What’s a Fiduciary & Fee-Only Advisor?

Yardley Wealth Management

MAY 30, 2023

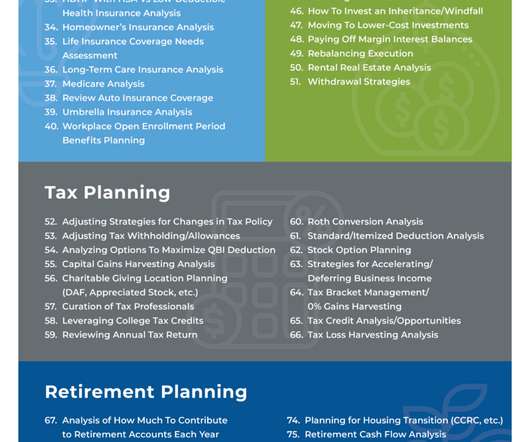

The post What’s a Fiduciary & Fee-Only Advisor? What’s a Fiduciary & Fee-Only Advisor? A fiduciary and fee-only advisor is an expert who acts in your best interest and only charges a fee for their services. What is a Fee-Only Advisor? What is a Fiduciary?

Let's personalize your content