DOL Opens Door for Crypto in 401(k)s

Wealth Management

MAY 28, 2025

The Department of Labor rescinded its 2022 guidance cautioning against cryptocurrency in 401(k) plans, reaffirming a neutral stance on digital assets in retirement accounts.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

MAY 28, 2025

The Department of Labor rescinded its 2022 guidance cautioning against cryptocurrency in 401(k) plans, reaffirming a neutral stance on digital assets in retirement accounts.

Trade Brains

JULY 9, 2025

That means if your retirement plan underestimates medical costs, you risk serious shortfalls. at the start of 2022, given an average inflation rate of 7.5% at the start of 2022, given an average inflation rate of 7.5% Out-of-pocket expenses cover ~62% of these, and insurance premiums are rising 10–15% in 2025 alone. 6,56,835.59

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

MainStreet Financial Planning

OCTOBER 30, 2024

Whether it’s savings, retirement funds, or net worth, understanding where you stand can provide valuable perspective on your financial progress. million The Federal Reserve 2022 Survey of Consumer Finances report found that the average net worth among all households was $1.06 Average net worth: $1.06 million among U.S.

Nerd's Eye View

JANUARY 8, 2025

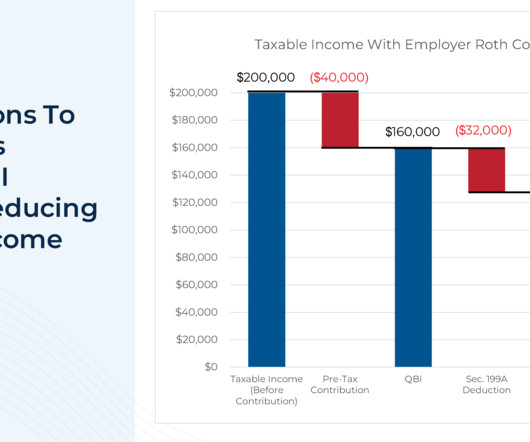

Solo 401(k) plans are a popular retirement savings vehicle for self-employed business owners. By maximizing both the employee employer contributions, solo 401(k) plan owners can often save significantly more than is possible with other types of retirement plans available to self-employed workers, like SEPs and standard IRAs.

Calculated Risk

DECEMBER 27, 2024

YoY in March 2022 and was at 4.0% By following wage changes for individuals, this removes the demographic composition effects (older workers who are retiring tend to be higher paid, and younger workers just entering the workforce tend to be lower paid). in July 2022. Real wage growth has trended down after peaking at 5.9%

The Big Picture

APRIL 17, 2025

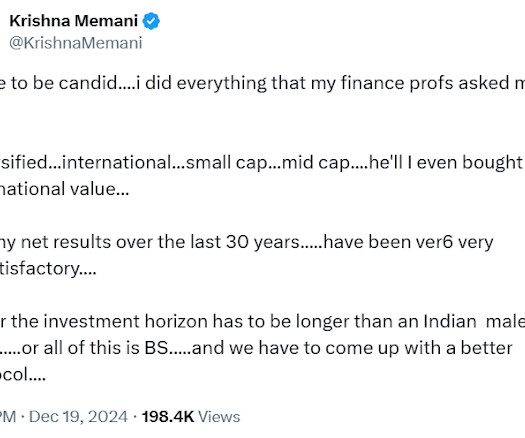

I have made some fortuitously timed buys, including Nasdaq 100 (QQQ) calls purchased during the October 2022 lows. My buddy could pay off his mortgage and car loans, pre-pay the kids colleges, fully fund retirement accounts, and still have cash left over. I was up so much on that trade that my trading demons were emboldened.

Wealth Management

JUNE 20, 2025

CREDIT: Joey Corsica & SpotMyPhotos Founded in 2022, Fynancial is already used by some big RIA firms, like Sanctuary Wealth and is integrated with many top technology providers, including eMoney Advisor, Orion and Wealthbox. The audience was impressed by Mili's presentation and their vision of where AI notetaking is headed.

Wealth Management

JULY 18, 2025

According to a recent survey commissioned by Kestra Financial and Bluespring Wealth Partners, less than half (41%) of first-generation advisors have transferred equity to successors, and just 6% of those planning to retire within 10 years have a fully documented succession plan.

WiserAdvisor

JUNE 13, 2025

It plays a crucial role in helping people achieve financial stability, prepare for retirement, and leave a lasting legacy for their families. Take the year 2022, for example. Here’s what to focus on: List your assets: Include properties, investments, savings, retirement accounts, insurance, and personal valuables. The good news?

Financial Symmetry

MARCH 31, 2025

especially for voters nearing or in retirement. Source: [link] As you can see, 66% of voters in 2022 fall in that category and would likely have a major influence on electing officials who support measures to fully fund Social Security. If you wait until full retirement age (67), youll receive 100% of your benefit.

Wealth Management

JULY 1, 2025

In 2022, Parthenon hired Miles as its chief executive when it bought RSM’s wealth management business and renamed it Choreo. He replaces Larry Miles, who will transition into the executive vice president of strategic partnerships role, a newly created position.

Financial Symmetry

JUNE 24, 2025

There’s also recency bias at play: The market downturns of 2022 and the COVID-19 shock in 2020 linger in memory, making us forget the equally compelling history of market recoveries and long-term growth. Longevity Risk: Today’s retirees and pre-retirees may live several decades beyond retirement. Cash is Comforting, but at What Cost?

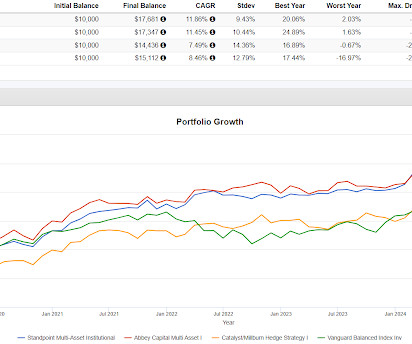

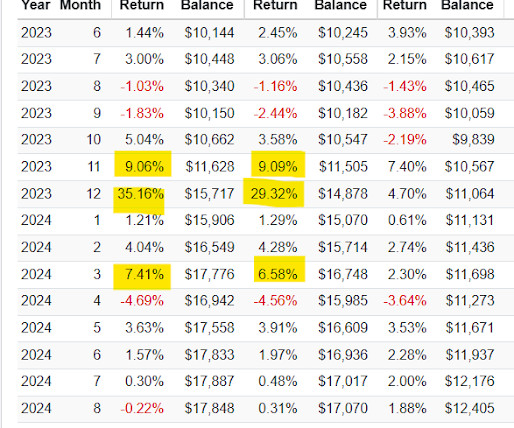

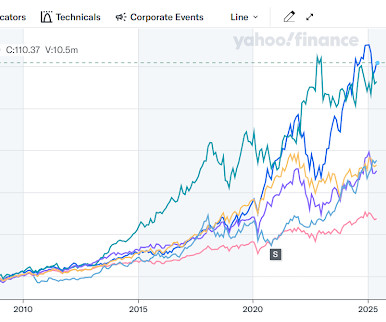

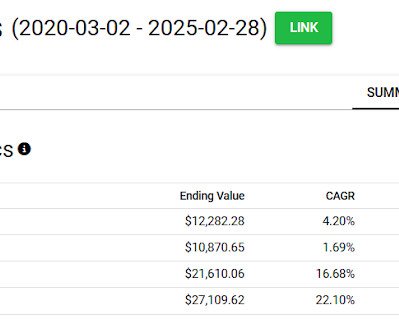

Random Roger's Retirement Planning

JUNE 2, 2025

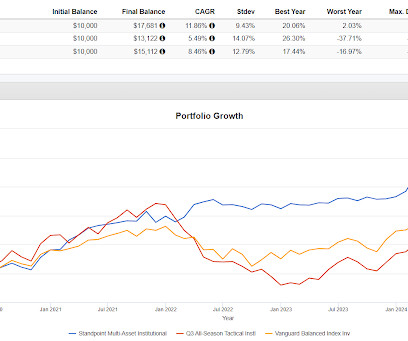

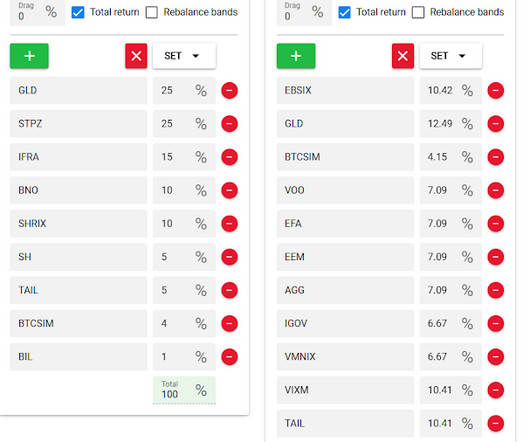

The Invenomic Fund (BIVIX) that we've looked at a few times is seriously skewed by two phenomenal years in 2021 and 2022 when it was up 61% and then 50%. If I had gotten a real answer I would have asked the same for 2022. In 2022, UPAR was down 30%. I asked three different AIs why it did so well in 2021.

Random Roger's Retirement Planning

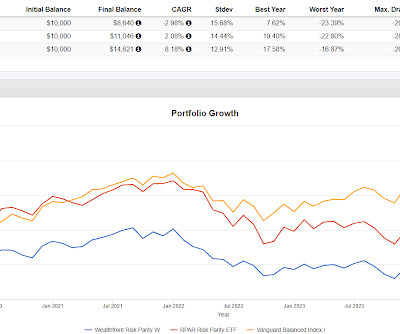

NOVEMBER 4, 2024

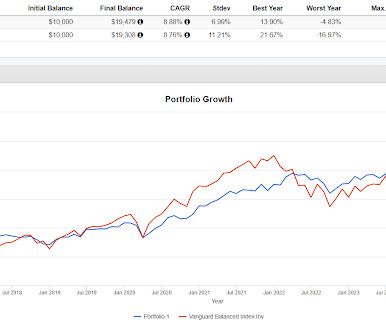

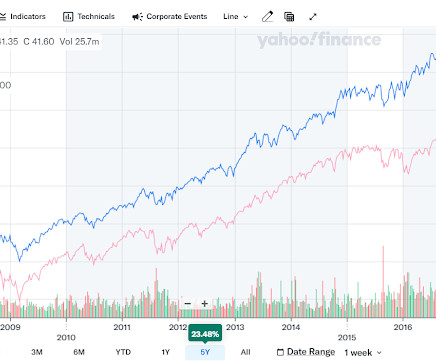

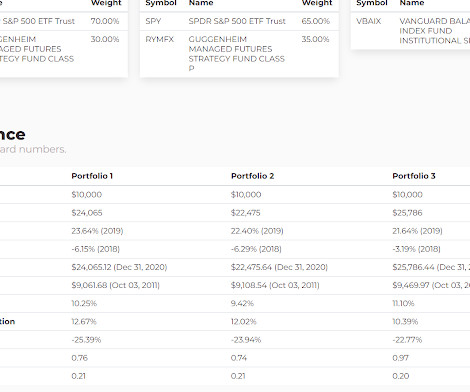

You can see on the backtest, RPAR fairing worse than VBAIX by almost 600 basis points in 2022 and then didn't really come back the way VBAIX did. Even RPAR, compounding at 2% in an 8% world for VBAIX has struggled. RPAR has 70% in treasuries although not all of them are long term. Risk parity is a good example of a great story.

Nerd's Eye View

MAY 2, 2025

a ski chalet), assessing whether it will lead to greater overall wellbeing, or, alternatively, more stress, is more challenging Enjoy the 'light' reading! a ski chalet), assessing whether it will lead to greater overall wellbeing, or, alternatively, more stress, is more challenging Enjoy the 'light' reading!

Random Roger's Retirement Planning

MARCH 5, 2025

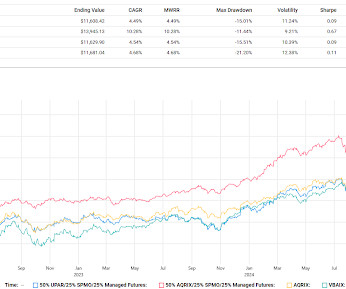

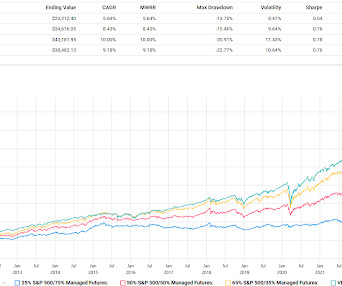

In 2022, it was up 104 basis points (total return). but it was low in 2022 when it mattered. In 2022, when managed futures was having its heyday, there were all of a sudden a lot of calls about putting 20% or more in managed futures. The results were fascinating. We pounded the table here why that was probably a bad idea.

Random Roger's Retirement Planning

FEBRUARY 12, 2025

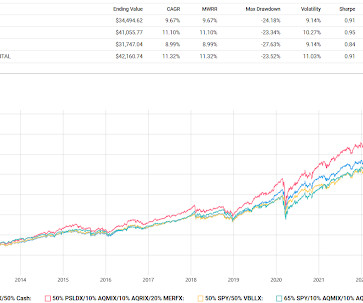

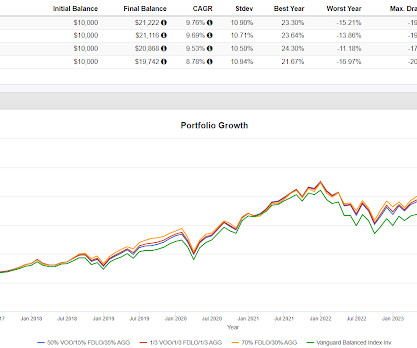

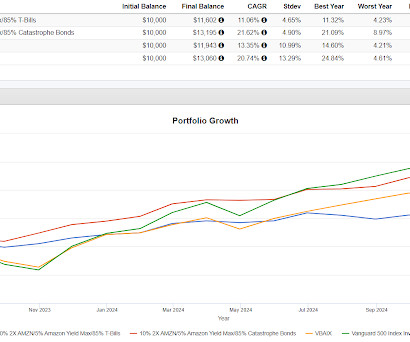

The title of the Man article is Why Alpha Matters for Retirement Savers and in it, they make their case for portable alpha. Portfolio 4 has middling stats compared to the others but in 2022 it was only down 8.23% versus 20% for Portfolio 1, 17% for Portfolio 2 and Portfolio 3 was down 22%.

Random Roger's Retirement Planning

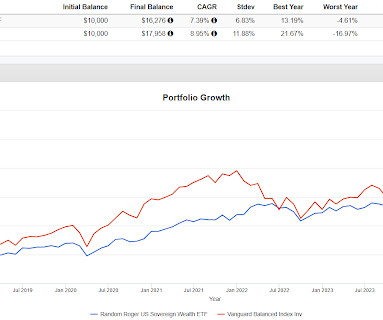

MARCH 15, 2025

There were a couple of instances of outperformance in the period studied including 2022 when it was up 46 basis points and it is slightly ahead this year too. so ok, hasn't been working on this go around but when the S&P 500 was bottoming out in the fall of 2022 with a 21% drop, COMT was up 21%.

Financial Symmetry

JUNE 18, 2025

You’ll also hear her as a regular guest on the Financial Symmetry podcast , where she brings her expertise to conversations around retirement, legacy planning, and life transitions. Rooted in Family, Faith, and Fun Outside of work, Allison finds joy in the everyday rhythms of family life.

Random Roger's Retirement Planning

NOVEMBER 28, 2024

All three were better than VBAIX in 2022 by 150-550 basis points. Somehow, it did worse than the S&P 500 by several hundred basis points in 2022. Based on the chart, I'm guessing that SPD was positioned in such a way as to miss the bounce that started in late 2022. The results are not skewed by one year.

Random Roger's Retirement Planning

JULY 2, 2025

If the idea is a smoother ride with 75/50 then we should be trying avoiding being overly vulnerable one one alternative hitting the skids in a year like 2022. has price inflation compounding at 4.31% but the TIP ETF has negatively compounded by a few basis points because it got crushed in 2022. Note that 2021 was a partial year.

Random Roger's Retirement Planning

FEBRUARY 20, 2025

QAISX outperformed VBAIX by a good bit in every year except 2022. Generically, if a fund creates the effect of an entire portfolio with just a 50% allocation, then of course it would go down more in nominal terms in a year like 2022 (expectations). The fund is the same age as BLNDX.

Random Roger's Retirement Planning

MARCH 12, 2025

The max drawdowns of the backtested portfolios bottomed out in late 2022 as follows To the extent quadrant style might intersect with all-weather, you can decide for yourself whether any of them were all weather enough. There's no wrong conclusion to draw, do you think they are all-weather enough?

Harness Wealth

APRIL 15, 2025

Data from the Federal Reserves 2022 Survey of Consumer Finances (SCF) (released in late 2023) offers the most recent comprehensive snapshot of American household wealth. Find Your Wealth Advisor at Harness How Net Worth Is Changing in America From 2016 to 2022, the median U.S. Whats on the Average American Balance Sheet?

Wealth Management

JULY 25, 2025

Related: Lawsuit: Edelman Didnt Ask Questions When Client Liquidated IRA For Crypto Scam Israel’s practice will operate as Legacy Point Wealth Management of Raymond James, with a focus on families and individuals, corporate retirement plans and business owners. He’s joined by registered client service associate Jake Balcom.

Random Roger's Retirement Planning

FEBRUARY 8, 2025

Consumer discretionary is another one that pretty reliably outperforms for ten year periods, not the last couple though after getting whacked pretty hard in 2022 though. As you might expect, staples went down much less in the Financial Crisis as well as in 2022. Tech is a very good bet to regularly outperform the S&P 500.

Random Roger's Retirement Planning

DECEMBER 22, 2024

We spend a lot of time here on how to diversify to try to smooth out the ride and how to hold up better when markets have a year like 2022 or 2008. Early on, the MCW and Quality versions outperformed VBAIX slightly, probably just due to having a little more equity exposure and all three of them significantly outperformed in 2022.

Random Roger's Retirement Planning

JANUARY 5, 2025

Yes the dividend funds did better than SPY in 2022 but not 2020 and in the financial crisis, I believe DVY was the only one that was around and being heaviest in financials, it did very badly. Going from memory, Amazon dropped 90% in the tech bubble, 75 or 80% in the Financial Crisis and in 2022 it dropped 49%.

Random Roger's Retirement Planning

JULY 4, 2025

The levered portfolio did slightly worse in 2022 but not catastrophically worse despite UPRO falling 56% and TYD falling 43%. When I plug all that into Portfoliovisualizer, it has the the levered portfolio with a much better kurtosis number meaning, despite the huge weightings to 3x funds, the vulnerability to large drawdowns is less.

WiserAdvisor

JULY 7, 2025

Are you thinking about cashing in on your Roth Individual Retirement Account (IRA) early? This article will help you understand the rules around a Roth IRA early withdrawal and walk you through what to consider before tapping into your retirement savings early. And over time, this affects how much you have for retirement.

Random Roger's Retirement Planning

FEBRUARY 1, 2025

It had a couple of terrible years this decade but was the best performer in 2022. The risk clearly is that in a year like 2022, managed futures "don't work" while equities are going down a lot but what I know of managed futures and studied, large drawdowns for managed futures haven't been anywhere near as big as large drawdowns for equities.

Random Roger's Retirement Planning

JANUARY 26, 2025

Isolating the returns of the diversifiers in 2022, but taking out OSOL and AMPD because they weren't around the whole year, you can see that only Bitcoin had a rough time, several were flat (which is good for a year like 2022) and several were up a lot.

Random Roger's Retirement Planning

JUNE 25, 2025

The outperformance isn't solely because of 2022, VOO/BALT outperformed in partial year, 2021, 2023 and 2024. That big drop in SHRIX in late 2022 was from the threat of Hurricane Ian but it turned out there was no triggering event from that one. Using BALT instead of AGG has given a higher compounded return with less volatility.

Random Roger's Retirement Planning

MAY 4, 2025

The purple line went through a nasty drop in 2022. The chart captures three ETFs and two common stocks with the Dow 30 in pink (leftover from another chart I was using for something else). The best performer has had several nasty declines. I haven't sold through any of those drawdowns.

Random Roger's Retirement Planning

MARCH 2, 2025

Barron's wrote about the difficulty of spending down accumulated assets in retirement. Several quick hits today. I am pretty sure this will be difficult for me if our savings play a big role in our month to month lifestyle. This was an article where always read the comments applies.

The Big Picture

JANUARY 21, 2025

I did it during the coronavirus collapse in 2020, and I did it again in 2022. I realized I had enough to retire if I wanted to. But learning how to spend in retirement. I’ve also, however, you know, thought about, you know, this is my retirement, right? It’s, it’s a temporary move.

Random Roger's Retirement Planning

MAY 22, 2025

The 2022 tech selloff and subsequent recovery periods would have hit XLK particularly hard due to this concentration. There was a little more but the above gives you the general idea.

Wealth Management

JULY 15, 2025

According to JPMorgan, Calcote told the client that the advisor reassigned to his account “hasn’t had a book in 15 years and is basically like working with someone who is brand new” (though this advisor was allegedly Calcote’s direct supervisor from 2016 through 2022).

Random Roger's Retirement Planning

MAY 15, 2025

We talked at length in 2022 and into 2023 when managed futures was booming and people were coming out of the woodwork to suggest huge weightings to managed futures which I said was a bad idea back then and is a bad idea right now in terms of constructing a portfolio. In that light, 20% or 25% makes no sense to me.

Random Roger's Retirement Planning

MAY 3, 2025

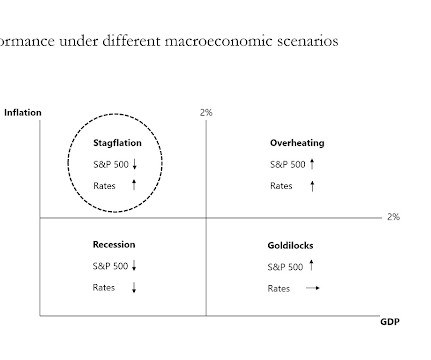

2022 gives a good test for stagflation as Slok sees it because rates went up and stocks went down. In 2022, that blend was down 89 basis points so some drag (PRPFX did worse than BLNDX that year) but not problematic. The Permanent Portfolio allocates 25% each to stocks, gold, long bonds and cash.

Random Roger's Retirement Planning

MAY 14, 2025

trillion market for 401(k)-type retirement plans as crucial to this growth. " There's a little less volatility and quite a bit more growth but there was no crisis alpha in 2022. This quote made my eyes bug out. Wall Street firms have been pushing to get private investments into the hands of individual investors , and they see the $12.4

Random Roger's Retirement Planning

NOVEMBER 21, 2024

It did decline about 5% in the 2020 Pandemic Crash and in 2022 it was up 1.36%. I put together the following that just looks at 2022, when investors needed the uncorrelated streams; There are 15 different return streams there in addition to VOO and VBAIX. The USAF backtest and RAAX don't really look too similar to me.

Random Roger's Retirement Planning

MAY 28, 2025

Portfolio 1 was way ahead in 2022, way behind in 2023 and 2024 but it was up nicely those years and this year it is way ahead. But orthogonality comes at a cost which is the anguish caused by the periods that deviate away from the index by the largest amount. In 2021 it lagged the index by 12%.

Random Roger's Retirement Planning

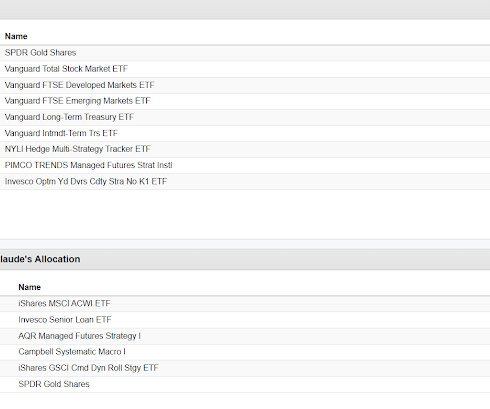

MAY 20, 2025

Both exchange portfolios held up much better in 2022. There are some interesting numbers in the Claude basket related to volatility and Sharpe Ratio. I'm not saying AI's role is nothing. It will evolve to add some amount of value, maybe a lot of value but I think it is too early to know.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content