How Looming Tax Changes Should Influence Your Retirement Tax Planning

Covisum

AUGUST 5, 2022

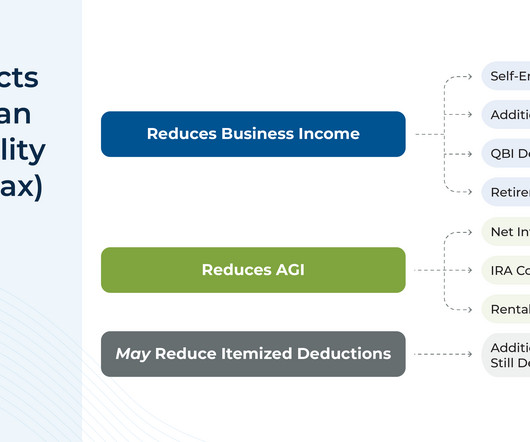

In the absence of Congressional action, multiple provisions of the Tax Cut and Jobs Act (TCJA) will expire at the end of 2025, and tax rules will revert to what they were before the legislation. The TCJA reduced specific tax brackets and increased the standard deduction.

Let's personalize your content