Weekend Reading For Financial Planners (June 14–15)

Nerd's Eye View

JUNE 13, 2025

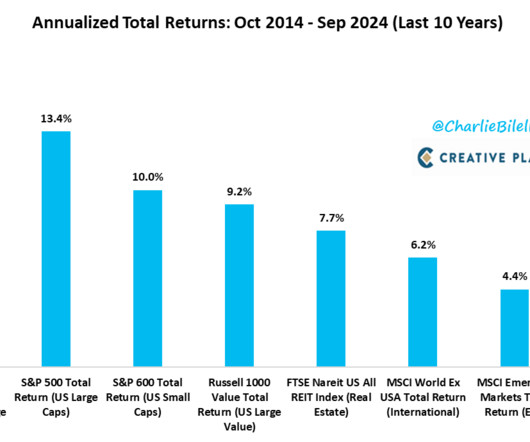

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Nerd's Eye View

DECEMBER 20, 2024

Together, these proposed changes (which are currently open for public comment) suggest CFP Board is seeking to ensure that those with the marks not only have sufficient education and experience upon receiving them, but also maintain and sharpen their skills over the course of their careers.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

JUNE 27, 2025

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

Nerd's Eye View

JANUARY 10, 2025

Also in industry news this week: A survey indicates that nearly 71% of new financial advisors drop out in the first 5 years, with firms offering better training and mentorship opportunities (as well as entry-level positions that don't come with business development targets) seeing higher employee retention rates How broker-dealer self-regulatory organization (..)

Nerd's Eye View

MARCH 21, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a report from Cerulli Associates found that, amidst an industry-wide trend towards comprehensive financial planning and away from pure transaction-based investment management, asset-based fees currently represent 72.4%

Nerd's Eye View

JANUARY 24, 2025

Nonetheless, given the scale and brand awareness of the wirehouses, and as their own use of fee-based models increases (as opposed to primarily relying on commissions from selling products), competition for clients (and advisors) will likely remain stiff going forward, even amidst the favorable trends for RIAs Also in industry news this week: A recent (..)

Nerd's Eye View

APRIL 11, 2025

Also in industry news this week: NASAA this week approved model rule amendments that would restrict the use of the titles "advisor" and "adviser" by broker-dealers (and their registered representatives) who are not also dually registered as investment advisers, which, if adopted by state regulators, would largely bring state rules on this issue in (..)

Nerd's Eye View

MAY 16, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that Republicans in the House of Representatives this week released their long-awaited tax plan to address the impending sunset of many measures in the 2017 Tax Cuts and Jobs Act.

Wealth Management

JUNE 11, 2025

Number 8860726. Whether clients support the policies with cash gifts or split-dollar, the discussion of options will necessarily involve a combination of insurance planning, tax planning, income and gift tax-oriented wealth transfer planning and investment planning. Registered in England and Wales.

International College of Financial Planning

JULY 11, 2025

The CFP® program isn’t just about mastering technical modules on investment planning, taxation, retirement, or insurance. You learn to think beyond numbers. At the International College of Financial Planning (ICOFP) , we have seen this transformation first-hand. It builds a mindset.

WiserAdvisor

MAY 29, 2025

Automatic investment plans : One of the easiest ways to stay consistent is to set up automatic transfers from your bank account to your investment account, ensuring youre always saving first. Automation removes the temptation to skip or delay investing and turns it into a disciplined habit.

Nerd's Eye View

MAY 2, 2025

a ski chalet), assessing whether it will lead to greater overall wellbeing, or, alternatively, more stress, is more challenging Enjoy the 'light' reading!

Abnormal Returns

OCTOBER 29, 2024

theverge.com) How social media can wreck your investing plan. blogs.cfainstitute.org) Investment success is about small advantages compounded over time. axios.com) If you believe the numbers. Strategy Another sign that gambling is being normalized. michaelparekh.substack.com) Oil The global oil market seems well supplied.

Tobias Financial

NOVEMBER 4, 2024

But should elections influence long-term investment decisions? We would caution investors against making changes to a long-term plan in a bid to profit or avoid losses from changes in the political winds. It is for information and planning purposes only. the tallest bar shows all months in which returns were between 1% and 2%).

Carson Wealth

JUNE 9, 2025

Congrats again to the Dow on an amazing run and to all the investors over the years who have benefited by sticking to their investment plans. If you’re well above this number, you can be fairly sure job growth is positive. Any bets on when it breaks 100k? What does that mean?

Carson Wealth

APRIL 23, 2025

The recently released Bank of America Global Fund Manager Survey showed a record number of participants who intend to cut US exposure, as shown in the chart below. A Gentle Reminder that Youve Planned for This The fears and worries are real, but there are some positives out there as well. Stick with your plan.

Trade Brains

JUNE 13, 2025

May 2025 marked a significant milestone in the country’s investing journey, as Systematic Investment Plans (SIPs) continued their record-breaking streak. What used to be a tool for the financially savvy urban elite has now become India’s favorite way to invest. The rise of SIPs isn’t just about a number.

Trade Brains

JULY 9, 2025

NHPC has ventured into solar and wind energy in addition to creating a number of renewable energy projects. The company is susceptible to changes in finance or policy because its expansion is directly linked to MoR’s investment plans for Indian Railways. Investments in securities are subject to market risks.

Nerd's Eye View

DECEMBER 13, 2024

Also in industry news this week: While the SEC has had the power to restrict mandatory arbitration clauses in RIA client agreements for more than a decade, an advisory committee meeting this week suggests support for such a measure isn't unanimous CFP Board saw a record number of exam-takers during 2024, reflecting recognition of the professional and (..)

Nerd's Eye View

NOVEMBER 3, 2023

Among other measures, the proposal would amend the current 5-part test that determines fiduciary status for retirement accounts by defining as a fiduciary act a one-time recommendation to roll funds from a company retirement plan to an Individual Retirement Account (IRA), strengthen advice standards for independent insurance professionals, apply to (..)

Nerd's Eye View

MAY 17, 2024

Also in industry news this week: The SEC this week announced a proposed rule that would require RIAs to collect and verify their clients' personal information in an effort to prevent illicit activity, though many firms likely are taking many of these steps already Why larger RIAs and those that have been acquired tend to have worse client and staff (..)

Nerd's Eye View

SEPTEMBER 23, 2022

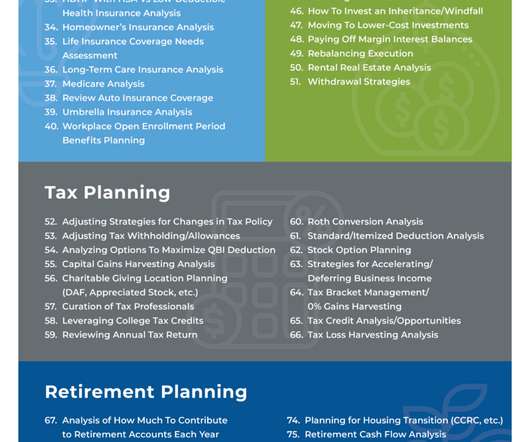

From there, we have several articles on insurance and investment planning: Why the chair of the Senate Finance Committee has taken an interest in the private placement life insurance market. A new designation is available for advisors looking to serve clients with nonqualified deferred compensation plans.

Abnormal Returns

MAY 21, 2023

bilello.blog) Strategy Why so many Americans think their house is the best investment. awealthofcommonsense.com) Every investment plan needs some room for error. newsletter.abnormalreturns.com) Mixed media A growing number of New York City office buildings are emptying out. Then check out our weekly e-mail newsletter.

Nerd's Eye View

AUGUST 11, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the Massachusetts Secretary of the Commonwealth has launched an investigation into how investment firms are using artificial intelligence-enabled technologies, echoing concerns expressed by the SEC that these tools could be used (..)

Nerd's Eye View

DECEMBER 25, 2023

Each week in Weekend Reading For Financial Planners, we seek to bring you synopses and commentaries on 12 articles covering news for financial advisors including topics covering technical planning, practice management, advisor marketing, career development, and more.

Nerd's Eye View

AUGUST 2, 2024

Further, the court indicated that its ultimate decision is likely to favor groups opposing the regulation, which could lead to an appeal by the DoL and leave advisors waiting (potentially much longer) for a final answer on what will be required of them going forward.

Nerd's Eye View

AUGUST 30, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a recent benchmarking study suggests that a number of RIAs are looking to move 'upmarket' and work with wealthier clients by expanding their service menu to include family office services, investment banking, and/or trust (..)

Nerd's Eye View

NOVEMBER 4, 2022

From there, we have several articles on investment planning: While I Bonds have received significant attention during the past year, TIPS could be an attractive alternative for many client situations.

Nerd's Eye View

FEBRUARY 23, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that while both the total number of RIAs and advisor headcount have seen significant gains in recent years, client assets remain concentrated among the largest firms, according to data from Cerulli Associates, with the 7% of RIAs (..)

Nerd's Eye View

AUGUST 2, 2024

Further, the court indicated that its ultimate decision is likely to favor groups opposing the regulation, which could lead to an appeal by the DoL and leave advisors waiting (potentially much longer) for a final answer on what will be required of them going forward.

Nerd's Eye View

AUGUST 25, 2023

Also in industry news this week: The SEC settled its first charges related to its new marketing rule with a firm that advertised 2,700% annual returns A survey suggests that older Americans prefer the term "longevity" to "aging", perhaps informing the way advisors discuss related issues with their clients From there, we have several articles on retirement (..)

Nerd's Eye View

JANUARY 13, 2023

From there, we have several articles on retirement planning: The latest rules for 2023 Required Minimum Distributions from inherited retirement accounts. We also have a number of articles on investment planning: A recent study indicates that rebalancing a portfolio on an annual basis is superior to longer or shorter time horizons.

Nerd's Eye View

SEPTEMBER 29, 2023

Also in industry news this week: After experiencing a downturn over the past few quarters, RIA M&A activity ticked higher in the 3rd quarter amid continued interest from sellers and increasing costs for internal succession A recent study shows that housing-related costs are more likely than healthcare spending to cause unexpected spending shocks (..)

Nerd's Eye View

NOVEMBER 28, 2022

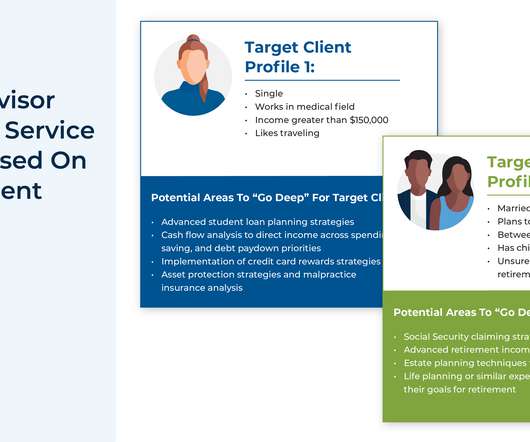

Traditionally, investment planning has been at the forefront of how financial advisors add value for their clients. But, with the rise of index funds and the commoditization of investment advice, generating sufficient investment ‘alpha’ to justify a fee has become more challenging for advisors.

Nerd's Eye View

NOVEMBER 28, 2022

Traditionally, investment planning has been at the forefront of how financial advisors add value for their clients. But, with the rise of index funds and the commoditization of investment advice, generating sufficient investment ‘alpha’ to justify a fee has become more challenging for advisors.

Nerd's Eye View

MARCH 8, 2024

to prevent fraud. Read More.

Nerd's Eye View

SEPTEMBER 8, 2023

Also in industry news this week: Changes to CFP Board’s procedural rules went into effect September 1 and are intended to make the disciplinary process more efficient for respondents as well as CFP Board staff, and to expand the CFP Board’s ability to pursue more complaints against CFP professionals A NASAA model rule follows in the footsteps (..)

Nerd's Eye View

JUNE 7, 2024

Also in industry news this week: Backers announced the new Texas Stock Exchange, which seeks to provide companies with a lower-cost alternative to the NYSE and Nasdaq, which, if successful, could create a more competitive landscape and potentially better execution and reduced trading costs for financial advisors and their clients The American College (..)

Nerd's Eye View

JUNE 28, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a recent study found that at a time when the number of SEC-registered broker-dealers and their registered representatives is declining, the number of SEC-registered RIAs, their assets under management, and the number of (..)

Gen Y Planning

JUNE 1, 2022

Bonds also generate income, making them a flexible part of your long-term cash flow plan. While bonds are an essential component of investing, it’s important to note that inflation and bonds typically don’t get along, which isn’t good news for today’s investors. While that number isn’t all that exciting, the next one assuredly is.

Clever Girl Finance

MARCH 19, 2024

No one cares more about your financial well-being than you, so having a personal financial plan is important. Knowing how to make a financial plan will allow you to save money, afford the things you want, and achieve long-term goals like saving for college and retirement. Table of contents What is a financial plan?

eMoney Advisor

FEBRUARY 9, 2023

If you are looking for opportunities to grow your business, expanding your services to clients at all stages of the financial planning lifecycle creates new opportunities for you to reach those households in search of professional advice. People in this stage may have just graduated from college and recently joined the working world.

Gen Y Planning

NOVEMBER 1, 2022

So, how can you determine your enough number that gives you the freedom to live the life you want today and in the future? But when you reverse the two, you may be surprised that you can easily define and make a plan to attain your “enough.”. and their current savings and investments. . Ongoing investments.

Your Richest Life

APRIL 15, 2024

Do you have a plan in place for your retirement? For many people, the extent of their retirement planning includes signing up for the plan at work – which is often more of a starting point than a comprehensive retirement plan. Some 457 plans can allow for Roth contributions and in-plan rollovers.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content