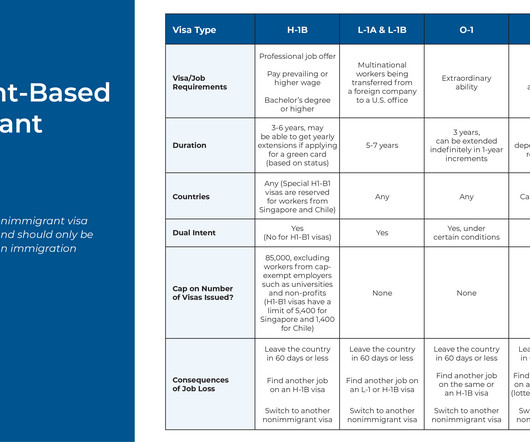

What types of accounts can I rollover into?

Getting Your Financial Ducks In A Row

JUNE 23, 2025

Photo credit: jb When you have money in several accounts and you’d like to have that money consolidated in one place, the question comes up – Which type of account can be tax-free rolled over into which other type of accounts? The post What types of accounts can I rollover into?

Let's personalize your content