Weekend Reading For Financial Planners (June 14–15)

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Nerd's Eye View

JULY 4, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that Congress has passed highly anticipated tax legislation, making 'permanent' (i.e.,

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

JULY 25, 2025

Also in industry news this week: A recent report highlights the rapid growth of RIA "consolidators" , with advisors seeking them out for compliance and succession support, though concerns about a potential loss of autonomy and independence from joining one remain The Treasury has delayed until 2028 the effective date for a proposed Anti-Money Laundering (..)

Harness Wealth

NOVEMBER 12, 2024

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year. In 2024, the lifetime gift tax exemption is $13.61 million ($27.22

Harness Wealth

JULY 31, 2025

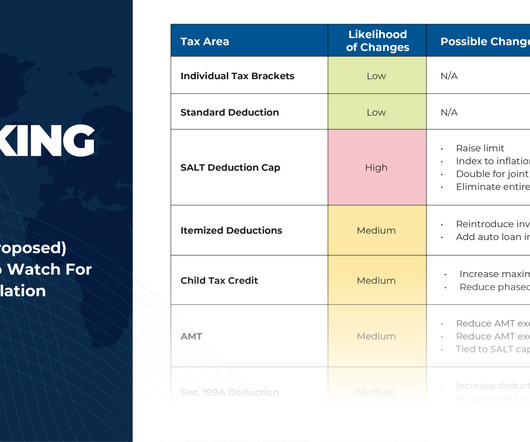

The impending TCJA sunset in 2026 necessitates immediate planning , particularly for high-net-worth clients who may face significant changes in tax treatment, and estate planning options. These aren’t just annual tweaks—they’re openings for meaningful, proactive tax planning.

Harness Wealth

AUGUST 13, 2025

The legislation also preserves existing tax benefits that many saw as temporary. To deliver long-term certainty for effective tax planning, the bill maintains the lower individual tax brackets and enhances standard deductions from the 2017 Tax Cuts and Jobs Act. percentage point difference from the alternative 39.6%

Financial Symmetry

APRIL 9, 2025

Tax planning might not top everyone’s list of leisure activities, but in the middle of tax season, theres a hidden opportunity. In this episode, we talk about five strategies you can use during tax season to create opportunities to help you reach your financial goals.

Harness Wealth

JANUARY 29, 2025

Deferring income to a future year will allow you to reduce your current tax burden and keep more of your money working for you. Effective ways to achieve this include: For employees : If your employer offers this option, request that your year-end bonus be deferred to January 2026.

WiserAdvisor

JULY 4, 2025

If your plan allows you to carry over unused amounts into the next year, the maximum carryover has also been increased in 2025 to $660, a modest bump from $640. Again, while this may not seem like a substantial hike, it does offer some extra wiggle room in your tax planning. first appeared on WiserAdvisor - Blog.

Harness Wealth

MAY 2, 2025

Unless Congress intervenes, the TCJAs sunset will usher in a swathe of tax increases in 2026, with analysts estimating that over $4 trillion worth of tax hikes could take effect. How will the 2026 tax brackets be affected if the TCJA expires? How will the 2026 tax brackets be affected if the TCJA expires?

Zajac Group

NOVEMBER 7, 2024

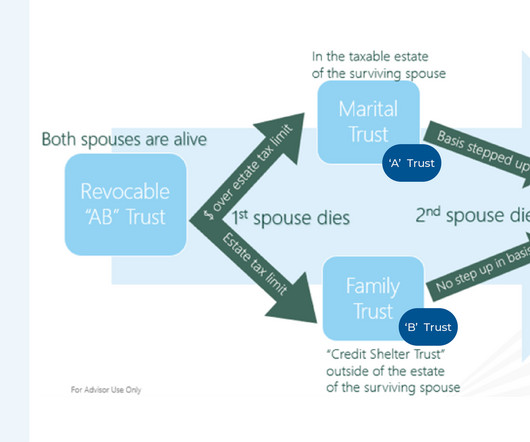

Creating wealth that can provide financial security for generations to come is an incredible feat, and it requires careful planning, consideration, and communication among family members. For reference, the federal estate tax exemption limit is set to revert back to $5 million (or around $7 million when adjusted for inflation).

Darrow Wealth Management

JULY 24, 2025

State and Local Tax (SALT) Deduction Cap The $10,000 cap on the SALT deduction is temporarily increased to $40,000 , but not for taxpayers earning more than $500,000 per year. Both the SALT cap and the income phaseout ranges will increase by 1% annually for 2026-2029 before reverting to $10,000 in 2030. However, starting in 2026, the.5%

Harness Wealth

JULY 14, 2025

However, legislative efforts are ongoing to make it permanent and potentially increase the deduction percentage from 20% to 23% from 2026. What are tax-efficient real estate exit strategies? The culmination of a successful real estate investment often involves its sale, which can trigger major tax liabilities.

Harness Wealth

JANUARY 28, 2025

In the realm of estate planning, the Lifetime Gift and Estate Tax Exemption is set for a substantial decrease in 2026, reverting to approximately $7 millionunless Congress intervenes. These adjustments apply to income tax returns for the 2025 tax year, filed during tax season in 2026, as outlined by the IRS.

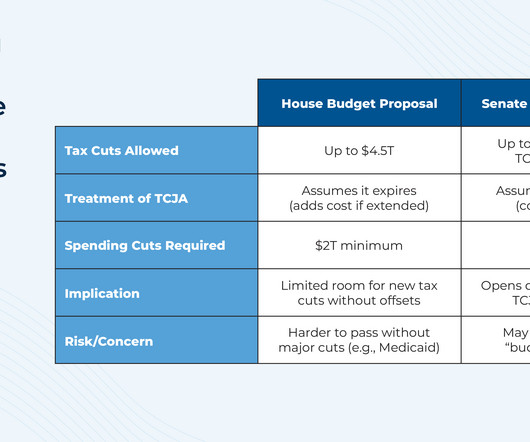

Nerd's Eye View

APRIL 30, 2025

Although it doesn't contain specific provisions for what will be included in the new bill, it provides a general framework for the bill's overall 'cost' to the Federal deficit, offering planners some idea of the bill's potential scope and providing at least some certainty for clients planning their taxes for 2026 and beyond.

Nerd's Eye View

NOVEMBER 13, 2024

Furthermore, the Trump campaign has proposed a number of additional tax cuts, including tax-free treatment of income from tips, overtime pay, and Social Security benefits, and even eliminating income tax entirely in favor of tariffs. Read More.

Harness Wealth

AUGUST 5, 2025

Family-owned property businesses, individual investors, and those who typically operate through LLCs, partnerships, or S corporations can continue to enjoy substantial tax savings. Without this extension, many would have faced significantly higher effective tax rates starting in 2026. This creates a complex decision matrix.

WiserAdvisor

JULY 29, 2025

Under the Tax Cuts and Jobs Act , the threshold is set to expire on December 31, 2025. It will revert to approximately $5 million (indexed for inflation to around $7 million) per person on January 1, 2026. Pay tuition and medical bills directly Some of the best estate tax planning tools are also the simplest.

Wealth Management

NOVEMBER 6, 2024

Smith, executive director with Eaton Vance, discusses tax law changes in 2026 and emphasizes the importance of proactive tax planning for investors.

Darrow Wealth Management

JULY 1, 2024

Although a number of these provisions will negatively impact taxpayers starting in 2026, there a few changes that will be positive. Here’s a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to prepare. For some, this may lead to more taxes paid on capital gains.

Nerd's Eye View

SEPTEMBER 6, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that the Treasury Department has finalized rules requiring most SEC-registered RIAs to implement risk-based Anti-Money Laundering and Countering the Financing of Terrorism programs, including a requirement to report suspicious (..)

Nerd's Eye View

APRIL 5, 2023

Given how frequently the tax code changes, advisors can add value for clients by ensuring their estate plans are aligned with current law to meet the clients’ objectives, and not with past rules that may no longer apply to them. However, the passage of TCJA resulted in the estate gift tax exemption nearly doubling (from $5.6M

Darrow Wealth Management

JULY 1, 2024

Although a number of these provisions will negatively impact taxpayers starting in 2026, there a few changes that will be positive. Here’s a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to prepare. For some, this may lead to more taxes paid on capital gains.

Darrow Wealth Management

JULY 30, 2024

For founders, employees, and executives with stock-based compensation, an 83(b) election can be a powerful tax planning tool. When you make an 83(b) election, you’re opting to pay tax on unvested shares now, instead of when the stock vests. It can also preclude some tax planning strategies down the road.

Darrow Wealth Management

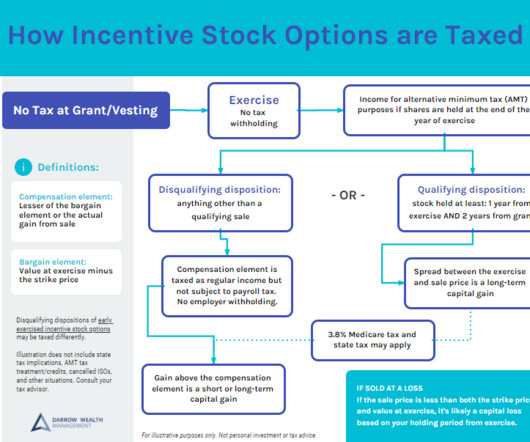

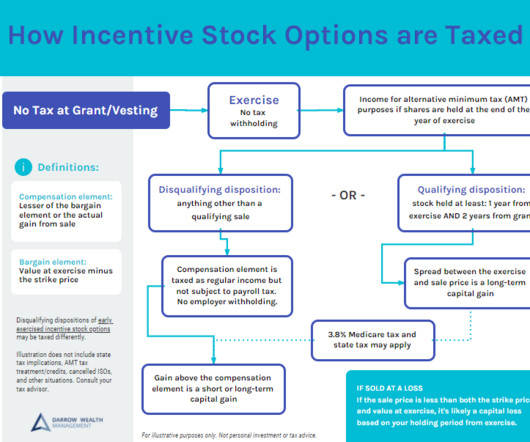

MARCH 29, 2024

There are two AMT tax rates: 26% and 28%. AMT exemptions and phase out were increased significantly in the 2017 Tax Cuts and Jobs Act. These higher limits are scheduled to sunset in 2026. Tax and financial planning with stock options Not every individual with incentive stock options will have tax planning options to consider.

Darrow Wealth Management

MARCH 24, 2024

6 tax strategies for incentive stock options and AMT Triggering the alternative minimum tax isn’t the end of the world, but you don’t want to do it by accident. By the end of the year, you already know most of the tax inputs so your CPA and financial advisor can help in developing a tax projection.

Harness Wealth

MAY 2, 2025

Unless Congress intervenes, the TCJAs sunset will usher in a swathe of tax increases in 2026, with analysts estimating that over $4 trillion worth of tax hikes could take effect. How will the 2026 tax brackets be affected if the TCJA expires? How will the 2026 tax brackets be affected if the TCJA expires?

Darrow Wealth Management

MARCH 24, 2024

6 tax strategies for incentive stock options and AMT Triggering the alternative minimum tax isn’t the end of the world, but you don’t want to do it by accident. By the end of the year, you already know most of the tax inputs so your CPA and financial advisor can help in developing a tax projection.

Darrow Wealth Management

DECEMBER 23, 2022

would keep the age 50 catch-ups and allow new ones: 401(k) & 403(b) plans: starting in 2025, the catch-up contribution will become the greater of $10,000 or 150% of the catch-up limit for individuals between age 60 – 63. Starting in 2026, the catch-up will be indexed by inflation. The Secure Act 2.0

Darrow Wealth Management

JULY 30, 2024

For founders, employees, and executives with stock-based compensation, an 83(b) election can be a powerful tax planning tool. When you make an 83(b) election, you’re opting to pay tax on unvested shares now, instead of when the stock vests. It can also preclude some tax planning strategies down the road.

Harness Wealth

MARCH 10, 2023

If the manager chooses to use the Three-Year Carried Interest Loophole, they would not be required to pay taxes on that $200,000 until 2026. However, if the investment is sold before the three-year mark, the standard tax rate would apply, and the manager would need to pay tax on their carried interest.

Darrow Wealth Management

MARCH 29, 2024

There are two AMT tax rates: 26% and 28%. AMT exemptions and phase out were increased significantly in the 2017 Tax Cuts and Jobs Act. These higher limits are scheduled to sunset in 2026. Tax and financial planning with stock options Not every individual with incentive stock options will have tax planning options to consider.

James Hendries

DECEMBER 11, 2022

Tax Planning – Have necessary steps been taken toward filing required business and individual tax returns, so they get filed on time? The type of business will determine the tax consequence. This act is set to expire January 1, 2026. Here are five tips that may assist with organizing a strategy.

Steve Sanduski

SEPTEMBER 17, 2024

And so right now, like a lot of advisors, we’re dealing with the fact that the unified credit is scheduled to go down in 2026. So it’s a lot of really intricate estate planning. But what I found was that my passion is spending time with the clients and the problem solving that comes with complex estate and tax planning.”

Cordant Wealth Partners

AUGUST 16, 2024

Other pay : Certain employees can be eligible for “pay in lieu of redeployment” (9 weeks) and an “additional separation bonus” (8 weeks) It’s important to note that severance payouts are taxed as ordinary income in the year of payout. Tax planning for a transition out of Intel is critical.

WiserAdvisor

JANUARY 23, 2024

If your financial advisor is not keeping a close eye on your taxes, they might be missing out on various opportunities that could impact your financial well-being. An effective financial advisor should be proactive in reviewing your tax plan before the year-end. Annual Roth conversions can be one measure to tackle the changes.

Nationwide Financial

MARCH 6, 2023

Even if a client believes they would not be subject to estate or gift tax under current law, you may want to re-examine the value of their assets to determine whether they exceed a lower exemption amount. Tax season has begun, and it’s not too early to think about planning for the 2023 tax year.

Darrow Wealth Management

JANUARY 30, 2023

Here are some tax planning strategies to consider when you should start drawing from your IRA. Tax planning strategies for required minimum distributions Tax planning shouldn’t stop when you retire. Retirees in a low tax bracket for the year have several planning options to consider.

Harness Wealth

JULY 29, 2024

If the sunset occurs, this inflation-adjusted amount, which is currently $13,610,000 as of July 2024 , could be reduced by one-half (after inflation adjustments for 2025 and 2026) starting on January 1, 2026. Keeping ahead of these changes, while managing client expectations, can seem like a tall order.

Sara Grillo

SEPTEMBER 11, 2023

Tax questions we should ponder more deeply Advisors are working on a way that is outdated when it comes to IRMAA planning. An example is how tax planning is handled. The financial industry is geared towards helping people save as much in taxes today as humanly possible. But are taxes going up or down in the future?

Harness Wealth

APRIL 18, 2025

We also cover concerning data showing financial illiteracy cost Americans over $243 billion in 2024, and news that President Trump has signed legislation blocking an IRS cryptocurrency reporting rule previously scheduled to take effect in 2026. Did you miss last weeks edition? You can find it here.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content