Health Savings Accounts – The Other Retirement Plan

The Chicago Financial Planner

OCTOBER 21, 2021

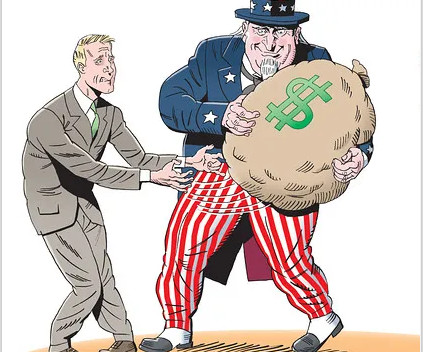

Saving for retirement is a major undertaking for most of us. Increasing healthcare costs and longer life expectancies make the hill a bit steeper to climb each year. Health savings accounts (HSA) provide another vehicle to save for retirement. The rising cost of healthcare in retirement . Vision care.

Let's personalize your content