Pass-Through Entity Taxes: Mechanics, Considerations, And Planning Opportunities For Navigating SALT Cap Workarounds

Nerd's Eye View

MAY 31, 2023

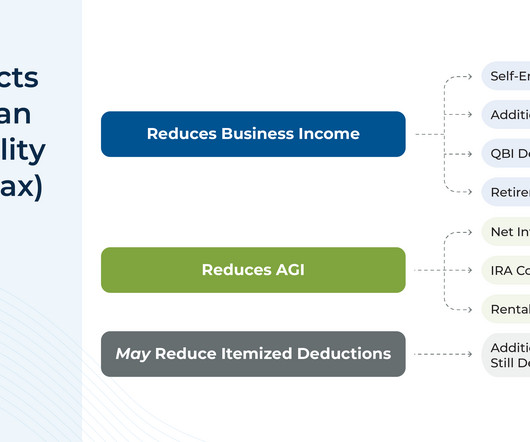

The 2017 Tax Cuts & Jobs Act introduced a $10,000 limit on the State And Local Tax (SALT) deduction that was previously available for taxpayers who itemized their deductions. Another set of considerations involves owners of businesses that operate in multiple states, which can compound the complexity of electing a PTET.

Let's personalize your content