The Close Relationship Between Financial Planning and Estate Planning

Wealth Management

AUGUST 12, 2024

Estate planning and financial planning are two peas in a pod that are becoming inextricably tied.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

AUGUST 12, 2024

Estate planning and financial planning are two peas in a pod that are becoming inextricably tied.

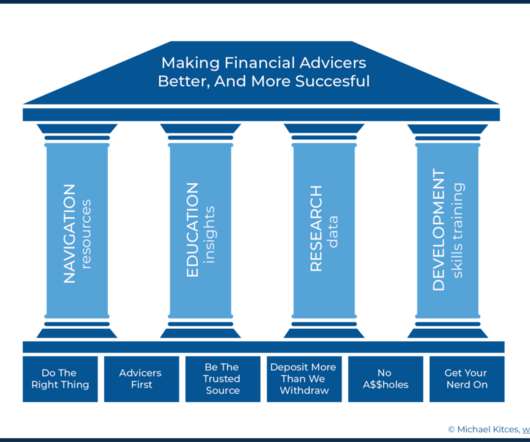

Nerd's Eye View

MAY 15, 2025

After all, it can feel odd to create an estate plan that will impact a client’s grandchildren… when those grandchildren may be older than the advisor themselves! But walking through every page of a financial plan line by line could take up an entire afternoon and often isn’t necessary.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Carson Wealth

DECEMBER 20, 2024

While many people approach their financial planning with careful strategy, its easy to overlook the same level of intention when it comes to charitable giving. Lets explore several potentially effective financial planning tools that may help you maximize your impact and meet your philanthropic goals. government.

Nerd's Eye View

NOVEMBER 21, 2022

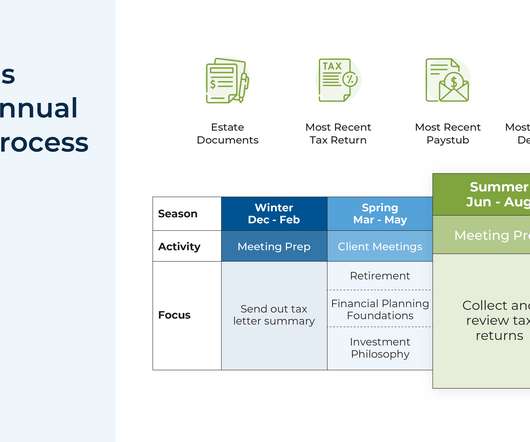

A common service model for many financial advisory firms is to schedule annual client meetings throughout the year where the advisor meets with each client in the month they started working with the firm, and conducts a comprehensive review of all planning topics for the client. Read More.

Abnormal Returns

NOVEMBER 6, 2024

podcasts.apple.com) Taxes A year-end tax planning checklist. greatergood.berkeley.edu) The laws of financial health are pretty simple. marknewfield.substack.com) How to look for holes in your financial plan. contessacapitaladvisors.com) Four steps to an estate plan. They aren't going up in value.

WiserAdvisor

JUNE 4, 2025

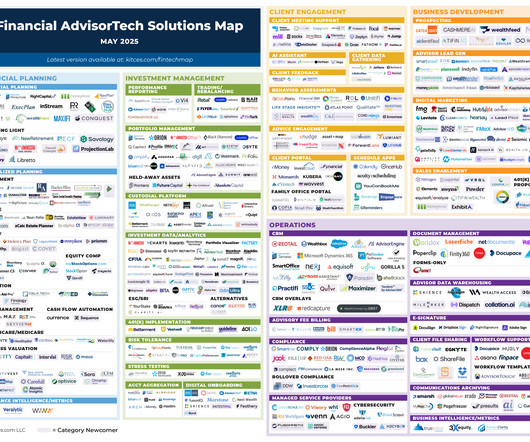

The financial planning industry is constantly undergoing change. Financial advisors should take these factors into account to ensure their clients receive the right experience. This article will discuss some of the most pivotal financial planning industry trends to watch out for this year.

Abnormal Returns

NOVEMBER 27, 2024

(nextavenue.org) Lessons learned from Warren Buffett's estate planning, including 'Tell your kids you are proud of them.' bloomberg.com) Financial disasters Another case where reaching for yield can be disastrous. axios.com) Financial planning A financial plan can help you navigate forks in the road.

Tobias Financial

JUNE 2, 2025

Estate planning is one of the most important steps in securing your financial legacy, but its also among the most complex. Vanilla helps us create a clearer, more organized view of a clients estate by integrating their financial and legacy planning.

Yardley Wealth Management

NOVEMBER 12, 2024

The post Securing Your Legacy: Financial Planning Tips for Your Children’s Future appeared first on Yardley Wealth Management, LLC. Securing Your Legacy: Financial Planning Tips for Your Children’s Future Introduction As parents, one of our greatest goals is to ensure our children’s future financial well-being.

Abnormal Returns

OCTOBER 9, 2024

wsj.com) Another reminder that TreasuryDirect is a mess (wsj.com) Estate planning Why it often takes a crisis to prompt movement on an estate plan. kindnessfp.com) Where people without children are passing on their estates. awealthofcommonsense.com) Receiving a financial windfall? Talk to someone.

Dear Mr. Market

DECEMBER 31, 2024

Because when it comes to financial planning, you’re ready to write it downand studies show that writing down your goals makes you 42% more likely to achieve them. Heres your top 10 financial planning checklist for the new year. A little planning now avoids big headaches later. But not this year. Not for you.

Integrity Financial Planning

AUGUST 28, 2022

Understand the basics first, and then create an estate plan. Wills and trusts are both important estate planning tools with important differences. Communication is crucial when preparing heirs to inherit wealth, and this includes discussing what they plan to do with the money. A Will vs. a Trust.

Yardley Wealth Management

JANUARY 21, 2025

The post Is Talking to a Financial Planner Worth It? Exploring the Benefits of Financial Planning appeared first on Yardley Wealth Management, LLC. Is Talking to a Financial Planner Worth It? Exploring the Benefits of Professional Financial Advice Introduction “Is talking to a financial planner worth it?”

Abnormal Returns

MARCH 4, 2024

(institutionalinvestor.com) Advisers Meghaan Lurtz, "When it comes to connecting emotions to goals, reflection questions can be an excellent way to help prospects identify the particular emotions that motivate them the most, which will ultimately help them stick to their financial plan."

Abnormal Returns

SEPTEMBER 9, 2024

Podcasts Michael Kitces talks financial wellness with Zack Hubbard. Zack is the Director of Financial Planning and Participant Engagement of Greenspring Advisors. fa-mag.com) How to use the new digital estate planning platforms. kitces.com) How planning changes for the child-free.

Abnormal Returns

MAY 6, 2024

Podcasts Brendan Frazier talks with Emily Koochel about the difference between behavioral finance and financial psychology. wiredplanning.com) Steve Chen talks with Jordan Hutchison, Vice President of Technology for RFG Advisory, about the evolving landscape of financial planning. kitces.com) What is financial planning?

Nerd's Eye View

NOVEMBER 30, 2022

Taxes are a central component of financial planning. Almost every financial planning issue – whether it is retirement, investments, cash flow, insurance, or estate planning – has tax considerations, and advisors provide a great deal of value in helping clients minimize their overall tax burden.

Integrity Financial Planning

OCTOBER 23, 2023

Estate planning can be difficult to think about, let alone plan for. Maybe you’ve avoided putting together a concrete plan because you don’t want to think too far into the future when it’s time to pass on what you have. Or maybe you don’t think an estate plan is necessary because you’re not rich enough to warrant one.

Nerd's Eye View

FEBRUARY 5, 2024

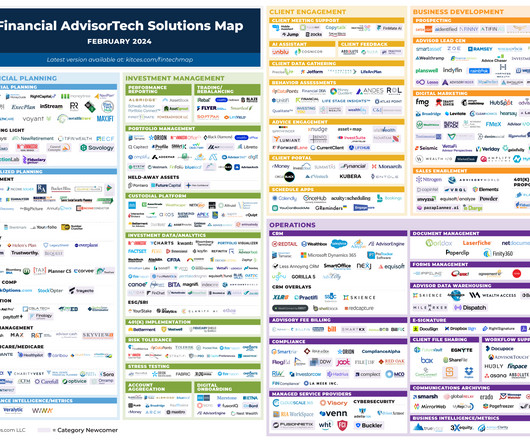

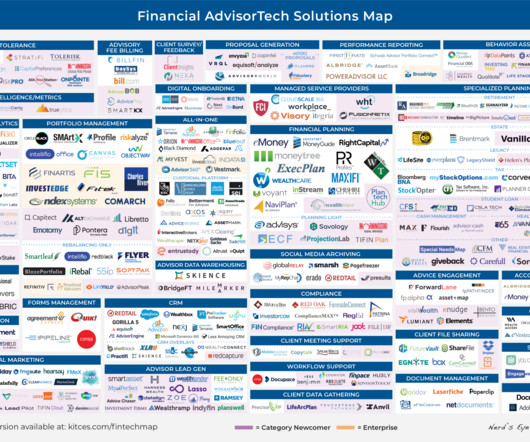

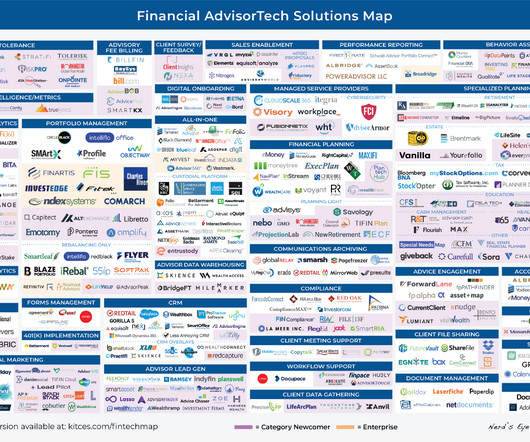

This month's edition kicks off with the news that financial planning software platform RightCapital has launched a workflow management tool called RightFlows to help advisors manage and assign steps in the financial planning process to team members and clients – which on the one hand capitalizes on advisor demand for workflow solutions tailored (..)

Nerd's Eye View

JANUARY 8, 2024

For instance, the financial advice industry has seen many changes to regulations (for both advisors and their clients), advisor business models, and the advisor technology landscape. In the context of the financial planning industry, whereas Financial Advice 1.0 Specifically, Financial Advice 3.0

Nerd's Eye View

MAY 5, 2025

This month's edition kicks off with the news that Altruist has announced a $152 million fundraising round, the latest in a steadily increasing series of capital raises as it has built out new technology features to compete with the "Big Two" custodians of Schwab and Fidelity – leaving the big question of what it intends to do with this fresh (..)

Abnormal Returns

SEPTEMBER 4, 2023

(standarddeviationspod.com) Creative Planning Creative Planning is buying Goldman Sachs' former Personal Financial Management unit. citywire.com) The deal underlines Creative Planning's rapid growth over the past few years. riabiz.com) Creative Planning could reintroduce the United Capital brand.

Darrow Wealth Management

MARCH 31, 2023

There are many financial planning considerations before, during, and after a divorce. A key part of the process from a financial standpoint is dividing the assets. Once the divorce is finalized, a crucial (but often overlooked) part of the process is updating estate documents and beneficiary designations.

Nerd's Eye View

APRIL 3, 2023

million in seed funding to support its growth as it builds out its "end-to-end" financial planning and advice engagement platform (but will it be able to replace, rather than augment, advisors' existing financial planning software?)

Nerd's Eye View

SEPTEMBER 19, 2022

2022 marks the 50 th anniversary of the enrollment of students into the first Certified Financial Planner (CFP) course, and in the years since then, financial planning (and the process of creating a financial plan) has changed extensively.

Steve Sanduski

FEBRUARY 18, 2025

Advisors who learn how to incorporate these and other emerging asset classes into Life-Centered Financial Plans will be offering a valuable service that sets them apart — especially in the eyes of high-net-worth individuals. Including collectibles in estate planning to avoid family disputes.

MainStreet Financial Planning

JANUARY 23, 2025

Review Your Estate Planning Documents Take some time to review the key documents in your estate plan, such as your will, power of attorney, and property deeds. The post Start the Year Strong: Get Your Financials in Shape for 2025 appeared first on MainStreet Financial Planning.

Nerd's Eye View

JUNE 19, 2024

The role of estate planning is most commonly considered to be about transferring assets from one generation to the next in the most efficient manner possible (e.g., how to minimize the burden of estate taxes and avoid the public spectacle of the probate process). at age 21 or 30) or stagger distributions at multiple ages.

Nerd's Eye View

JUNE 19, 2024

The role of estate planning is most commonly considered to be about transferring assets from one generation to the next in the most efficient manner possible (e.g., how to minimize the burden of estate taxes and avoid the public spectacle of the probate process). at age 21 or 30) or stagger distributions at multiple ages.

Nerd's Eye View

SEPTEMBER 3, 2024

Zack is the Director of Financial Planning and Participant Engagement of Greenspring Advisors, an RIA based in Towson, Maryland, that manages $2 billion of private wealth assets under management for 1,300 client households and advises on an additional $5 billion in retirement plan assets.

Abnormal Returns

DECEMBER 5, 2022

Podcasts Rick Ferri talks estate planning with Ryan Barrett and Mike Piper. investmentnews.com) 401(k) plans Auto-enrollment helps boost 401(k) participation rates, the most for men. wsj.com) Planning The ways that a financial planner can add value for a client are nearly limitless. Here are 101 action items.

Nerd's Eye View

OCTOBER 18, 2022

What's unique about Louis, though, is how he and his partner (in anticipation of a shift in the financial advisory industry to more automated client services nearly 10 years ago) developed a robo-advice technology prototype to help clients have their investments managed at a very low cost… which then struggled to gain traction with consumers, (..)

Nerd's Eye View

JULY 25, 2022

Yet despite this – and perhaps even because of it – advisory firms are putting an ever-greater focus on financial planning in 2022, as a way to both show value to clients in the midst of difficult market returns, and, more broadly, to help clients navigate the current environment.

Abnormal Returns

MARCH 20, 2023

(wiredplanning.com) Daniel Crosby talks with Emily Koochel about defining and seeking financial wellness. barrons.com) The FDIC is planning to sell SVB Private separately from the rest of the bank. investmentnews.com) What it's like to make a mid-career shift to financial planning. thinkadvisor.com)

Clever Girl Finance

DECEMBER 1, 2022

No one cares about your financial well-being more than you, so it's important to have a financial plan for yourself. Knowing how to make a financial plan will allow you to save money, afford the things you really want, and achieve long-term goals like saving for college and retirement. What is a financial plan?

Abnormal Returns

MAY 29, 2023

Podcasts Michael Kitces talks with Meg Bartelt of Flow Financial Planning about evolving her practice. kitces.com) Brendan Frazier talks with Bari Tessler, author of "The Art of Money: A Life-Changing Guide to Financial Happiness." financial-planning.com) JP Morgan Chase ($JPM) is dipping its toe in the AI waters with 'IndexGPT.'

Nerd's Eye View

JANUARY 22, 2024

For example, an advisor may think of "risk management" in terms of life and property insurance coverage, whereas HNW clients may instead think of tax and estate-planning strategies as asset protection measures – particularly for the future wealth of their heirs.

Clever Girl Finance

MARCH 19, 2024

No one cares more about your financial well-being than you, so having a personal financial plan is important. Knowing how to make a financial plan will allow you to save money, afford the things you want, and achieve long-term goals like saving for college and retirement. Table of contents What is a financial plan?

Yardley Wealth Management

FEBRUARY 18, 2025

We’ll also explore the role of income tiers, provide real-world case studies, and highlight key considerations when implementing this strategy in your financial plan. Waterfall wealth management simplifies the process by categorizing financial goals into priority levels.

Nerd's Eye View

NOVEMBER 29, 2022

We also talk about how Anh began her career as an attorney, but decided to move away from the more transactional short-term relationship of litigation, and then, it was while she was working for Goldman Sach’s Ayco, that she realized that she could have a greater impact on her clients’ lives through financial planning and ultimately decided (..)

Carson Wealth

JANUARY 4, 2024

Your financial focus and planning in each decade should follow suit. Let’s look at three financial tactics to focus on in each decade of your life, starting with your 20s. Which decade should you really start to plan for retirement? Which decade should you really start to plan for retirement? Invest in yourself.

Nerd's Eye View

JULY 3, 2023

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: All-in-one software platform Blueleaf has launched a new “aggregation-as-a-service” solution, promising better client data aggregation capabilities than existing solutions by automating the process of weaving multiple (..)

eMoney Advisor

FEBRUARY 9, 2023

Of an estimated 104 million households seeking some level of financial advice, 88 million of those households want that advice from a financial professional. In this overview, we will explore the demographics of each stage, the financial planning needs of people in each stage, and strategies for serving them.

WiserAdvisor

NOVEMBER 4, 2022

In addition to this, you can save more and plan for more significant purchases with greater ease. For these reasons and several others, it is essential to follow specific financial planning tips for dual-income families. Is financial planning for dual-income families different from others?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content