Asset Allocation: Is It Enough?

Wealth Management

NOVEMBER 10, 2022

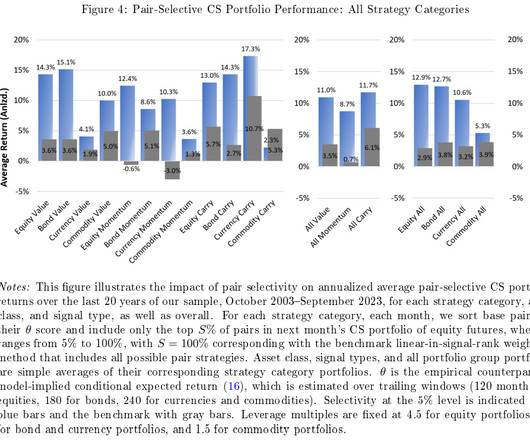

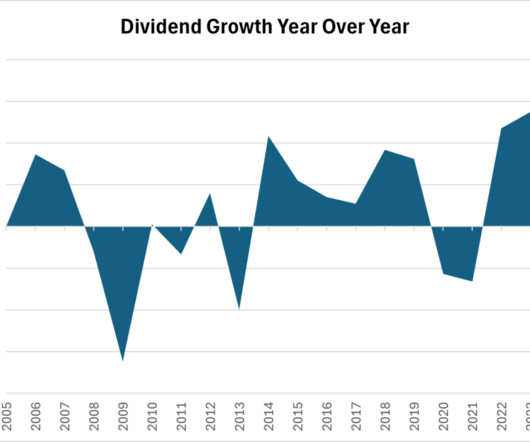

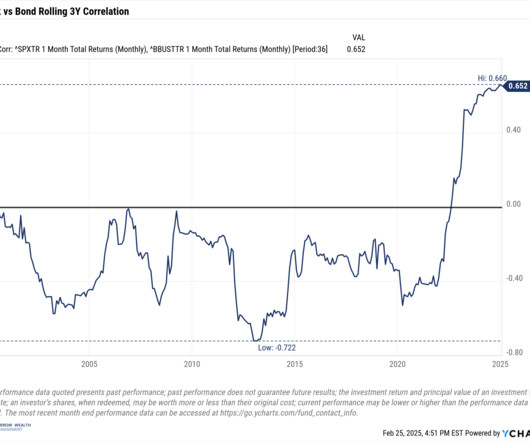

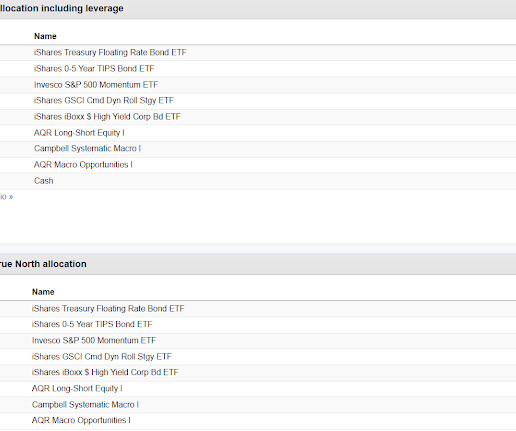

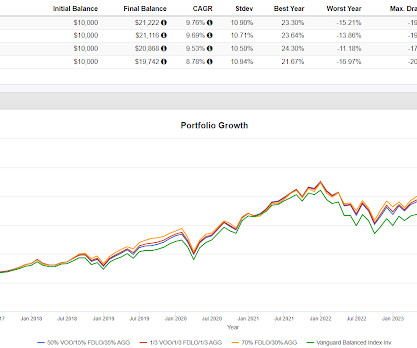

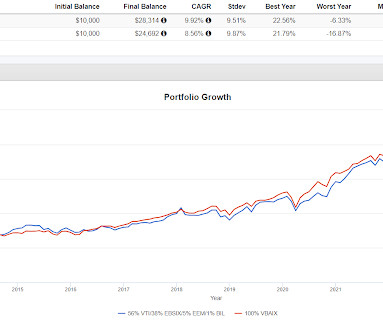

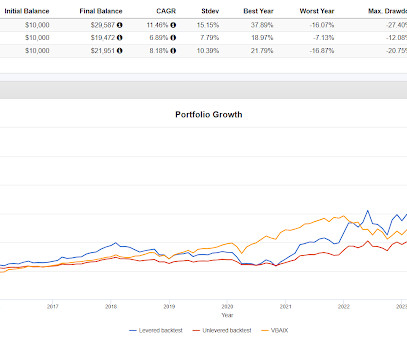

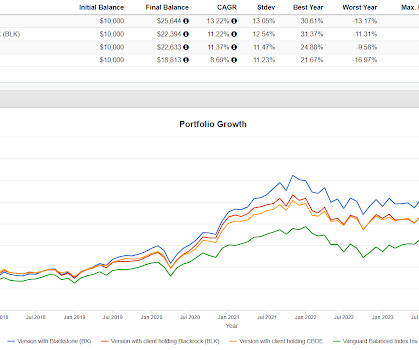

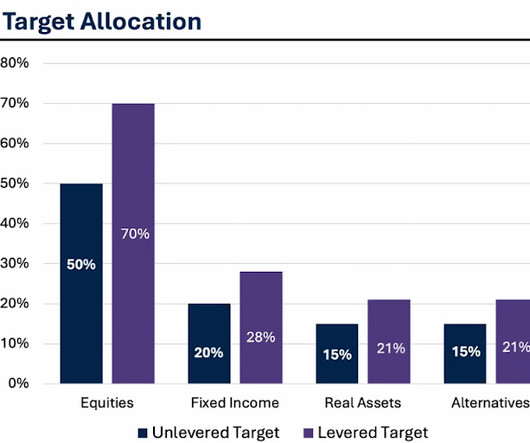

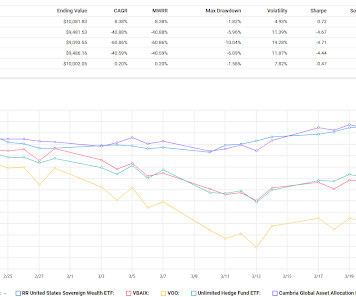

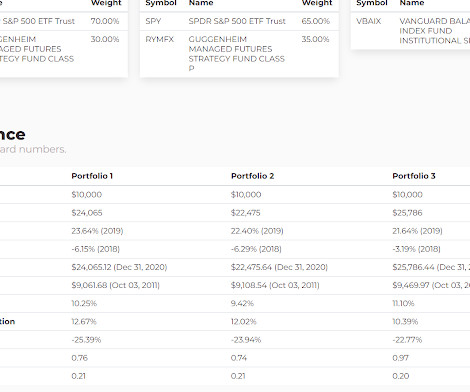

Asset allocation is one of the most important portfolio decisions for investors. However, advisors who rely solely on asset allocation-based analyses may face inherent blind spots that negatively impact their clients.

Let's personalize your content