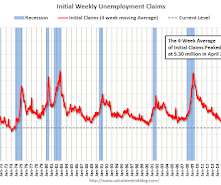

Weekly Initial Unemployment Claims decrease to 243,000

Calculated Risk

AUGUST 25, 2022

The DOL reported : In the week ending August 20, the advance figure for seasonally adjusted initial claims was 243,000 , a decrease of 2,000 from the previous week's revised level. The previous week's level was revised down by 5,000 from 250,000 to 245,000. The 4-week moving average was 247,000, an increase of 1,500 from the previous week's revised average.

Let's personalize your content