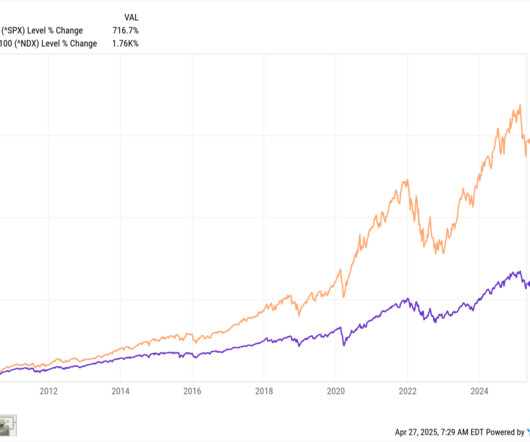

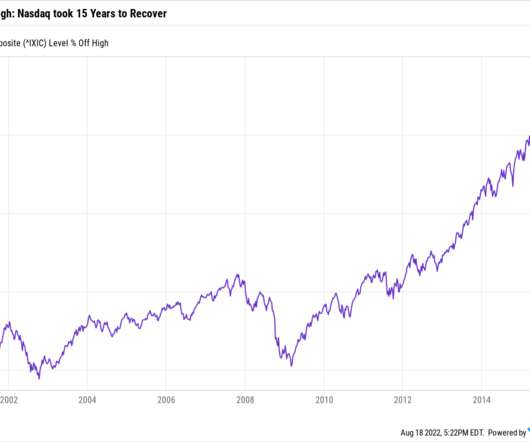

A Spectacularly Underappreciated 15 Years

The Big Picture

APRIL 28, 2025

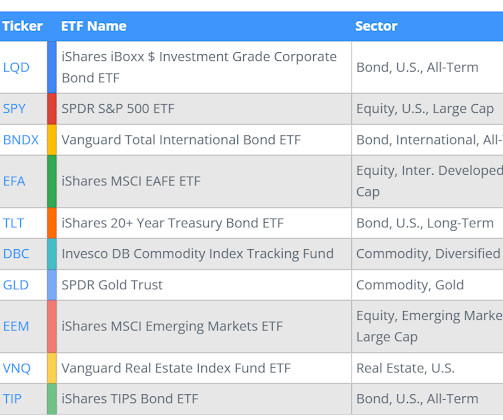

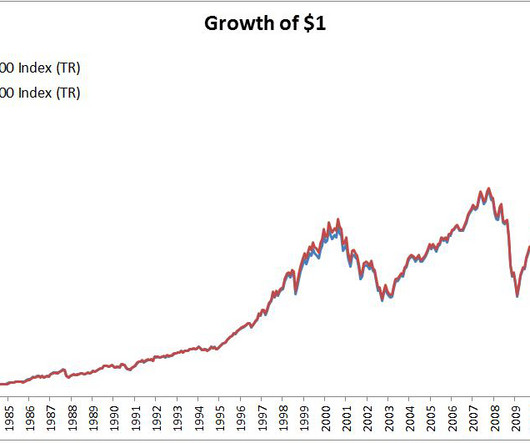

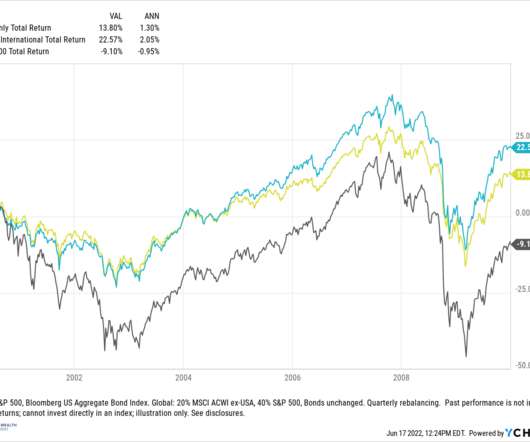

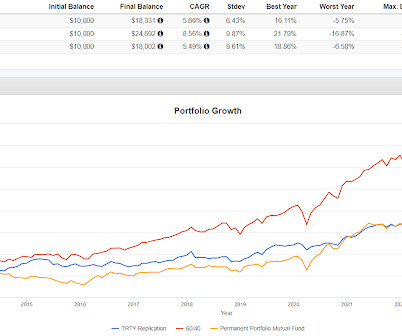

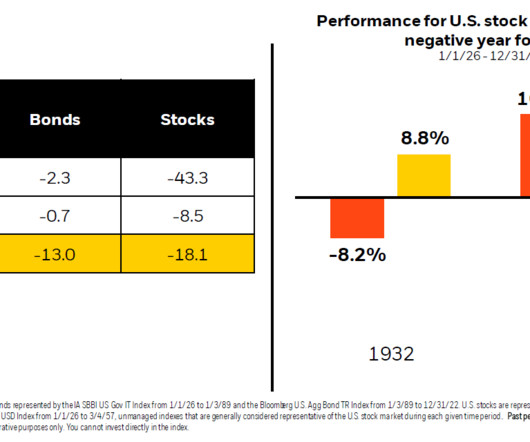

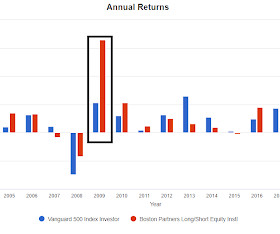

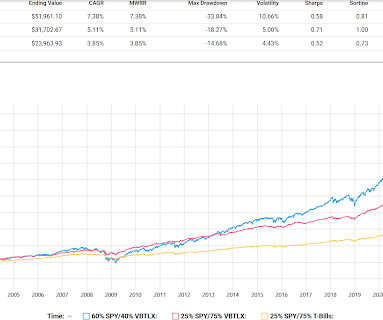

From March 2000 to the double lows October 2002 and March 2003, the Nasdaq 100 fell 82.9% (peak to trough). See also Lazy Portfolios rolling returns. Plus bonds down 15% – the first double-digit drop for both asset classes in 4 decades. For two decades, every dip purchase was soon rewarded.

Let's personalize your content