How Financial Advisers Can Boost Online Reputation Through Google Reviews (While Complying With SEC Marketing Rule Requirements)

Nerd's Eye View

JUNE 17, 2024

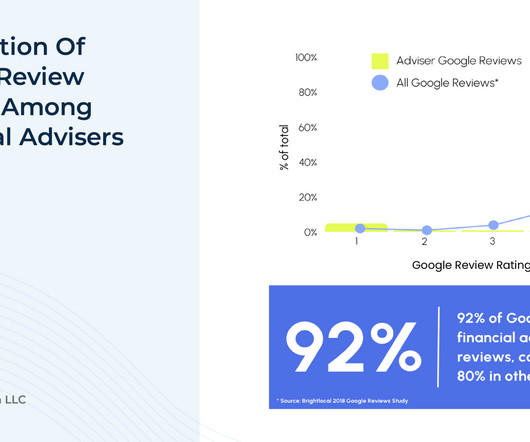

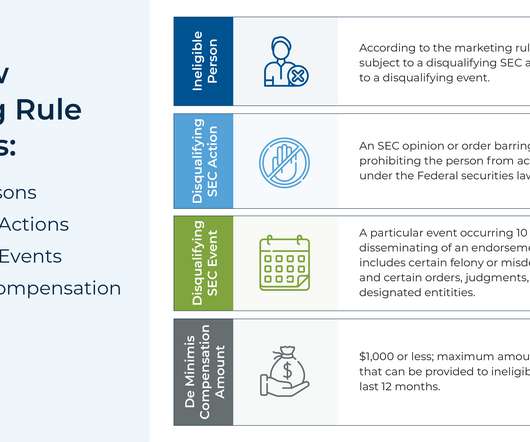

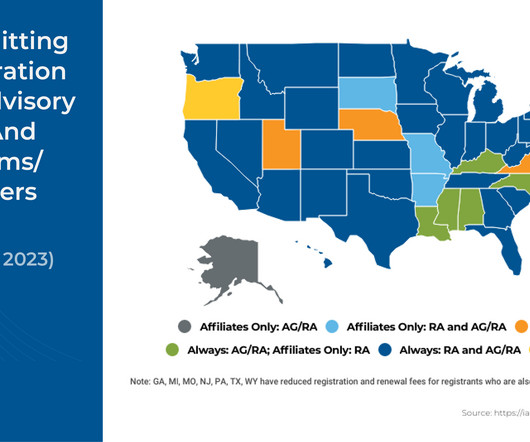

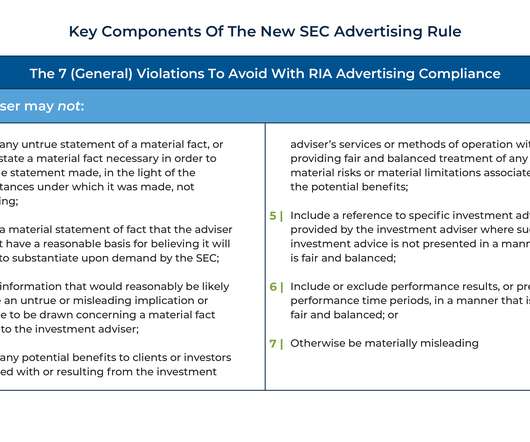

Nonetheless, fewer than 10% of SEC-registered investment advisers report using them, even though the SEC’s updated investment adviser marketing rule allows financial advisors to proactively encourage testimonials (from clients), use endorsements (from non-clients), and highlight their own ratings on various third-party review sites.

Let's personalize your content