4 Pitfalls of Not Having a Financial Plan

Carson Wealth

APRIL 25, 2024

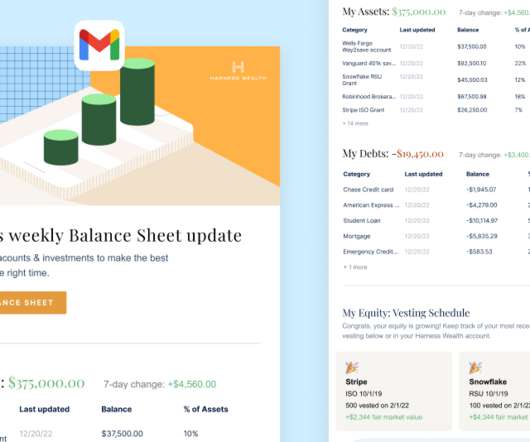

Investment strategy: Determine asset allocation and investment vehicles aligned with risk tolerance and financial goals. Insurance coverage: Evaluate insurance needs for health, life, disability, long-term care and property, ensuring adequate coverage. What Could Happen if You Don’t Have a Financial Plan?

Let's personalize your content