Small Cap Value: Waiting for the Jumpstart

Validea

SEPTEMBER 6, 2023

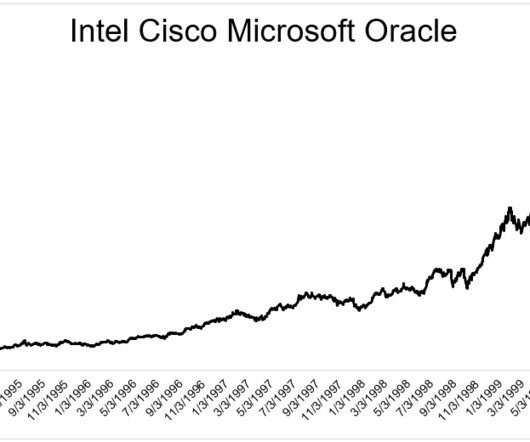

By Justin Carbonneau ( Twitter | LinkedIn | YouTube ) — Over the past few weeks, I’ve seen a number of charts highlighting the opportunity in small-cap stocks given their absolute and relative valuations. As you can see, small/mid-cap value has rarely been so cheap (our data goes back to 2006). Only 12.4% Only 11.7%

Let's personalize your content