How Much Does Having The ‘Right’ Capital Market Assumptions Matter In Retirement Planning?

Nerd's Eye View

DECEMBER 11, 2024

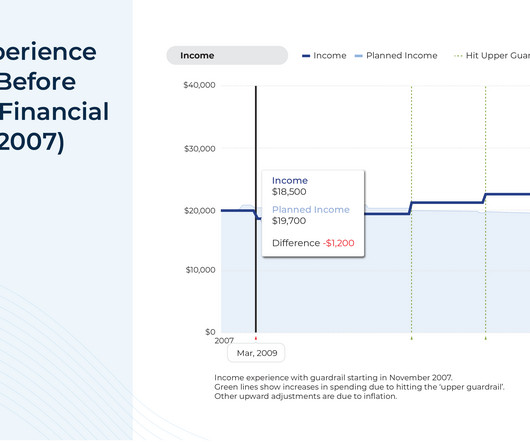

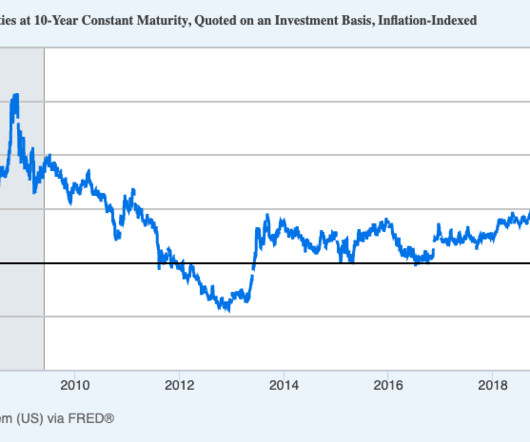

Advisors want to help clients set a secure, reliable retirement plan, yet even the most comprehensive assumptions will inevitably deviate from reality at least to some degree. These assumptions are rooted in Capital Market Assumptions (CMAs), which project how different assets might perform in the future.

Let's personalize your content