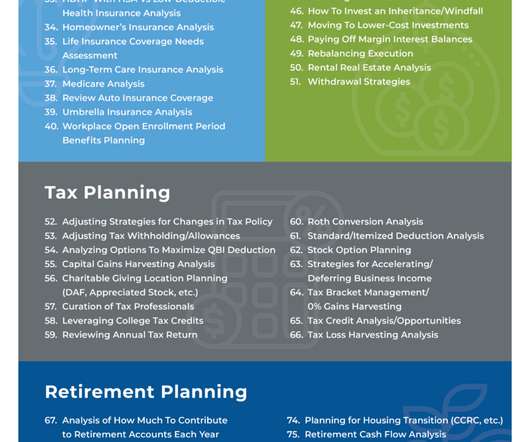

101 Ways Advisors Can Add Value And Attract Their Ideal Clients

Nerd's Eye View

NOVEMBER 28, 2022

Traditionally, investment planning has been at the forefront of how financial advisors add value for their clients. But, with the rise of index funds and the commoditization of investment advice, generating sufficient investment ‘alpha’ to justify a fee has become more challenging for advisors.

Let's personalize your content