Your Retirement Planning Starter Pack

Carson Wealth

MARCH 7, 2024

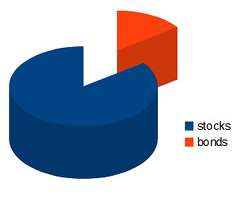

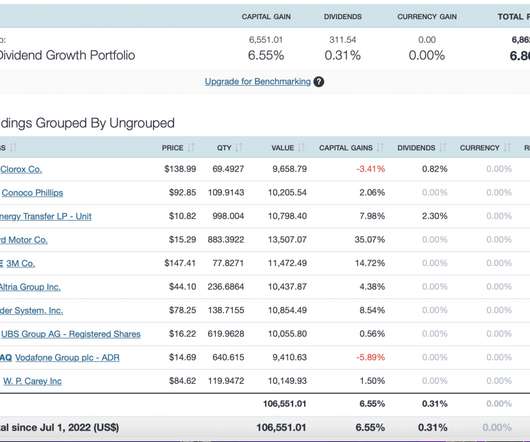

By Jake Anderson, CFP ® , Wealth Planner When helping clients begin retirement planning, the same questions often arise: What should my retirement plan look like? Your lifestyle, goals, family situation, and risk tolerance will give a unique signature to your retirement plan. How much should I be saving?

Let's personalize your content