GMO Launches Nebo Wealth At T3

Wealth Management

JANUARY 22, 2024

The new platform is meant to help advisors achieve portfolio personalization at scale, and bridge an industry gap between financial planning and asset allocation.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JANUARY 22, 2024

The new platform is meant to help advisors achieve portfolio personalization at scale, and bridge an industry gap between financial planning and asset allocation.

Abnormal Returns

FEBRUARY 26, 2025

tonyisola.com) Age is just one factor when it comes to your asset allocation. humbledollar.com) Personal finance Two questions to ask if you need to re-prioritize your financial plan. timmaurer.com) Financial influencers are not looking out for your best interests. meaningfulmoney.life) Why we keep striving.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

The Big Picture

SEPTEMBER 28, 2022

What is in your control : Your Portfolio : You want to create something robust enough to withstand drawdowns and recessions; not necessarily the best possible set of assets but the ones you can live with day in and day out. This includes a broad Asset Allocation including full Diversification of asset classes, geographies, etc.

International College of Financial Planning

MARCH 12, 2025

Many influencers dont have professional financial expertise; theyre just good at marketing. What to Do Instead: Stick to fundamentals: Learn about asset allocation, risk management, and diversification before investing. Investing Without a Game Plan The Mistake: Gen Z loves DIY investing, thanks to easy-to-use apps.

MainStreet Financial Planning

MARCH 12, 2025

This ensures you wont need to sell investments when markets are down, protecting your long-term financial plan and providing peace of mind during turbulent times. Reevaluate Your Asset Allocation If watching your investment portfolio fluctuate causes anxiety, your current allocation might be too aggressive.

Nerd's Eye View

OCTOBER 23, 2024

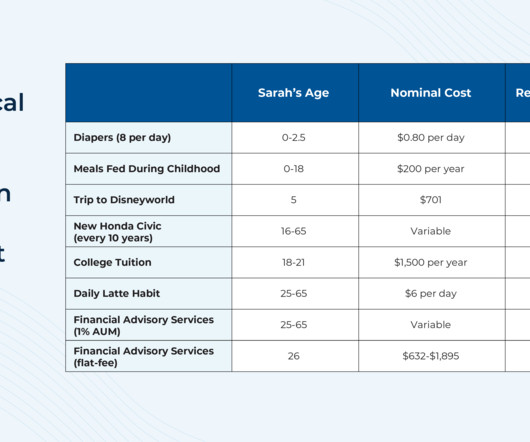

Though in practice, while a 1% AUM fee is a common 'starting point' in the industry, the actual fee structure can vary based on the firm's approach; for example, some firms may reduce the fee for high-net-worth clients, or charge an additional fee for separate and additional services (from deeper financial planning to add-ons like tax preparation).

Yardley Wealth Management

AUGUST 20, 2024

The post Staying Disciplined: How to Stick to Your Financial Plan Despite Market Volatility appeared first on Yardley Wealth Management, LLC. Staying Disciplined: How to Stick to Your Financial Plan Despite Market Volatility Introduction: Market volatility is a fact of life for investors.

The Chicago Financial Planner

FEBRUARY 3, 2022

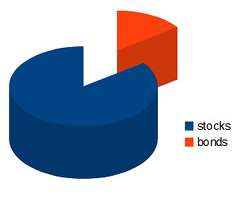

Investors who are well-diversified may be hurt but generally not to the extent of those who are highly allocated to stocks. Review your asset allocation . If you haven’t done so recently, perhaps it is time to review your asset allocation and make some adjustments. Go shopping . The Bottom Line .

MainStreet Financial Planning

AUGUST 16, 2022

There are many steps in building an investment portfolio, in this article, I’ll discuss how asset allocation and risk tolerance are important considerations when investing. In simple terms, asset allocation is the mix of all the different types of investments you have in your portfolio. Some examples include U.S.

Darrow Wealth Management

FEBRUARY 9, 2025

Allocation choices also shouldn’t be based on the notion that dipping into principal derails a financial plan. In another words, if your asset allocation is 60% stocks and 40% bonds, the current weighted average yield is 2.19%. Examples include real estate, financials, and utilities.

Darrow Wealth Management

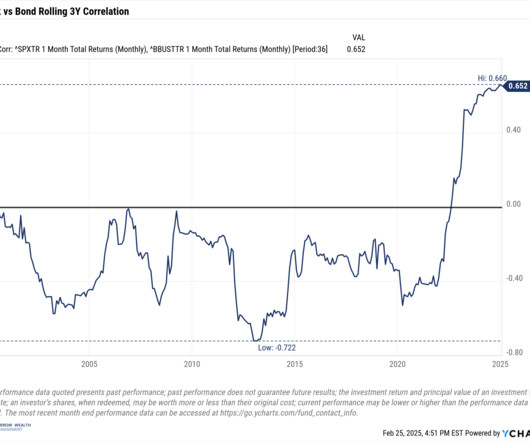

MARCH 3, 2025

Because of these differences, stocks and bonds accomplish different things in an asset allocation. Why stocks and bonds belong in a diversified portfolio Investors have different needs, risk tolerances, time horizons, and financial situations which should be considered in an asset allocation.

The Chicago Financial Planner

JUNE 13, 2022

Assuming that you have a financial plan with an investment strategy in place there is really nothing to do at this point. Ideally you’ve been rebalancing your portfolio along the way and your asset allocation is largely in line with your plan and your risk tolerance. Do nothing. Focus on risk. Look for bargains.

Nerd's Eye View

JANUARY 4, 2023

Financial advisors have a wide range of strategies at their disposal to create financial plans for their clients. This strategy is valuable because it generally allows for higher initial withdrawal rates than more static approaches that don’t accommodate clients willing to adjust their spending in retirement.

AdvicePay

JULY 14, 2022

The adoption of the fee-for-service financial planning model is changing the dynamics of business operations inside wealth management firms. But without a well-defined service model to deliver financial planning services, advisors soon discover that unstructured, ad-hoc service offerings don’t scale very well.

Yardley Wealth Management

FEBRUARY 18, 2025

We’ll also explore the role of income tiers, provide real-world case studies, and highlight key considerations when implementing this strategy in your financial plan. Peace of mind – Offers clarity and confidence in financial decision-making. Work with a financial advisor to tailor the strategy to your unique needs.

eMoney Advisor

DECEMBER 27, 2022

As client expectations continue to evolve, there is an opportunity for financial planners to broaden and deepen their service offerings by providing holistic financial planning. Holistic financial planning goes beyond traditional financial planning to help clients achieve the best outcomes as defined by their individual needs.

Discipline Funds

MARCH 10, 2025

This is also what makes retirement planning so difficult – you effectively lose an asset in your portfolio when your income stops or declines. And this is why I’ve become such a big advocate of defining our durations within our financial plans.

MainStreet Financial Planning

MARCH 7, 2025

If youre searching for a fiduciary financial planner, flat-fee financial planning, or the best alternative to AUM-based advisors, this article will help you decide which model is right for you. Unlike AUM advisors, they dont have an incentive to keep assets under management, so their recommendations are truly objective.

Abnormal Returns

NOVEMBER 21, 2022

(riabiz.com) CI Financial ($CIXX) is planning to spin-off its U.S. riabiz.com) Retirement Why retirees should include Social Security into their asset allocation. riabiz.com) What mid-life women need from a financial adviser. unit debt-free in 2023. thinkadvisor.com) How Notice 2022-53 has affected the tax code.

Yardley Wealth Management

DECEMBER 17, 2024

Interest rates remain a significant factor in financial planning, affecting everything from mortgage rates to investment returns. The past few years have taught us valuable lessons about the importance of building resilient financial strategies that can weather various economic conditions.

eMoney Advisor

MARCH 21, 2023

Historically, staying the course and following a financial plan has outperformed rash investment decisions when there are times of uncertainty in the financial market. But it takes a strong plan—and no small amount of willpower—to do this. You can also look at cash management and debt reduction solutions.

Advisor Perspectives

DECEMBER 26, 2023

Featuring an open architecture model marketplace and an integrated proposal-generation tool targeting clients and prospects, Rendezvous empowers advisors with the technological resources to streamline goals-based financial planning and proposal generation, offer investment solutions and asset allocation tools that achieve clients’ goals and reclaim (..)

The Chicago Financial Planner

FEBRUARY 5, 2022

Rather I suggest an investment strategy that incorporates some basic blocking and tackling: A financial plan should be the basis of your strategy. Perhaps it’s time to rebalance and to rethink your ongoing asset allocation. Take stock of where you are. Take stock of where you are. Costs matter.

International College of Financial Planning

DECEMBER 29, 2024

In today’s increasingly complex financial landscape, professional financial planning education has become more crucial than ever. The CFP certification stands as the gold standard in financial planning, offering professionals a comprehensive pathway to excellence in this dynamic field.

The Chicago Financial Planner

NOVEMBER 8, 2021

Financial Planning is vital. If you don’t have a financial plan in place, or if the last one you’ve done is old and outdated, this is a great time to review your situation and to get an up-to-date plan in place. Do it yourself if you’re comfortable or hire a fee-only financial advisor to help you.

Tobias Financial

MARCH 16, 2025

Whether youre new to investing or have years of experience, taking a step back to evaluate your strategy can help ensure that your portfolio remains aligned with your objectives, especially in times of market uncertainty and volatility.

Gen Y Planning

MARCH 10, 2025

As we move through the first quarter of 2025, weve had several clients, colleagues, and friends reach out with questions about recent market movements and the impact of tariff discussions on their personal financial plan. Diversifying portfolios across asset classes, sectors, and geographies to reduce concentrated risks.

Discipline Funds

NOVEMBER 11, 2024

This included: 2:44 Defined Duration Investing – my new asset allocation process by which I focus on quantifying the time horizons over which to use certain instruments and help match them to a financial plan. In this episode they discuss the 8 big lessons they’ve learned from me over the years.

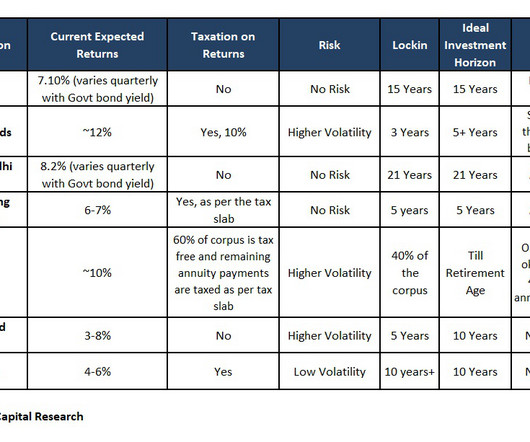

Truemind Capital

FEBRUARY 23, 2024

A few days ago, I had a very unusual request from the HR of a multi-billion dollar company with whom I was in discussion regarding sessions on financial well-being for their employees. Since we have expertise in long-term investment strategies and financial planning, I told her that we could not help her with this requirement.

Tobias Financial

APRIL 11, 2024

We are thrilled to announce that our Wealth Advisors, Edzai Chimedza, CFP® and Franklin Gay , CFP®, EA will be leading two Financial Planning Seminars at Nova Southeastern University. Contact us today, and let’s discuss how we can assist with your specific financial situation. appeared first on www.tobiasfinancial.com.

Nationwide Financial

JANUARY 25, 2023

Here are some key points to use with clients as you help them assess their retirement plans. Review risk tolerance and current asset allocation strategy It’s important to ensure your clients’ portfolios align with their risk tolerance because taking too much risk can negatively impact their ability to navigate market fluctuations.

Discipline Funds

OCTOBER 18, 2024

The simple answer is that the short-term movements of the stock market should be irrelevant to your financial plan assuming you have a well constructed temporally diversified portfolio. Insurance is largely optional and plan dependent, but I think of the other 4 time horizons as essential. 2) Stock market gambling.

Zoe Financial

MARCH 21, 2025

When to Work with a Financial Advisor Many high earners and affluent individuals seek financial guidance at pivotal moments, such as: 1. Preparing for Retirement Transitioning from a career to retirement requires careful financial planning. A financial advisor can: Help you maintain a disciplined investment strategy.

MainStreet Financial Planning

DECEMBER 20, 2023

Over the course of the year the market moves up and down and that can throw off your portfolio allocation and the end of the year is a great time to do a rebalance where you evaluate whether you need to make any changes to get your portfolio aligned with the target asset allocation.

Random Roger's Retirement Planning

MAY 10, 2024

An investor needing something close to equity market returns for their financial plan to work needs something of a "normal" allocation to equities. Not that 20% is universally wrong, not everyone needs close to equity market returns for their financial plan to work. Maybe that's 50% or maybe 60% but it's not 20%.

Discipline Funds

FEBRUARY 21, 2023

This innovative approach to asset allocation helps improve the probability of meeting your financial goals by helping you better understand your liabilities and the way specific assets align with those liabilities. We then apply the proper assets based on liability needs, not based on asset performance wants.

Truemind Capital

JULY 8, 2024

Originally posted on LinkedIn : www.linkedin.com/shivanichopra Email us at connect@truemindcapital.com or call us at 9999505324. Truemind Capital is a SEBI Registered Investment Management & Personal Finance Advisory platform.

International College of Financial Planning

JULY 30, 2022

Earning the CFP designation requires a rigorous course of study covering investment planning, income taxation, retirement planning and risk management. The Certified Financial Planner course is the perfect course to achieve all topics related to finance. By paying for CFP services, you strengthen your overall financial plan.

Carson Wealth

MAY 30, 2025

The duo also breaks down recent market behavior, performance gaps between retail and institutional money, and the critical importance of having (and sticking to) a financial plan. Volatility is Normal, Not a Red Flag: Market pullbacks of 5%-10% happen regularly, and near-bear markets every few years.

Validea

SEPTEMBER 24, 2024

Asset Allocation Insights The Shiller P/E can also inform asset allocation decisions. By using it appropriately – focusing on its long-term implications rather than short-term predictions – investors can make more informed decisions about their portfolio allocations and financial planning strategies.

Random Roger's Retirement Planning

AUGUST 27, 2022

A point we've been making here for ages is that with an adequate savings rate, appropriate asset allocation and the ability to avoid succumbing to panic, an investor should be able to have retirement plan success as defined above. If you're 60, think you want to retire at 65 and need $1.4 million to do so and have $1.3

WiserAdvisor

APRIL 25, 2023

Rebalancing a 401(k) refers to adjusting the asset allocation of your investment portfolio back to its original target percentages. Your investment strategy determines the target percentages for each asset, often based on your risk tolerance, investment goals, and time horizon. Click to compare vetted advisors now.

International College of Financial Planning

JULY 31, 2023

Their knowledge extends to various investment products, risk management, tax implications, and financial planning. Armed with this expertise, investment advisors can comprehensively analyze clients’ financial situations and devise tailored strategies to align with their unique goals and risk tolerances.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content