DOL Opens Door for Crypto in 401(k)s

Wealth Management

MAY 28, 2025

The Department of Labor rescinded its 2022 guidance cautioning against cryptocurrency in 401(k) plans, reaffirming a neutral stance on digital assets in retirement accounts.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

MAY 28, 2025

The Department of Labor rescinded its 2022 guidance cautioning against cryptocurrency in 401(k) plans, reaffirming a neutral stance on digital assets in retirement accounts.

Nerd's Eye View

JANUARY 8, 2025

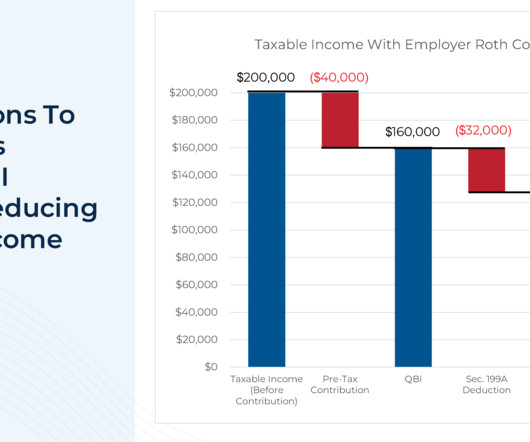

Solo 401(k) plans are a popular retirement savings vehicle for self-employed business owners. By maximizing both the employee employer contributions, solo 401(k) plan owners can often save significantly more than is possible with other types of retirement plans available to self-employed workers, like SEPs and standard IRAs.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Chicago Financial Planner

NOVEMBER 27, 2022

One of the best tax deductions for a small business owner is funding a retirement plan. Beyond any tax deduction you are saving for your own retirement. You deserve a comfortable retirement. If you don’t plan for your own retirement who will? I generally consider this a plan for the self-employed.

The Chicago Financial Planner

OCTOBER 21, 2021

Saving for retirement is a major undertaking for most of us. Health savings accounts (HSA) provide another vehicle to save for retirement. Many of you have the option to enroll in high-deductible insurance plans that allow the use of a health savings account via your employer. The rising cost of healthcare in retirement .

Nerd's Eye View

SEPTEMBER 20, 2023

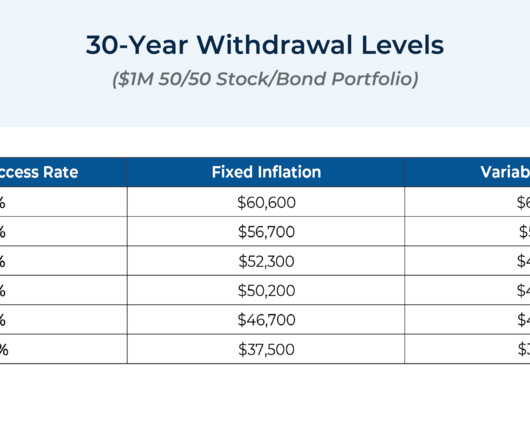

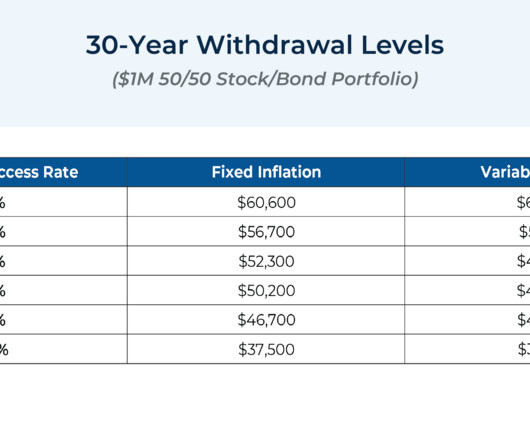

30 years ago, when financial plans relied mainly on constant investment return projections derived from straight-line appreciation and time-value of money calculations, financial advisors began acknowledging and accounting for the variable and uncertain nature of investment returns. Read More.

Wealth Management

JANUARY 31, 2023

Vestwell conducted the fourth-annual “Retirement Trends Report” in fall 2022 and received responses from almost 1,300 savers, 500 financial advisors and 250 small businesses.

Nerd's Eye View

FEBRUARY 8, 2023

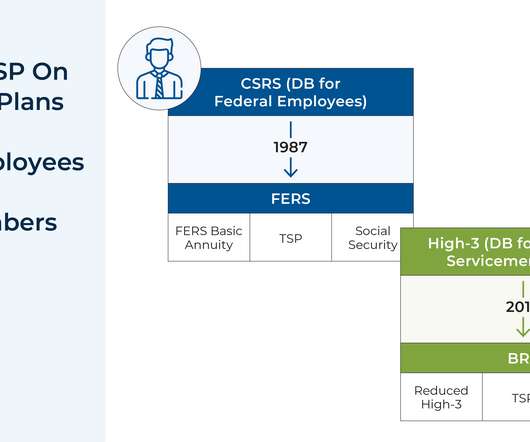

Seasoned financial advisors have likely worked with clients with a wide variety of workplace retirement accounts, which can vary in terms of their investment offerings, fees, and other characteristics. In 2022, the TSP underwent a series of changes impacting its many account holders. But given that the U.S. But given that the U.S.

Trade Brains

JULY 9, 2025

That means if your retirement plan underestimates medical costs, you risk serious shortfalls. at the start of 2022, given an average inflation rate of 7.5% over that period. If you planned to live on ₹1 lakh per month today, you might need ₹1.5 – ₹1.7 at the start of 2022, given an average inflation rate of 7.5%

Wealth Management

AUGUST 16, 2022

The Wipfli Financial Advisors acquisition comes with a retirement practice and a mass-affluent focused tech platform.

Wealth Management

AUGUST 16, 2022

Economic turmoil took a toll on savings in the first half of 2022 and that’s just the tip of the iceberg as many in the US lack employer-sponsored plans.

Wealth Management

JULY 2, 2025

Related: Planning for Older Clients and Those with Disabilities Many GRATs include a so-called “swap” power in which the grantor is permitted to substitute assets of equivalent value with the GRAT. Smith, 2022 U.S. April 26, 2022)) has held that exercising the swap power could be considered a purchase under the insider trading rules.

Wealth Management

AUGUST 16, 2022

Economic turmoil took a toll on savings in the first half of 2022 and that’s just the tip of the iceberg as many in the US lack employer-sponsored plans.

Nerd's Eye View

MAY 2, 2025

a ski chalet), assessing whether it will lead to greater overall wellbeing, or, alternatively, more stress, is more challenging Enjoy the 'light' reading! a ski chalet), assessing whether it will lead to greater overall wellbeing, or, alternatively, more stress, is more challenging Enjoy the 'light' reading!

Wealth Management

JULY 1, 2025

In 2022, Parthenon hired Miles as its chief executive when it bought RSM’s wealth management business and renamed it Choreo. He replaces Larry Miles, who will transition into the executive vice president of strategic partnerships role, a newly created position.

Wealth Management

JUNE 20, 2025

The other competitors in this year’s demos included Addepar , Altrata , BILL , Encorestate Plans , GReminders , MileMarker , Mili AI , Wealthfeed , Zeplyn and Zocks. Related: Scenes from Day 2 of Wealth Management EDGE “My parents are 67 and 68, they have the classic Dell desktop covered in dust—everything is on their phone,” he said.

MainStreet Financial Planning

OCTOBER 30, 2024

Whether it’s savings, retirement funds, or net worth, understanding where you stand can provide valuable perspective on your financial progress. million The Federal Reserve 2022 Survey of Consumer Finances report found that the average net worth among all households was $1.06 appeared first on MainStreet Financial Planning.

Nerd's Eye View

JUNE 26, 2024

Traditionally, the challenge in using a 529 plan to save for higher education expenses has been figuring out how much to save to cover the beneficiary's college costs without overshooting and saving more in the 529 plan than is actually needed. The Secure 2.0

Nerd's Eye View

NOVEMBER 3, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the Department of Labor this week released its long-awaited "retirement security rule", its latest effort to curb conflicts of interest around retirement savings recommendations.

Wealth Management

JUNE 27, 2025

The firm had been an owner-operated business until late 2022, when Ryan Hanks, founder and CEO of Madison Capital Group, a real estate investment firm, took a majority stake in Orange Street Holdings, the entity that owns Realta. Q&A: What Was Behind Schechter’s Decision to Sell to Arax?

Integrity Financial Planning

JANUARY 9, 2023

The 2022 economic climate has been bumpy for most and, in some cases, even bumpier for retirees. 1] However, in 2022, this number spiked to 9.1% 2] With higher prices in consumer goods, retirees may have had to reevaluate their withdrawals and spending on retirement accounts as their income became strained.

Nerd's Eye View

SEPTEMBER 20, 2023

30 years ago, when financial plans relied mainly on constant investment return projections derived from straight-line appreciation and time-value of money calculations, financial advisors began acknowledging and accounting for the variable and uncertain nature of investment returns. Read More.

Nerd's Eye View

SEPTEMBER 2, 2022

From there, we have several articles on investments: How Morningstar plans to simplify its rating system amid continued concerns about its effectiveness. The variety of ways individuals approach retirement, from choosing where to live to finding purpose in their daily lives.

Abnormal Returns

DECEMBER 26, 2022

kitces.com) Christine Benz and Jeff Ptak discuss the recent "The State of Retirement Income" report. morningstar.com) Ryan Detrick and Sonu Varghese talk with Phil Pearlman about the connection between health and wealth planning. thinkadvisor.com) Being able to move unused 529 plan funds into an IRA is a neat trick.

Abnormal Returns

JULY 31, 2023

riaintel.com) Creative Planning has inked a custody deal with Goldman Sachs ($GS). morningstar.com) QLACs are coming to the 401(k) plan. theatlantic.com) 2022 saw a jump in investment fraud. riaintel.com) Retirement A certain portion of the population never wants to retire. financial-planning.com)

Nerd's Eye View

OCTOBER 21, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that Congress appears poised to pass a series of changes affecting retirement planning, dubbed “SECURE ACT 2.0”, ”, by the end of the year. Social Security COLA for 2023.

Nerd's Eye View

JANUARY 19, 2024

Nevertheless, there is potential for many individual RIAs to expand their staffing further, with the addition of specialized planning and operations roles being seen as a potential avenue to boost firm growth.

Abnormal Returns

FEBRUARY 13, 2023

wsj.com) Direct indexing Vanguard is planning a bigger push into direct indexing. wealthmanagement.com) Retirement Why most people underestimate their chances of living into old (90+) age. wsj.com) Retirement spending is more flexible than commonly thought. riabiz.com) The number of CFPs grew some 5% in 2022. (fa-mag.com)

The Chicago Financial Planner

FEBRUARY 6, 2022

In spite of what was said on PBS Frontline The Retirement Gamble and elsewhere in the press, in my opinion 401(k) plans are one of the best retirement savings vehicles available. Here are 4 steps to make sure that your 401(k) plan is working hard for your retirement. Get started . Are you self-employed ?

Abnormal Returns

DECEMBER 14, 2022

Podcasts Christine Benz and Jeff Ptak talks with Jamie Hopkins of Carson Wealth about some common retirement planning questions. ft.com) Who really benefits from 529 plans? nytimes.com) Planning Doug Boneparth, "Cash flow lives at the heart of financial organization." morningstar.com) 20 thing to do before year-end.

Nerd's Eye View

DECEMBER 2, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with a research study suggesting that the market volatility experienced in 2022 could increase demand for financial planning services.

Good Financial Cents

JANUARY 26, 2023

Early retirement has become a popular financial goal. Even if you never retire early, just knowing that you can is liberating! Can You Really Retire at 50? Can You Really Retire at 50? Table of Contents Can You Really Retire at 50? FAQs on Retiring Early at 50 It’s a big bold claim – retire at 50?

Nerd's Eye View

SEPTEMBER 9, 2022

Also in industry news this week: As broker-dealers increasingly offer fee-based planning services, RIAs are responding by enhancing their own service offerings, and offering alternative fee structures to differentiate themselves from the competition.

Nerd's Eye View

AUGUST 12, 2022

From there, we have several articles on Mergers & Acquisition (M&A) trends: M&A activity so far in 2022 is set to exceed 2021’s record pace despite economic headwinds, meaning there could simply be a ‘new normal’ of higher activity regardless of the economic environment. Enjoy the ‘light’ reading!

The Big Picture

NOVEMBER 27, 2023

When you get it wrong, it crushes your retirement plans. My own track record at making big calls is pretty damned good, but none of our clients wants me slinging around their retirement monies based on my gut instinct. But when they get market timing wrong, they lose subscribers. I sure as hell don’t want to either.

Abnormal Returns

FEBRUARY 23, 2023

morningstar.com) It's easy to forget how bad 2022 was for retirement account investors. novelinvestor.com) Going to a four-day workweek requires planning. Markets Higher for longer, has put pressure on bond yields in February. cnbc.com) Strategy Not everyone is giving up on the crypto markets.

Integrity Financial Planning

JUNE 12, 2023

As you plan for retirement, it’s important to consider tax optimization strategies to minimize your tax liabilities. Here are three key ways to optimize taxes in retirement, based on information from sources published between 2022 and 2023.

The Big Picture

APRIL 17, 2025

I have made some fortuitously timed buys, including Nasdaq 100 (QQQ) calls purchased during the October 2022 lows. It doesnt matter if it is Nvidia, Bitcoin, founders stock, or an employee stock option purchase plan (ESOP), sometimes the sheer size of a windfall is paralyzing. Torn about what to do, he asked my opinion.

Darrow Wealth Management

NOVEMBER 20, 2023

If you think retirement planning moves stop at retirement, think again. Although it won’t make sense in every situation, retirement can be a unique opportunity for Roth conversions for some investors. If they converted $100,000 to a Roth on December 31st 2022, their RMD would be $3,774 less this year.

Darrow Wealth Management

DECEMBER 23, 2022

Congress is once again poised to make sweeping changes to the retirement and tax rules in the last two weeks of the year. retirement changes. retirement changes. There are many components of the 2022 Act that will impact employers that aren’t outlined below. 529 plan to Roth IRA rollovers. The Secure Act 2.0

WiserAdvisor

OCTOBER 4, 2022

Retirement planning can be a bit complex. There are multiple factors to weigh in, right from healthcare and inflation to estate planning, business succession planning, tax planning, and more. However, the main drawback to this can be the lack of foresight regarding what and how to plan.

Nerd's Eye View

AUGUST 5, 2022

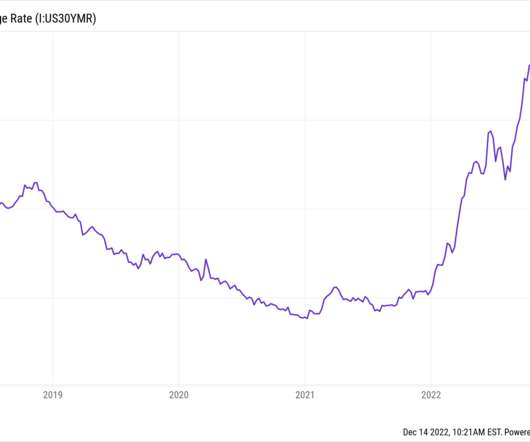

We also have a number of articles on retirement planning: How the variability in annuity payouts across annuity providers has exploded in 2022, creating an opportunity for advisors to add value to clients by comparison shopping across insurance companies.

The Chicago Financial Planner

DECEMBER 5, 2021

For those of you who are self-employed it is important that you save for your own retirement. For 2022 these limits increase to $61,000 and $67,500. For 2022 these contribution limits increase to $20.500 and $27,000, plus the employer-funded profit sharing component in both years. Building a business is hard work.

Nerd's Eye View

OCTOBER 15, 2024

What's unique about Mark, though, is how he uses a liability-driven-investing approach to build retirement portfolios and manage sequence of return risk, with a particular focus on using closed end bond funds to generate income needed to cover his client's expenses during the early (and most financially dangerous) years of retirement.

The Chicago Financial Planner

JUNE 13, 2022

After a strong finish in 2020 and very solid returns in 2021, we’ve seen a lot of market volatility so far in 2022. Assuming that you have a financial plan with an investment strategy in place there is really nothing to do at this point. If not perhaps you are taking more risk than you had planned. Do nothing.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content