofits with up to 10,000 employees or up to $2.5

Brown Advisory

APRIL 28, 2020

On April 23rd, Congress approved a second emergency package to expand funding for small businesses, nonprofits, hospitals and money for COVID-19 testing. The measure replenishes the Paycheck Protection Program (PPP) and Economic Injury Disaster Loan (EIDL) program for nonprofits and small businesses. Documentation Preparedness.

Brown Advisory

APRIL 16, 2018

The Other 95% achen Mon, 04/16/2018 - 13:23 The traditional goal for a nonprofit’s investment portfolio was to earn a 5% return or so that could be used to fund the nonprofit’s programs. Today, we help nonprofits make an impact with the other 95% of their portfolio.

Brown Advisory

APRIL 16, 2018

The traditional goal for a nonprofit’s investment portfolio was to earn a 5% return or so that could be used to fund the nonprofit’s programs. Today, we help nonprofits make an impact with the other 95% of their portfolio. When a nonprofit wants a mission-aligned investment strategy, we use the same process.

The Big Picture

MARCH 4, 2025

So taxes and bonds for sure. So kind of an, you know, easy transition taxes and bonds to, to corporate bonds. Barry Ritholtz : And, and just for the youngsters listening, 25 or so years ago, high rated municipal tax free bonds were yielding five, 6% maybe more, maybe Melissa Smith : More.

Good Financial Cents

DECEMBER 12, 2022

Currently, their AUM (assets under management) is over $6 billion with over 500,000 users (according to Wikipedia ). While that’s certainly a large of assets for a relatively new firm, in comparison industry giant Fidelity currently has over $4.5 trillion in customer assets. What Services does M1 Finance Offer?

James Hendries

NOVEMBER 26, 2022

billion to nonprofits and community organizations on #GivingTuesday in 2021, a 6% increase from 2020. Ideally, at the beginning of every year – with your financial professional – you would map out a plan to maximize the tax benefits of your giving. And according to GivingTuesday.org, the giving in the U.S. alone totaled $2.7

Brown Advisory

MARCH 28, 2019

The “5% rule” was instituted in 1981 by the IRS; this rule requires private foundations to distribute at least 5% of portfolio assets each year, and over time this rule has been voluntarily adopted by nonprofits of all types. In the past, spend-rate planning was a fairly straightforward task for investment committees.

Brown Advisory

MARCH 28, 2019

The “5% rule” was instituted in 1981 by the IRS; this rule requires private foundations to distribute at least 5% of portfolio assets each year, and over time this rule has been voluntarily adopted by nonprofits of all types. In the past, spend-rate planning was a fairly straightforward task for investment committees.

Clever Girl Finance

DECEMBER 16, 2023

Figure out how much money you make in after-tax income. More accurately, 70% of your take-home pay, or net income after taxes, not pre-tax income. 401(k)s offer the opportunity to save for retirement before taxes. Keep in mind that these accounts are tax-deferred, not tax-free.

Brown Advisory

MARCH 27, 2020

By comparison, the 2008 Troubled Asset Relief Program (“TARP”) was $700 billion, and the subsequent American Recovery and Reinvestment Act (“ARRA”) of 2009 was $831 billion. There are a number of temporary income tax provisions in the CARES Act that will be of interest to our private clients. trillion, equivalent to about 10% of U.S.

Brown Advisory

MARCH 27, 2020

By comparison, the 2008 Troubled Asset Relief Program (“TARP”) was $700 billion, and the subsequent American Recovery and Reinvestment Act (“ARRA”) of 2009 was $831 billion. . There are a number of temporary income tax provisions in the CARES Act that will be of interest to our private clients. trillion, equivalent to about 10% of U.S.

WiserAdvisor

FEBRUARY 2, 2023

The value of financial assets, such as real estate, can also significantly drop in a recession. Mass layoffs impact not only for-profit corporations but also nonprofit organizations. Diversifying your investments across different asset classes and industries can help reduce the recession’s impact on your portfolio.

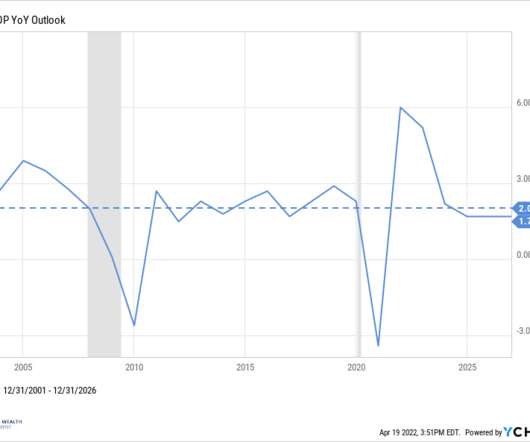

Darrow Wealth Management

APRIL 20, 2022

The Personal Consumption Expenditures (PCE) measures the change in the prices of goods and services consumed by all households and nonprofit institutions serving households. Given the strength of household balance sheets and that the Fed is raising rates from zero, prepare for inflation to stick around. Taming inflation won’t be easy.

Brown Advisory

MARCH 28, 2017

Assets in investments aligned to environmental, social or governance factors increased nearly fivefold between 2012 and 2016, according to US SIF Foundation. Still, nearly three out of four investors wait for their advisors to raise the topic of sustainability in relation to their portfolios, according to a 2013 survey by Calvert Investments.

Brown Advisory

MARCH 28, 2017

Assets in investments aligned to environmental, social or governance factors increased nearly fivefold between 2012 and 2016, according to US SIF Foundation. . . Values-based investing can be complex, and transitioning an entire portfolio can often involve meaningful tax and transaction expenses. Starting Points.

Brown Advisory

SEPTEMBER 12, 2016

Impact investors align their assets behind their advocacy, whether it be for advances in environmental stewardship, human livelihood or public policy. SIBs are not backed by tax revenue or the creditworthiness of the issuer. Although simple in intent, impact investing is often complex in execution.

Brown Advisory

SEPTEMBER 12, 2016

Impact investors align their assets behind their advocacy, whether it be for advances in environmental stewardship, human livelihood or public policy. SIBs are not backed by tax revenue or the creditworthiness of the issuer. Although simple in intent, impact investing is often complex in execution.

The Big Picture

MAY 20, 2025

We want to donate half of our profits to nonprofit organizations. Tell us a little bit about the impact of that on running an asset management business. It’s been helpful for the after-tax return of the shareholders. That’s when you launched where you launched. Tell us where that idea came from.

Clever Girl Finance

JANUARY 26, 2024

There, you can learn about better budgeting , mortgages, taxes, and more related to homeownership. Expert tip: A credit counselor can help with more than debt management For anyone struggling with debt and unsure how to move forward, seeing a certified nonprofit credit counselor is a great place to begin.

Brown Advisory

OCTOBER 11, 2021

ajackson Mon, 10/11/2021 - 11:55 Endowment and Foundation (E&F) Investment Committees often consider the value of alternatives for their nonprofit. We believe that the investment return needed to achieve that objective should be the most important guidepost for a portfolio’s asset allocation. Source: BLOOMBERG.

Brown Advisory

OCTOBER 11, 2021

Endowment and Foundation (E&F) Investment Committees often consider the value of alternatives for their nonprofit. We believe that the investment return needed to achieve that objective should be the most important guidepost for a portfolio’s asset allocation. Source: BLOOMBERG. It is not representative of an actual portfolio.

The Big Picture

AUGUST 15, 2023

So if you start with the S&P 500 or in this case stocks and bonds, you only have two asset classes, right. So the proper benchmark for those pools has to look a little bit like the underlying assets they’re investing in. If you look at the types of assets that Yale invests in, you can create a benchmark for each pool.

Brown Advisory

MARCH 28, 2017

Impact investors align their assets behind their advocacy, whether it be for advances in environmental stewardship, human livelihood or public policy. SIBs are not backed by tax revenue or the creditworthiness of the issuer. Although simple in intent, impact investing is often complex in execution.

Brown Advisory

MARCH 28, 2017

Impact investors align their assets behind their advocacy, whether it be for advances in environmental stewardship, human livelihood or public policy. SIBs are not backed by tax revenue or the creditworthiness of the issuer. Although simple in intent, impact investing is often complex in execution.

Brown Advisory

NOVEMBER 8, 2021

which disrupt supply chains, damage property and otherwise hurt an issuer’s assets or operations. infrastructure—utilities, airports, other key public assets—is at risk of being inundated by flooding, according to a new report by the nonprofit First Street Foundation. Securitized assets are also impacted by climate risk.

SEI

SEPTEMBER 17, 2022

Maybe we can touch base on your asset management distribution business. But over the past five years, the good news is that business has gotten diversified as that one or really two larger clients kind of moderated and in one case shrunk pretty significantly in terms of assets with us. Ryan Hicke: Yeah, IMF clients, advisor clients.

WiserAdvisor

FEBRUARY 2, 2023

The value of financial assets, such as real estate, can also significantly drop in a recession. Mass layoffs impact not only for-profit corporations but also nonprofit organizations. Diversifying your investments across different asset classes and industries can help reduce the recession’s impact on your portfolio.

Carson Wealth

JUNE 26, 2025

Retirement-related behavioral and financial changes raise many tax planning questions and opportunities. A trusted tax professional can help you implement these and other strategies to help you minimize taxes in retirement, helping your money last longer and you realize your goals.

Harness Wealth

FEBRUARY 4, 2025

However, unlike stocks and bonds, alternative investments, or alts as theyre commonly known, have unique tax treatments and complex reporting requirements that investors should carefully consider before investing. Well also go into some potential strategies to optimize tax efficiency. How Are Alternative Investments Taxed?

Carson Wealth

DECEMBER 5, 2024

million nonprofit organizations registered in the U.S. The Tax Impact of Charitable Giving The personal financial and income tax impact from charitable giving can affect the size of the gift and the timing of giving. Donations can also be deferred until death to manage estate taxes or create a charitable legacy.

Nerd's Eye View

AUGUST 23, 2023

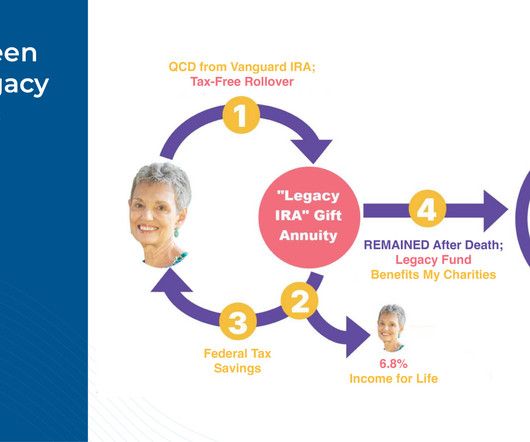

However, the caveat with current CGAs has been that they could only be funded with after-tax dollars before the donor’s death, meaning that if an individual only had tax-deferred funds (e.g., Second, they reduce the donor's tax bill in the year the CGA is created by excluding the amount contributed to the CGA from taxable income.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content