Accounting Advisory Services: A Comprehensive Guide for CPAs

Harness Wealth

OCTOBER 23, 2023

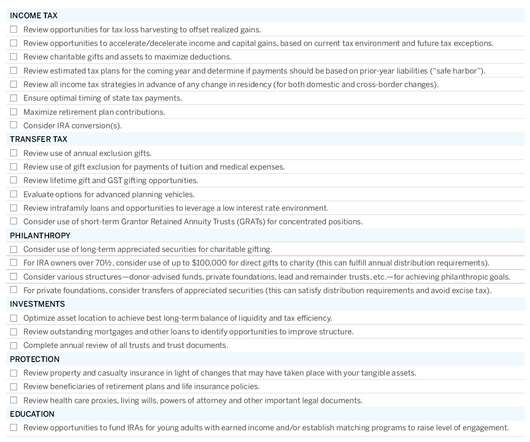

Key Takeaways: Accounting advisory services extend beyond traditional tax preparation to offer strategic financial guidance. Specialized areas can include estate planning and tax-efficient investment strategies. Table of Contents What Are Accounting Advisory Services?

Let's personalize your content