Fiduciary Duties of Trustees in the Age of COVID

Wealth Management

SEPTEMBER 7, 2022

Court finds that trustee failed to carry out contractual obligations.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

SEPTEMBER 7, 2022

Court finds that trustee failed to carry out contractual obligations.

Wealth Management

MARCH 7, 2024

In contrast, the outgoing director of the SEC's Investment Management Division said the degree of risk in AI’s proliferation is “obvious.” The advocacy group for advisors argued the rule is overly broad.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Abnormal Returns

APRIL 7, 2025

Podcasts Michael Kitces talks with Nick Rodkin, managing partner of Stoic Financial, about working with client couples. nextavenue.org) Advisers Clients prefer advisers with a fiduciary duty. kitces.com) Matt Zeigler talks with Danika Waddell, founder of Xena Financial Planning.

Wealth Management

APRIL 14, 2023

Overcoming the RIA/Annuity disconnect by addressing common financial advisor objections.

Wealth Management

JULY 29, 2024

In his new book, the ‘father of life planning’ advocates for a broader fiduciary duty, one that extends to all institutions. Here’s how advisors play into that grand vision.

Wealth Management

APRIL 20, 2023

By not taking ESG factors into account, financial advisors may be shirking their fiduciary duty.

Wealth Management

MARCH 21, 2025

The SEC accused Cambridge Investment Research's RIA business of breaching its fiduciary duty in recommending certain mutual funds and money market sweep funds.

Wealth Management

MARCH 5, 2025

Choreos lawsuit comes a day after Compound announced it had brought on members of the Des Moines, Iowa-based team that had overseen $1.2 billion in client assets.

Wealth Management

MARCH 20, 2023

Several law firms are looking into whether Focus’ board members breached their fiduciary duties in agreeing to the sale at $53 per share.

Nerd's Eye View

OCTOBER 25, 2023

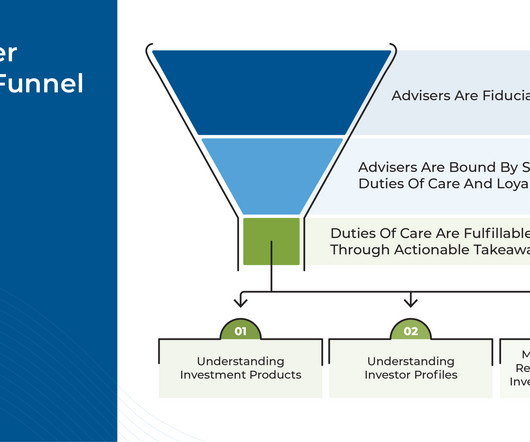

There is a general understanding that investment advisers have a fiduciary relationship with their clients – in other words, that they are required to act in the client's best interests. These 3 components in practice make up a core part of the adviser's fiduciary duty to their clients.

Nerd's Eye View

JUNE 21, 2023

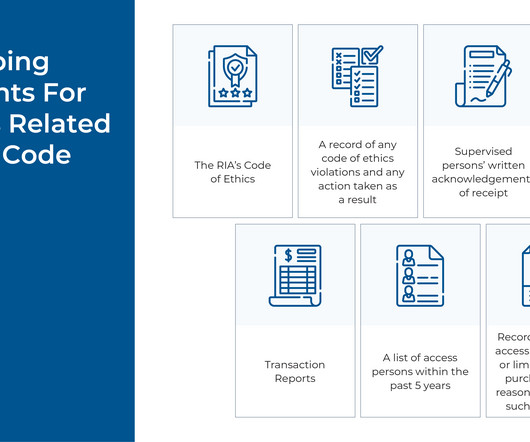

All investment advisers are fiduciaries that owe a duty of care and loyalty to their clients, and, in an ideal world, advisory firms and their staff would abide by these requirements without the need for a prescriptive code of ethics.

Wealth Management

APRIL 20, 2023

Redd examines litigation in recent years that’s exposed a possible exception to the widely held belief that exercising a power of appointment isn’t a fiduciary act.

Nerd's Eye View

MAY 26, 2023

Also in industry news this week: How consumer concerns about the stability of the banking industry could present independent advisors with an opportunity to add value by managing client cash Why an advisor’s fiduciary duty can sometimes come into conflict with the best insurance options for their clients From there, we have several articles on (..)

The Big Picture

MAY 20, 2025

The transcript from this weeks, MiB: John Montgomery, Bridgeway Capital Management , is below. 00:02:52 [Speaker Changed] Well, the statistical side definitely comes from my degree and then work as a project manager at MIT. First of all, my, some of my co-portfolio managers will bristle if you refer to us as a factor based firm.

Darrow Wealth Management

NOVEMBER 4, 2024

Looking to find fiduciary financial advisors and wealth managers? Only fiduciary advisors are legally bound to act in your best interest at all times. Here are five ways you can find a full-time fiduciary financial advisor. What is a fiduciary advisor? business owners selling a company , stock compensation, etc.).

Nerd's Eye View

FEBRUARY 17, 2023

Further, an investment adviser who can make trades on behalf of a client would be deemed to have custody of the client’s assets, which could substantively shift a very sizable portion of the wealth management RIA community under the custody rule, though it remains to be seen whether or what exact custody rule compliance requirements would be (..)

Nerd's Eye View

JANUARY 19, 2024

Also in industry news this week: While the total number of RIA M&A deals in 2023 fell short of a record-setting 2022 amidst an elevated interest rate environment, continued interest from private equity firms and creative deal structures could boost deal flow in 2024 While the SEC authorized 11 "Spot" Bitcoin ETFs last week, comments from chair (..)

Nerd's Eye View

SEPTEMBER 27, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent study by Cerulli has shown a sharp increase in the number of affluent investors willing to pay for advice, which on the one hand reflects the increasing financial complexity in peoples' lives (while they've also gotten (..)

Abnormal Returns

JANUARY 31, 2023

papers.ssrn.com) Fund management How do active managers invest their own money? ritholtz.com) Fund investors reward fund managers with 'skin in the game.' blog.validea.com) How anti-ESG movements could be contrary to a fiduciary duty. Indexing The index effect is disappearing. nytimes.com)

Advisor Perspectives

JULY 15, 2024

They exist in all fee models, whether they be commissions, assets under management, fixed fee, or hourly. Conflicts are everywhere in financial planning. Any time money changes hands there are conflicts of interests.

Ron A. Rhodes

MARCH 18, 2023

While the SEC has provided an interpretative release [SEC Release IA-5248, Commission Interpretation Regarding Standard of Conduct for Investment Advisers (July 12, 2019)] regarding the fiduciary duties of investment advisers,…

Darrow Wealth Management

FEBRUARY 13, 2025

If youre looking for a fee-only financial advisor or wealth manager, its probably because you know fee-only advisors don’t sell products. Although some firms use these compensation methods, the majority base fees on a percentage of assets under management (AUM) for their services. Independent firm.

Sara Grillo

MARCH 11, 2024

He’s taking the world by storm as an hourly financial planner, not managing any assets just giving out powerful financial planning guidance that clients love. He finds that alot of people prefer to manage their investments themselves, just with a little guidance from him. Yeah, the title basically says it all. Good for you, bro.

Good Financial Cents

JUNE 11, 2023

You see, financial advisors that focus primarily on wealth management can be costly to keep around. They charge either a percentage of assets managed or a flat hourly rate that can run as high as several hundred dollars per hour, plus trading commissions and administrative fees. Personal Capital to the rescue.

eMoney Advisor

DECEMBER 20, 2022

As cryptocurrency continues to become a more significant part of the investment world, what responsibility lies with financial advisors who have a fiduciary duty to protect their clients? The Fiduciary Duty is exemplified by the Duty of Care, which applies to financial advice about all financial assets.

MarketWatch

MARCH 13, 2023

9 buyout proposal by management. The resignation letter indicated in part that it is the view of the former special committee directors that they could not satisfy their fiduciary duties to the company and fulfil their mandate in the circumstances,” the bank said. The company said Feb. to C$15.75.

Fortune Financial

SEPTEMBER 25, 2023

How to Choose the Right Wealth Management Firm in Kansas City Managing your wealth is a crucial aspect of financial success and security. Let’s look at key factors to consider when selecting the ideal wealth management firm in the Kansas City metro area. But with many options available, how do you choose the right one?

Park Place Financial

SEPTEMBER 8, 2022

To facilitate more effective personal financial management, utilize this guide to find an advisor best suited to meet your needs and desires. . Typically, these advisors are skilled in multiple areas, such as general wealth management or estate planning. Wealth Manager . Reflect on Your Financial Situation .

Fortune Financial

SEPTEMBER 25, 2023

How to Choose the Right Wealth Management Firm in Kansas City Managing your wealth is a crucial aspect of financial success and security. Let’s look at key factors to consider when selecting the ideal wealth management firm in the Kansas City metro area. But with many options available, how do you choose the right one?

WiserAdvisor

JUNE 12, 2022

The advisor can also help you create a well-diversified investment portfolio , plan your expenses and liabilities, and also help you manage your overall finances smoothly. For example, some financial advisors charge a rough percentage of the total assets they manage, while others have a fixed rate.

Ron A. Rhodes

AUGUST 6, 2023

I have increasingly witnessed registered investment adviser (RIA) firms, as well as brokerage firms, generally disavow (often in their client services agreement) any duty to manage the investment portfolios of…

Sara Grillo

AUGUST 14, 2023

Legal definition of the fiduciary standard To quote directly from a paper by Attorney Lorna Schnase , two bodies of law form the legal basis for the fiduciary standard: Common law: Under common law principles of agency, an investment adviser, as agent, owes fiduciary duties to its client, as principal.3

Truemind Capital

SEPTEMBER 10, 2019

Investment management is never a part-time activity but a full-time job. Quality investment management is much more than selecting schemes from star-rating websites or buying a stock based on little insights. Fiduciary duty should be on the top of the mind of any genuine adviser. 🔊 Play Audio.

Brown Advisory

JANUARY 3, 2023

The “mainstreaming” of sustainable investing has been the story of the decade in investment management. Notably, higher levels of scrutiny from regulators have already ratcheted up expectations for funds and managers that wish to assert their environmental, social, and governance or “ESG” research credentials.

Brown Advisory

JANUARY 3, 2023

The “mainstreaming” of sustainable investing has been the story of the decade in investment management. Notably, higher levels of scrutiny from regulators have already ratcheted up expectations for funds and managers that wish to assert their environmental, social, and governance or “ESG” research credentials.

Brown Advisory

JANUARY 3, 2023

The “mainstreaming” of sustainable investing has been the story of the decade in investment management. Notably, higher levels of scrutiny from regulators have already ratcheted up expectations for funds and managers that wish to assert their environmental, social, and governance or “ESG” research credentials.

Tobias Financial

JULY 11, 2023

It signifies a commitment to professionalism, ethics, and a fiduciary duty to act in our clients’ best interests. By adhering to these principles, our advisors uphold the highest standards of integrity, providing the utmost care and diligence in managing our client’s financial well-being.

Sara Grillo

DECEMBER 22, 2023

. #3 Leverage Fiduciary resources and learn what a pure fiduciary is Institute for the Fiduciary Standard houses a library of Advisor On My Side resources. Read about the six core fiduciary duties. Six Core Fiduciary Duties for Financial Advisors. Check it out. link] Stettner, Morey. (9 MarketWatch.

Brown Advisory

NOVEMBER 29, 2022

For our part, as an investment firm, we must view climate decisions through the lens of our fiduciary duty to generate attractive investment returns that help our clients achieve their goals over the long term. We also describe our initial plans under the Net Zero Asset Managers initiative (NZAMi). Sincerely, . Emily Dwyer.

Walkner Condon Financial Advisors

APRIL 17, 2023

At Walkner Condon we use the assets under management (AUM) model. We get paid based on a percentage of a client’s assets that we manage. This fee covers not only investment management, but also financial planning. What does it mean to be a fiduciary? A fiduciary is someone who manages money or property for someone else.

Brown Advisory

NOVEMBER 29, 2022

For our part, as an investment firm, we must view climate decisions through the lens of our fiduciary duty to generate attractive investment returns that help our clients achieve their goals over the long term. We also describe our initial plans under the Net Zero Asset Managers initiative (NZAMi).

Walkner Condon Financial Advisors

APRIL 21, 2023

How we are Compensated At Walkner Condon we use the assets under management (AUM) model. We get paid based on a percentage of a client’s assets that we manage. This fee covers not only investment management, but also financial planning. What does it mean to be a fiduciary?

Brown Advisory

DECEMBER 5, 2023

Yet a whole slew of relevant environmental, social, and governance-related information has been panned by political agendas that are far removed from the purview of investment managers. All of these potential outcomes of a company’s ability to manage its environmental, social, and governance issues should be of interest to investors.

Carson Wealth

JANUARY 14, 2023

When talking about financial advisors we often use the term “fiduciary standard of care” to describe how those who are obliged to or have opted into a fiduciary standard are required to treat clients and consumers. Fiduciary vs. Non-Fiduciary Not every financial professional is required to hold a fiduciary standard of care.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content