Weekend Reading For Financial Planners (June 14–15)

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Nerd's Eye View

DECEMBER 20, 2024

Together, these proposed changes (which are currently open for public comment) suggest CFP Board is seeking to ensure that those with the marks not only have sufficient education and experience upon receiving them, but also maintain and sharpen their skills over the course of their careers.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

JUNE 27, 2025

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

Nerd's Eye View

JANUARY 10, 2025

Also in industry news this week: A survey indicates that nearly 71% of new financial advisors drop out in the first 5 years, with firms offering better training and mentorship opportunities (as well as entry-level positions that don't come with business development targets) seeing higher employee retention rates How broker-dealer self-regulatory organization (..)

Wealth Management

AUGUST 1, 2025

Diana Britton , Executive Editor , WealthManagement.com August 1, 2025 2 Min Read Martine Lellis, principal, M&A partner development, Mercer Advisors Mercer Global Advisors, one of the nation’s largest and most acquisitive registered investment advisors with $77 billion in assets, has purchased Family Wealth Planning Group, a Naples, Fla.-based

Yardley Wealth Management

AUGUST 20, 2024

The post Staying Disciplined: How to Stick to Your Financial Plan Despite Market Volatility appeared first on Yardley Wealth Management, LLC. Staying Disciplined: How to Stick to Your Financial Plan Despite Market Volatility Introduction: Market volatility is a fact of life for investors.

Nerd's Eye View

AUGUST 12, 2025

What's unique about Ryan, though, is how he has added $80 million of client assets during the past seven years primarily by holding in-person educational retirement planning seminars that attract his ideal target client.

Nerd's Eye View

MARCH 4, 2025

Sten is the owner of Legacy Investment Planning, a hybrid advisory firm based in Franklin, Tennessee, that oversees $220 million in assets under management for 90 client households. Welcome everyone! Welcome to the 427th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Sten Morgan.

Nerd's Eye View

JANUARY 24, 2025

Nonetheless, given the scale and brand awareness of the wirehouses, and as their own use of fee-based models increases (as opposed to primarily relying on commissions from selling products), competition for clients (and advisors) will likely remain stiff going forward, even amidst the favorable trends for RIAs Also in industry news this week: A recent (..)

WiserAdvisor

JUNE 4, 2025

Apart from new laws and changes in regulations, it is also important to pay attention to emerging investment trendsevery year. The financial planning industry is constantly undergoing change. This article will discuss some of the most pivotal financial planning industry trends to watch out for this year.

Nerd's Eye View

JUNE 12, 2025

In our 166th episode of Kitces & Carl , Michael Kitces and client communication expert Carl Richards discuss how advisors can bridge the gap between planning and a client's lived experience to guide better decision-making. a tax bill or refund). a tax bill or refund).

Nerd's Eye View

MARCH 21, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a report from Cerulli Associates found that, amidst an industry-wide trend towards comprehensive financial planning and away from pure transaction-based investment management, asset-based fees currently represent 72.4%

Dear Mr. Market

DECEMBER 31, 2024

Because when it comes to financial planning, you’re ready to write it downand studies show that writing down your goals makes you 42% more likely to achieve them. Heres your top 10 financial planning checklist for the new year. A little planning now avoids big headaches later. Happy Planning and best to you in 2025!

Nerd's Eye View

APRIL 11, 2025

Also in industry news this week: NASAA this week approved model rule amendments that would restrict the use of the titles "advisor" and "adviser" by broker-dealers (and their registered representatives) who are not also dually registered as investment advisers, which, if adopted by state regulators, would largely bring state rules on this issue in (..)

Nerd's Eye View

MAY 16, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that Republicans in the House of Representatives this week released their long-awaited tax plan to address the impending sunset of many measures in the 2017 Tax Cuts and Jobs Act.

Trade Brains

JULY 9, 2025

That means if your retirement plan underestimates medical costs, you risk serious shortfalls. over that period. If you planned to live on ₹1 lakh per month today, you might need ₹1.5 – ₹1.7 Building an Inflation-Resistant Retirement Plan Equities (30–50%) – Over the long term, equities typically beat inflation.

WiserAdvisor

JUNE 13, 2025

Keeping it safe, growing it wisely, and using it to support your future takes careful planning. Yet even the best financial plans can stumble. Mistake #2: Not having an estate plan in place Estate planning is essential for protecting what you’ve worked hard to build. Wealth management isn’t only for the ultra-rich.

Tobias Financial

AUGUST 5, 2025

During our latest Quarterly Market Update Webinar, our Portfolio Manager, Charles “Chad” NeSmith, CFA, CFP®, and Wealth Advisor, Franklin Gay, CFP®, EA , reviewed recent market activity and provided insights into how the legislation, along with broader economic trends, may shape financial planning strategies in the months ahead.

Yardley Wealth Management

FEBRUARY 4, 2025

From maximizing deductions to managing capital gains, we’ll cover everything you need to know about smart tax planning. It’s triggered by large deductions, multiple dependents, or significant capital gains, requiring careful planning of deductions and income recognition. Click here and contact us for more information.

International College of Financial Planning

JULY 2, 2025

The Certified Financial Planner (CFP) certification is widely regarded as the gold standard in personal financial planning. It is awarded globally by the Financial Planning Standards Board (FPSB). Retirement and Tax Planning Specialist – Covers retirement income strategies, tax optimisation, and goal-based planning.

International College of Financial Planning

JULY 11, 2025

The CFP® program isn’t just about mastering technical modules on investment planning, taxation, retirement, or insurance. At the International College of Financial Planning (ICOFP) , we have seen this transformation first-hand. It is to help clients stick to their plan when everything else is moving.

WiserAdvisor

MAY 29, 2025

Automatic investment plans : One of the easiest ways to stay consistent is to set up automatic transfers from your bank account to your investment account, ensuring youre always saving first. Automation removes the temptation to skip or delay investing and turns it into a disciplined habit.

Financial Symmetry

JULY 28, 2025

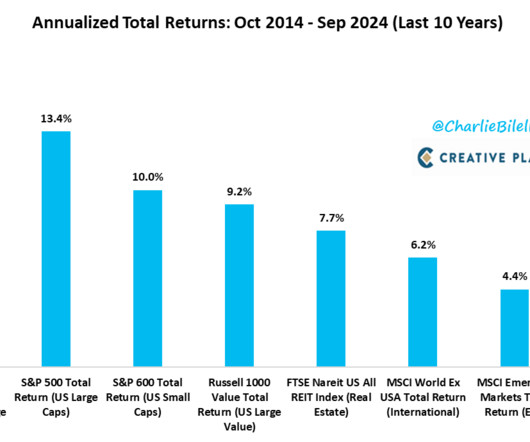

Planning for the long game, projections from major investment firms suggest international stocks and US value companies could outpace trendy US growth stocks over the next decade. The key lesson is to focus on a globally diversified, evidence-backed investment plan. Tune out the noise of media hype.

Wealth Management

JUNE 11, 2025

Whether clients support the policies with cash gifts or split-dollar, the discussion of options will necessarily involve a combination of insurance planning, tax planning, income and gift tax-oriented wealth transfer planning and investment planning. Charles L. Ratner Charles L. See more from Charles L.

Trade Brains

JUNE 13, 2025

When it comes to mutual fund investing, one of the biggest decisions an investor faces are whether to invest using Systematic Investment Plans (SIP) or a lump sum investment. A Systematic Investment Plan is a method of investing where you invest a specified fixed amount regularly (usually monthly) in a mutual fund.

Trade Brains

JUNE 30, 2025

The 20 th century has seen a rise in numerous investment options, among these the gilt mutual funds (MFs) have emerged as one of the most reliable investment plans. Gilt funds primarily invest in government securities, which are issued by the Reserve Bank of India (RBI).

Yardley Wealth Management

SEPTEMBER 10, 2024

The post Investing for Retirement: Strategies for Long-Term Success appeared first on Yardley Wealth Management, LLC. Investing for Retirement: Strategies for Long-Term Success Introduction Investing for retirement is a journey that demands careful planning, patience, and discipline. What lifestyle do you envision?

Tobias Financial

NOVEMBER 4, 2024

But should elections influence long-term investment decisions? We would caution investors against making changes to a long-term plan in a bid to profit or avoid losses from changes in the political winds. It is for information and planning purposes only. On the contrary, it may lead to costly mistakes.

Trade Brains

JULY 17, 2025

Expense Ratio (as of July 14, 2025): 1.87% (for regular plan, direct plan likely lower) 3-Year Annualized Return: 38.66% 5-Year Annualized Return: 32.59% This thematic fund invests in public sector undertakings (PSUs). Quant Small Cap Fund Direct Plan Growth Category: Equity AUM (as of July 14, 2025): ₹29,629.09

Workable Wealth

NOVEMBER 25, 2020

They afford more flexibility and control over your investment options, fees, and providers making it an excellent complement to an existing 401(k). Traditional IRAs operate similarly to your workplace plan. Contributions are pre-tax, investments grow tax-free, and distributions are taxed as ordinary income.

Carson Wealth

JUNE 9, 2025

Congrats again to the Dow on an amazing run and to all the investors over the years who have benefited by sticking to their investment plans. The fasted 1,000 point milestone to milestone interval ever was only five days from 32,000 to 33,000 in March 2021. Any bets on when it breaks 100k?

Abnormal Returns

OCTOBER 29, 2024

theverge.com) How social media can wreck your investing plan. blogs.cfainstitute.org) Investment success is about small advantages compounded over time. Strategy Another sign that gambling is being normalized. morningstar.com) Fund management Does the world need a leveraged Berkshire Hathaway ($BRK.B)

Nerd's Eye View

MAY 2, 2025

a ski chalet), assessing whether it will lead to greater overall wellbeing, or, alternatively, more stress, is more challenging Enjoy the 'light' reading!

NAIFA Advisor Today

JANUARY 28, 2025

As a Retirement Income Certified Professional and a Life and Annuities Certified Professional, John advises clients on retirement planning, investment planning, and risk management. Zack is also skilled in presenting, emceeing, event planning, program management, and social media.

SEI

JULY 15, 2025

For clients with significant capital gains and long-term horizons, these strategies remain critical tools in tax-aware investment planning. Learn how business development companies offer access to private credit and equity investing. Get the latest insights. July 15, 2025 Understanding business development companies.

Carson Wealth

APRIL 23, 2025

A Gentle Reminder that Youve Planned for This The fears and worries are real, but there are some positives out there as well. Stick with your plan. isnt the way to reach long-term investment goals. Rebalancing, staying diversified, and following your investment plan are important concepts to focus on in times like this.

Trade Brains

JULY 3, 2025

If your monthly salary is in the range of ₹30,000–₹50,000 Invest 10%–15% Before aggressively investing and for your emergency fund (emergency savings should arrange for at least 3 months of expenses!)

Fintoo

JUNE 26, 2025

Once confined to paper certificates, vaults, and real estate deeds, wealth today lives in the cloud, in digital wallets, on investment platforms, and across financial apps. Why cybersecurity is the new cornerstone of wealth protection in 2025 The way we understand, grow, and store wealth has transformed drastically.

Trade Brains

JUNE 13, 2025

May 2025 marked a significant milestone in the country’s investing journey, as Systematic Investment Plans (SIPs) continued their record-breaking streak. What used to be a tool for the financially savvy urban elite has now become India’s favorite way to invest.

Harness Wealth

JULY 31, 2025

The 2025 tax year brings inflation-adjusted brackets that could affect investment planning, with long-term capital gains thresholds increasing by approximately 2.8% Net Investment Income Tax on top of regular capital gains rates, making tax-efficient investing strategies particularly important for those above certain income thresholds.

Fintoo

JULY 18, 2025

Exit load is the fee mutual funds charge you when you redeem your investment before […] The post How to Handle Exit Loads in Mutual Funds: A 2025 Guide from an Investor’s Perspective appeared first on Fintoo Blog. Introduction: Why Exit Load Matters in 2025 What is an exit load in mutual fund?

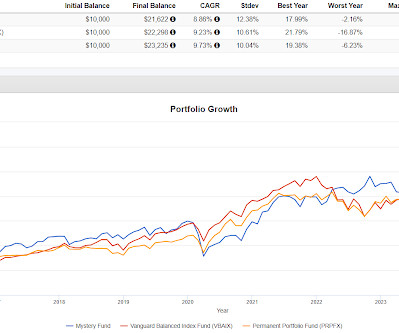

Random Roger's Retirement Planning

FEBRUARY 9, 2025

The point is to understand that a portfolio that is valid for a long term investment plan will have periods where it lags in a frustrating manner. In real life, the Mystery Fund isn't suitable as a one portfolio solution despite being in the ballpark. The result is close but the fund isn't valid for that purpose.

Trade Brains

AUGUST 10, 2025

Mumbai, August 11, 2025: Shriram Asset Management Company (Shriram AMC), a part of Shriram Group, has announced the launch of Shriram Chhoti SIP, a low-ticket size Systematic Investment Plan (SIP) that allows investors to start investing with just ₹250 per month.

Tobias Financial

MARCH 12, 2025

You may be wondering how all of this impacts your financial future and the plans youve worked hard to build. We know market swings can be unsettling, but we encourage you to focus on your long-term financial plan rather than short-term fluctuations. These concerns are understandable, and youre not alone in feeling this way.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content