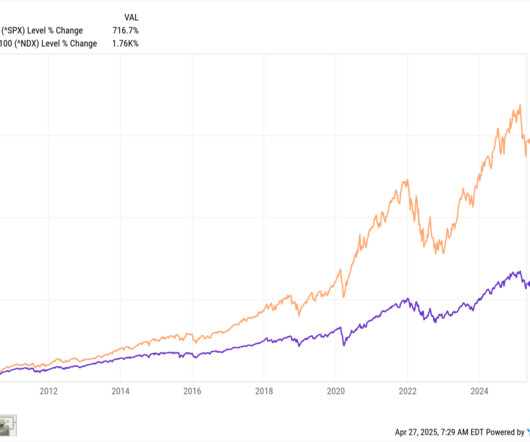

A Spectacularly Underappreciated 15 Years

The Big Picture

APRIL 28, 2025

This current 15-year peak was through February 2024 at ~ 16%. Financial Repression was the rallying cry for underperforming managers. is not what risk managers call a rational trading day. Over the ensuing 16 years, the crowd may have forgotten that pain. Any single day where markets rally 12.5%

Let's personalize your content