From Rocket Ship to Roller Coaster

Investing Caffeine

FEBRUARY 1, 2022

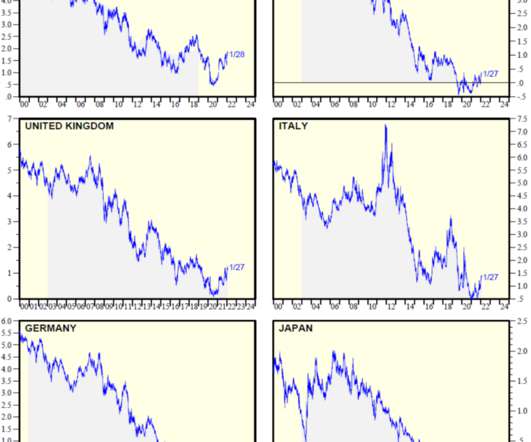

T he stock market has been like a rocket ship over the last three years 2019/2020/2021, advancing +90% as measured by the S&P 500 index, and +136% for the NASDAQ. Math Matters. I did okay in school and was educated on many different topics, including the basic principle that math matters. Source: Calafia Beach Pundit.

Let's personalize your content