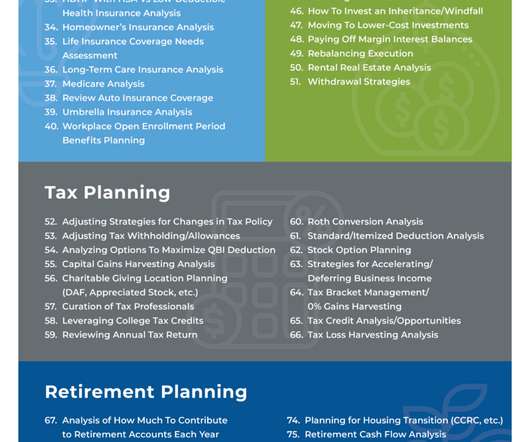

101 Ways Advisors Can Add Value And Attract Their Ideal Clients

Nerd's Eye View

NOVEMBER 28, 2022

From advisors who earn commissions from the sales of financial products to fee-only investment advisors who charge based on client assets under management, the value advisors provide to their clients has often been centered on investment management.

Let's personalize your content