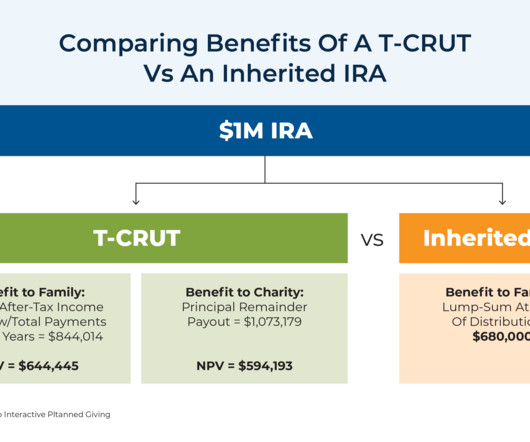

Using A Testamentary Charitable Remainder Unitrust (T-CRUT) To Give Twice To Both Loved Ones And Charitable Organizations

Nerd's Eye View

JANUARY 31, 2024

In late 2019, Congress passed the Setting Every Community Up for Retirement Enhancement (SECURE) Act, introducing several significant changes to retirement planning. Of the many provisions in the bill, the so-called "Death of the Stretch" arguably received the lion's share of consternation from the financial advisor community.

Let's personalize your content