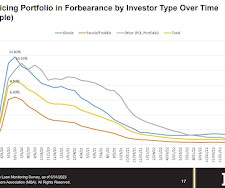

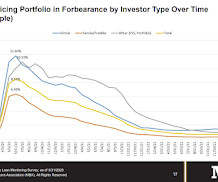

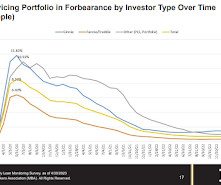

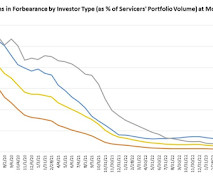

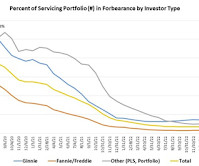

MBA Survey: Share of Mortgage Loans in Forbearance Increases to 0.50% in November

Calculated Risk

DECEMBER 23, 2024

From the MBA: Share of Mortgage Loans in Forbearance Increases to 0.50% in November The Mortgage Bankers Associations (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance increased to 0.50% as of November 30, 2024. million borrowers since March 2020.

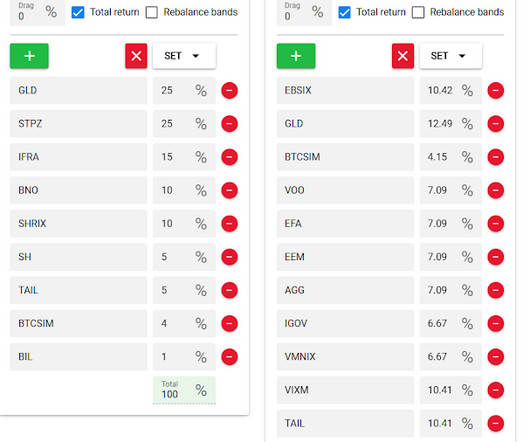

Let's personalize your content