Weekend Reading For Financial Planners (May 3–4)

Nerd's Eye View

MAY 2, 2025

a ski chalet), assessing whether it will lead to greater overall wellbeing, or, alternatively, more stress, is more challenging Enjoy the 'light' reading!

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

MAY 2, 2025

a ski chalet), assessing whether it will lead to greater overall wellbeing, or, alternatively, more stress, is more challenging Enjoy the 'light' reading!

Nerd's Eye View

NOVEMBER 3, 2023

Among other measures, the proposal would amend the current 5-part test that determines fiduciary status for retirement accounts by defining as a fiduciary act a one-time recommendation to roll funds from a company retirement plan to an Individual Retirement Account (IRA), strengthen advice standards for independent insurance professionals, apply to (..)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

DECEMBER 13, 2024

Also in industry news this week: While the SEC has had the power to restrict mandatory arbitration clauses in RIA client agreements for more than a decade, an advisory committee meeting this week suggests support for such a measure isn't unanimous CFP Board saw a record number of exam-takers during 2024, reflecting recognition of the professional and (..)

Nerd's Eye View

MAY 17, 2024

Also in industry news this week: The SEC this week announced a proposed rule that would require RIAs to collect and verify their clients' personal information in an effort to prevent illicit activity, though many firms likely are taking many of these steps already Why larger RIAs and those that have been acquired tend to have worse client and staff (..)

Nerd's Eye View

AUGUST 25, 2023

Also in industry news this week: The SEC settled its first charges related to its new marketing rule with a firm that advertised 2,700% annual returns A survey suggests that older Americans prefer the term "longevity" to "aging", perhaps informing the way advisors discuss related issues with their clients From there, we have several articles on retirement (..)

Nerd's Eye View

NOVEMBER 4, 2022

From there, we have several articles on investment planning: While I Bonds have received significant attention during the past year, TIPS could be an attractive alternative for many client situations.

Nerd's Eye View

JANUARY 13, 2023

From there, we have several articles on retirement planning: The latest rules for 2023 Required Minimum Distributions from inherited retirement accounts. Why relying on Treasury Inflation-Protected Securities (TIPS) to support the bulk of retirement income needs could be risky.

Nerd's Eye View

DECEMBER 25, 2023

Each week in Weekend Reading For Financial Planners, we seek to bring you synopses and commentaries on 12 articles covering news for financial advisors including topics covering technical planning, practice management, advisor marketing, career development, and more.

Dear Mr. Market

DECEMBER 31, 2024

Because when it comes to financial planning, you’re ready to write it downand studies show that writing down your goals makes you 42% more likely to achieve them. Heres your top 10 financial planning checklist for the new year. A little planning now avoids big headaches later. Happy Planning and best to you in 2025!

Your Richest Life

APRIL 15, 2024

Do you have a plan in place for your retirement? For many people, the extent of their retirement planning includes signing up for the plan at work – which is often more of a starting point than a comprehensive retirement plan. Some 457 plans can allow for Roth contributions and in-plan rollovers.

Tobias Financial

OCTOBER 12, 2023

Additionally, financial habits such as lower contributions to retirement plans and reliance on tangible assets pose unique challenges. According to Catalina, empowering the Latino community financially requires knowledge, advocacy, and strategic planning.

NAIFA Advisor Today

JANUARY 28, 2025

As a Retirement Income Certified Professional and a Life and Annuities Certified Professional, John advises clients on retirement planning, investment planning, and risk management. Zack is also skilled in presenting, emceeing, event planning, program management, and social media.

Yardley Wealth Management

OCTOBER 7, 2020

The post Is COVID-19 affecting your Retirement Planning? Is COVID-19 affecting your Retirement Planning? Retirement Planning Financial Planning Risk. Over their lifetimes, most people have heard warnings and advice from retirement advisors about various aspects of their plans.

Yardley Wealth Management

FEBRUARY 4, 2025

From maximizing deductions to managing capital gains, we’ll cover everything you need to know about smart tax planning. It’s triggered by large deductions, multiple dependents, or significant capital gains, requiring careful planning of deductions and income recognition. Click here and contact us for more information.

Million Dollar Round Table (MDRT)

JULY 21, 2022

This is the time to do comprehensive financial planning: retirement planning, investment planning, tax planning and estate planning. Discuss more advanced estate planning, charitable planning and special family issues.

Talon Wealth

OCTOBER 26, 2023

Retirement planning can be intimidating, especially if you need help figuring out where to start. Determine When to Start Saving When it comes to saving for retirement, earlier is almost always better. Create a Budget Creating a budget allows you to track your expenses and ensure you’re saving enough for retirement.

Yardley Wealth Management

SEPTEMBER 10, 2024

The post Investing for Retirement: Strategies for Long-Term Success appeared first on Yardley Wealth Management, LLC. Investing for Retirement: Strategies for Long-Term Success Introduction Investing for retirement is a journey that demands careful planning, patience, and discipline.

eMoney Advisor

FEBRUARY 9, 2023

If you are looking for opportunities to grow your business, expanding your services to clients at all stages of the financial planning lifecycle creates new opportunities for you to reach those households in search of professional advice. People in this stage may have just graduated from college and recently joined the working world.

WiserAdvisor

JANUARY 16, 2024

This data can serve as a baseline for tailoring your retirement plan, taking into account factors such as inflation, your current age, and your desired retirement age. These figures can serve as a valuable reference point for individuals planning their retirement.

Clever Girl Finance

MARCH 19, 2024

No one cares more about your financial well-being than you, so having a personal financial plan is important. Knowing how to make a financial plan will allow you to save money, afford the things you want, and achieve long-term goals like saving for college and retirement. Table of contents What is a financial plan?

Carson Wealth

DECEMBER 1, 2022

Meeting with a qualified financial planning professional can help you begin building positive and lasting behaviors.?? . Take Advantage of Retirement Plans and Matching Contributions. Employers often match a portion of this contribution to a retirement plan as an employer benefit. . Million after 40 years!

WiserAdvisor

AUGUST 26, 2022

Are you good with numbers, accounting, and financial planning? If yes, then DIY financial planning might be a good option for you. On the other hand, if you tend to struggle with budgeting or find financial planning overwhelming, then professional money management could be a better solution. What is DIY financial planning?

Carson Wealth

OCTOBER 6, 2022

I have two friends, both in education, who literally threw away their 403(b) enrollment forms because they didn’t understand what the tax-sheltered retirement plan was. 1. Employer match on 401(k) plans. There’s not a lot of mystery surrounding the 401(k) retirement and savings investment plan.

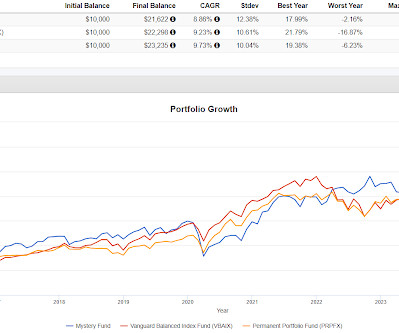

Random Roger's Retirement Planning

FEBRUARY 9, 2025

The point is to understand that a portfolio that is valid for a long term investment plan will have periods where it lags in a frustrating manner. In real life, the Mystery Fund isn't suitable as a one portfolio solution despite being in the ballpark. The result is close but the fund isn't valid for that purpose.

International College of Financial Planning

APRIL 25, 2024

This certification is recognized globally and showcases a deep, systematic understanding of personal financial management, including investment planning, risk management, tax planning, and retirement planning. From there, they collaborate with you to develop a tailored financial plan.

Darrow Wealth Management

OCTOBER 28, 2024

Deciding how to allocate and invest the proceeds after the sale of your company is a big decision that requires careful planning. If you are expecting a sudden windfall , develop a plan to allocate the proceeds and reinvest in your future. Are you planning to retire? Create a formal financial plan.

NAIFA Advisor Today

DECEMBER 20, 2023

As a Retirement Income Certified Professional (RICP) and a Life and Annuities Certified Professional (LACP), John advises clients on retirement planning, investment planning, and risk management. He serves as a NAIFA leader and has held several leadership roles at the local, state, and national levels.

Talon Wealth

AUGUST 26, 2023

We all know retirement is an important milestone that requires careful planning. Of course, one of the most important aspects of retirement planning is managing retirement taxes. Taxes can significantly impact the amount of money you’ll have for retirement.

Talon Wealth

OCTOBER 26, 2023

We all know retirement is an important milestone that requires careful planning. Of course, one of the most important aspects of retirement planning is managing retirement taxes. Taxes can significantly impact the amount of money you’ll have for retirement.

International College of Financial Planning

JANUARY 18, 2023

He is a BFSI Industry Veteran with over 30 Years of Experience across various functions Financial planning is, in the words of renowned author Alan Lakein, “Bringing the future into the present so that you may do something about it now.” The new framework provides the tools to meet the highest financial planning standards.

Carson Wealth

JANUARY 17, 2023

Consider the following five steps to take planning for retirement in your 40s: . Align Your Current Spending and Savings Plans with Future Goals . Discretionary expenses include money spent traveling, eating out, contributing to savings and retirement plans or occasional purchases and upgrades.

International College of Financial Planning

JULY 30, 2022

Earning the CFP designation requires a rigorous course of study covering investment planning, income taxation, retirement planning and risk management. A Person who completes the CFP course is qualified to provide financial planning services to those with a high degree of financial responsibility.

Nationwide Financial

DECEMBER 7, 2022

There’s value in staying invested in that asset allocation and not trying to time the market’s ups and downs or succumbing to fear when markets turn tumultuous. Retirement planning is a long-term process with many risks and challenges for investors.

International College of Financial Planning

NOVEMBER 10, 2021

This has led to the constant lookout for Investment Advisors who are trained to offer clients the right advice and direction concerning investments based upon investment goals, the length of the investment, and the risk appetite. Retirement Planning Course – Retirement planning is gaining huge popularity among Indians.

Park Place Financial

MARCH 10, 2022

FINANCIAL PLANNING 4 Financial Strategies to Leverage if your Portfolio is Worth Millions Schedule a Complimentary Financial Review CLICK HERE TO SCHEDULE. Financial planning investment strategies can be found at every corner of the Internet, but not all advice applies to every person. Diversify your Investment Portfolio.

Park Place Financial

NOVEMBER 29, 2022

Discover some of the benefits of structured products and their value for investment. These pre-packaged investments usually feature assets connected to interest and an additional. Investment Planning with Park Place Financial. simply need guidance with investment planning, turn to Park Place Financial for customized.

International College of Financial Planning

JANUARY 15, 2024

Let’s discuss financial planning courses online and get an insight into its ability and success. Embracing Financial Planning Courses Online versus On-Campus Learning The advent of online financial planning courses marks a pivotal shift in educational methodologies. The college has vast course options to choose from.

Tobias Financial

MARCH 12, 2025

You may be wondering how all of this impacts your financial future and the plans youve worked hard to build. We know market swings can be unsettling, but we encourage you to focus on your long-term financial plan rather than short-term fluctuations. These concerns are understandable, and youre not alone in feeling this way.

WiserAdvisor

DECEMBER 15, 2023

These professionals meticulously assess your financial situation, income level, and retirement goals to tailor personalized strategies. For instance, they can guide you on leveraging employer-sponsored retirement plans, such as a 401(k) with employer matches, to optimize your contributions and harness the full benefits of the accounts.

Darrow Wealth Management

OCTOBER 29, 2024

Consider the following: The equity portion of the portfolio has grown at a much higher rate than the bonds , creating an investment mix that is more heavily weighted in stocks than planned. While that can certainly make life easier, an age-based investment isn’t always the best choice. Why does this matter?

International College of Financial Planning

FEBRUARY 23, 2024

This blog delves into the essence of CERTIFIED FINANCIAL PLANNER® certification, its significance, and how it can be a game-changer for aspiring financial planners, especially through courses offered by the International College of Financial Planning (ICOFP).

International College of Financial Planning

MARCH 31, 2023

About Integrated Diploma in Wealth Management Program The Integrated Diploma in Wealth Management is designed to provide students with a broad understanding of wealth management, financial planning, investment management, and risk management.

International College of Financial Planning

JULY 10, 2023

The exam comprises multiple-choice questions, case studies, and client scenarios that assess your understanding and application of financial planning concepts. Over the years, the CFP exam has undergone refinements in line with the evolution of the financial planning profession.

International College of Financial Planning

OCTOBER 5, 2021

Hence, you must have a passion for finance and always stay ahead in the game.The laws, regulations, and compliance requirements concerning investment, planning, and finance keep changing regularly and you must stay abreast with them. Investments, tax planning, retirement planning is a dynamic field.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content