Weekend Reading For Financial Planners (May 3–4)

Nerd's Eye View

MAY 2, 2025

a ski chalet), assessing whether it will lead to greater overall wellbeing, or, alternatively, more stress, is more challenging Enjoy the 'light' reading!

Nerd's Eye View

MAY 2, 2025

a ski chalet), assessing whether it will lead to greater overall wellbeing, or, alternatively, more stress, is more challenging Enjoy the 'light' reading!

NAIFA Advisor Today

FEBRUARY 6, 2025

Previously, he served terms on the FSP National Board of Directors from 2011 through 2016. He is the author of several books, including Free Throws for Financial Professionals: Winning Principles for Unlocking Business Success, Above the Clouds: Winning Strategies from 30,000 Feet, and The New Rules of Retirement Planning.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Random Roger's Retirement Planning

NOVEMBER 21, 2024

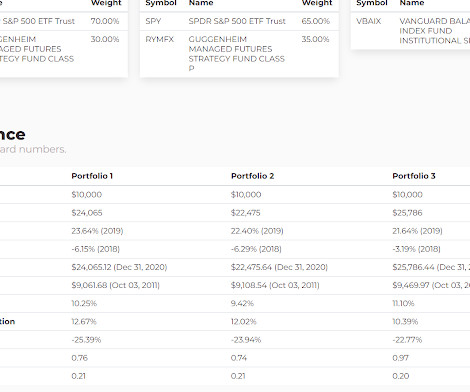

The backtest runs from the start of 2011 to the end of 2020. To my knowledge, RYMFX was the first managed futures mutual fund and it had the space to itself for several years after in launched in 2007.

Dear Mr. Market

NOVEMBER 22, 2024

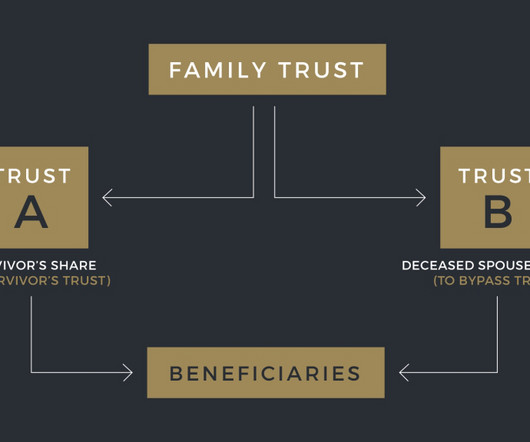

Has it been nearly a decade (or more) since you and your spouse updated your estate plan? If so, there’s a good chance your plan includes the classic “AB Trust” structure, which—prior to 2011—was the primary way for married couples to double the value of their federal estate tax exemptions.

Getting Your Financial Ducks In A Row

OCTOBER 17, 2022

Two primary goals of the IRA were to provide a tax-advantaged retirement plan to employees of businesses that were unable to provide a pension plan; in addition, to provide a vehicle for preserving tax-deferred status of qualified plan assets at employment termination (rollovers).

Random Roger's Retirement Planning

APRIL 9, 2024

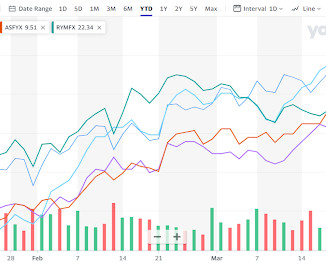

As we say all the time, whereas stocks are the thing that goes up the most, most of the time in the modern era I would want more than 25% in equities for anyone needing normal stock market growth for their retirement plan to work. ASFYX is a client and personal holding.

Random Roger's Retirement Planning

APRIL 11, 2024

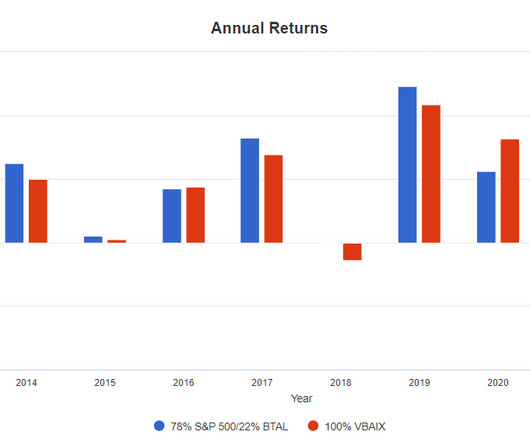

The managed futures blends' worst years in this study were 2011 when they were down slightly versus up 4.31% for VBAIX and 2018 when they were down 5.5%-6% I don't discount having been lucky to have found RYMFX pretty much right after it started trading and for selling it some time in 2011. 6% while VBAIX was down 2.84%.

Let's personalize your content