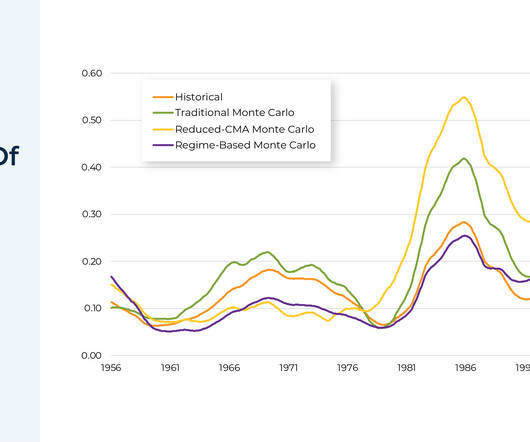

How Much Does Having The ‘Right’ Capital Market Assumptions Matter In Retirement Planning?

Nerd's Eye View

DECEMBER 11, 2024

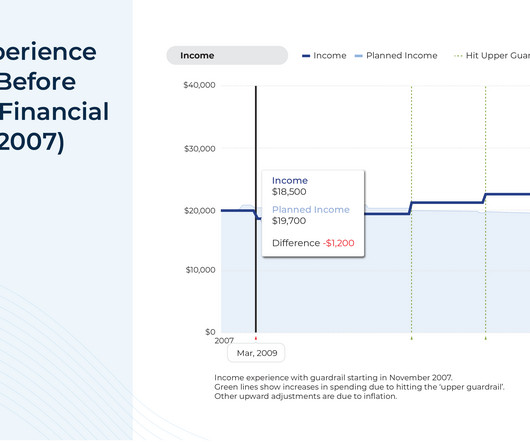

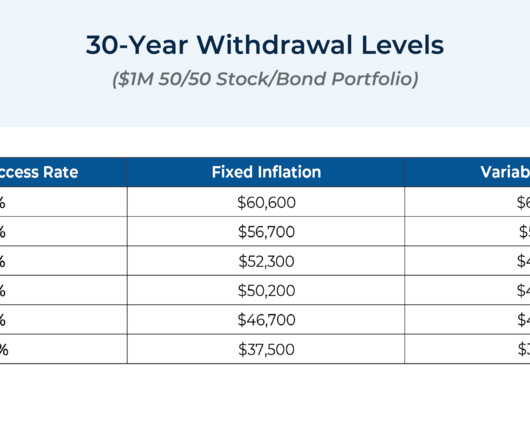

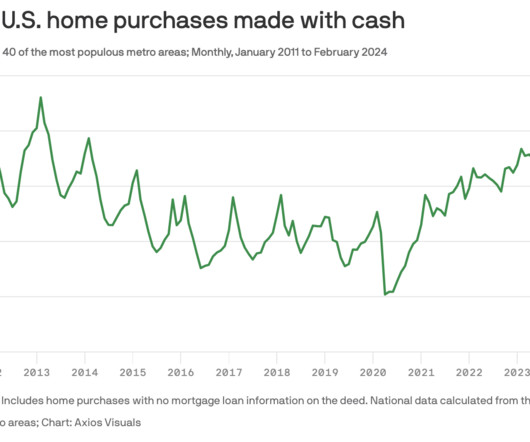

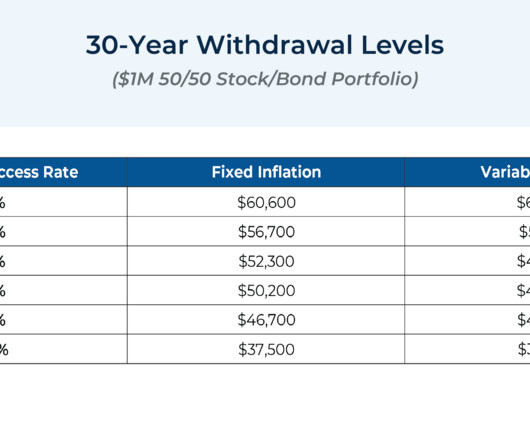

"How much can I spend in retirement?" Advisors want to help clients set a secure, reliable retirement plan, yet even the most comprehensive assumptions will inevitably deviate from reality at least to some degree. Ideally, retirement spending would align perfectly with a client's needs – neither too much nor too little.

Let's personalize your content