Rethinking Wealth Preservation in a Declining Dollar Era

Wealth Management

JUNE 4, 2025

Growing US fiscal pressures prompt advisors to consider Swiss-based investments as a hedge against dollar devaluation and to preserve multigenerational wealth.

Wealth Management

JUNE 4, 2025

Growing US fiscal pressures prompt advisors to consider Swiss-based investments as a hedge against dollar devaluation and to preserve multigenerational wealth.

The Big Picture

JUNE 3, 2025

I’m on the road visiting our new office in Chicago and then heading to meet clients in San Francisco. However, after hearing some misinformation on TV from the usual suspects, I felt compelled to remind people of some key facts about the US debt and deficits. For a period of ~20 years, beginning after the September 11th attack, accelerating after the GFC, and running up until the 2022 rate hikes, the United States enjoyed incredibly low interest rates.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

JUNE 6, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a recent report finds that the number of SEC-registered RIAs, the assets that they manage, and the number of clients they serve all increased between 2023 and 2024 and suggests the industry is robust across the size spectrum, with both smaller and mid-sized firms seeing growth (often pushing them into higher size brackets and/or from state to SEC registration) and re

Calculated Risk

JUNE 3, 2025

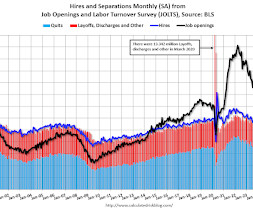

From the BLS: Job Openings and Labor Turnover Summary The number of job openings was little changed at 7.4 million in April , the U.S. Bureau of Labor Statistics reported today. Over the month, both hires and total separations were little changed at 5.6 million and 5.3 million, respectively. Within separations, quits (3.2 million) and layoffs and discharges (1.8 million) changed little. emphasis added The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

JUNE 6, 2025

State Street survey reveals growing retail investor appetite for alternative assets, with private equity expected to benefit most from market democratization.

Abnormal Returns

JUNE 1, 2025

Top clicks this week Want to get wealthy? Own equity. (awealthofcommonsense.com) Great investors take (a lot) of notes. (polymathinvestor.com) Where is all that [ETF] money coming from? (awealthofcommonsense.com) Nothing great happens without conviction. (investing101.substack.com) You've been warned. On the dangers of private equity. (wsj.com) You think the U.S. has an index concentration problem?

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JUNE 4, 2025

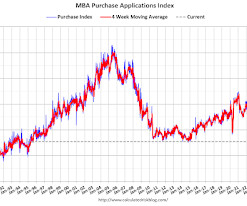

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey Mortgage applications decreased 3.9 percent from one week earlier, according to data from the Mortgage Bankers Associations (MBA) Weekly Mortgage Applications Survey for the week ending May 30, 2025. This weeks results included an adjustment for the Memorial Day holiday. The Market Composite Index, a measure of mortgage loan application volume, decreased 3.9 percent on a seasonally adjusted basis from one week earlier.

Wealth Management

JUNE 6, 2025

In addition, Steward opens an Arizona office with the acquisition of a $225M RIA; Mariner brings on a $1.4B firm with professional athlete clients; and $8B Perigon recruits an advisor from Merrill Lynch.

Abnormal Returns

JUNE 3, 2025

Quant stuff How to (carefully) use ChatGPT in your research. (quantpedia.com) A round-up of recent white papers including 'When the Market Outgrows the Index.' (bpsandpieces.com) The winners of the Quantpedia Awards 2025 including "The Unintended Consequences of Rebalancing" by Harvey, Mazzoleni & Melone. (quantpedia.com) Analysts What analysts actually pay attention to.

Nerd's Eye View

JUNE 3, 2025

Welcome everyone! Welcome to the 440th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Nina Hajjar. Nina is a partner of Stratos CA, a hybrid advisory firm affiliated with Stratos Wealth Partners and based in Los Angeles, California, that oversees approximately $500 million in assets under management for 300 client households.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Calculated Risk

JUNE 2, 2025

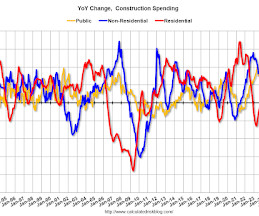

From the Census Bureau reported that overall construction spending decreased: Construction spending during April 2025 was estimated at a seasonally adjusted annual rate of $2,152.4 billion, 0.4 percent below the revised March estimate of $2,162.0 billion. The April figure is 0.5 percent below the April 2024 estimate of $2,163.2 billion. During the first four months of this year, construction spending amounted to $660.2 billion, 1.4 percent above the $651.3 billion for the same period in 2024. em

Wealth Management

JUNE 3, 2025

BNY Pershing head Jim Crowley said this years annual INSITE conference reflects the start of a transition to bringing more of the services of its parent bank to advisors.

Advisor Perspectives

JUNE 4, 2025

The “sell and stay” approach in wealth management mergers and acquisitions (M&A) is a transformative trend reshaping how advisors approach their succession planning and business transitions.

Fortune Financial

JUNE 4, 2025

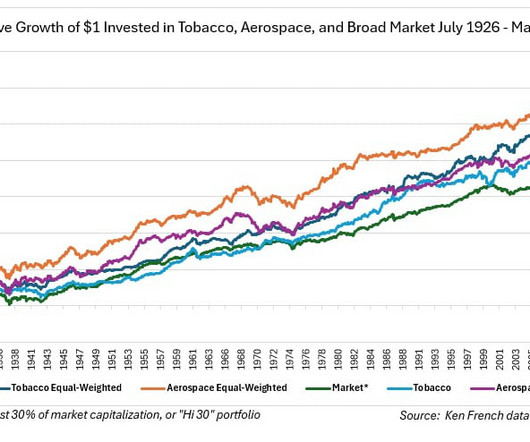

As an investor, imagine if you could invest in an industry that enjoys the pricing power and regulatory barriers enjoyed by tobacco incumbents as well as the growth prospects of high tech? That would be a kind of investment Nirvana, wouldn’t it? Well, it just so happens that such an industry exists, and it is the multilayered aerospace industry.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Calculated Risk

JUNE 4, 2025

From ADP: ADP National Employment Report: Private Sector Employment Increased by 37,000 Jobs in May; Annual Pay was Up 4.5% After a strong start to the year, hiring is losing momentum , said Dr. Nela Richardson, chief economist, ADP. Pay growth, however, was little changed in May, holding at robust levels for both job-stayers and job-changers. emphasis added This was well below the consensus forecast of 120,000.

Wealth Management

JUNE 6, 2025

Jason Smith, the founder and CEO of Prosperity Capital Advisors and JL Smith Holistic Wealth Management shares insights in creating a self-sustaining, scalable financial advisory practice, emphasizing the importance of a documented financial planning process, building an ensemble practice and the cultural and operational shifts required to sustain high performance.

Advisor Perspectives

JUNE 3, 2025

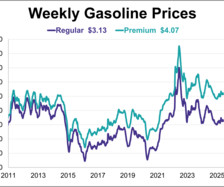

Gas prices dropped for a second straight week this week. As of June 2nd, the price of regular and premium gas were each down 3 cents from the previous week.

A Wealth of Common Sense

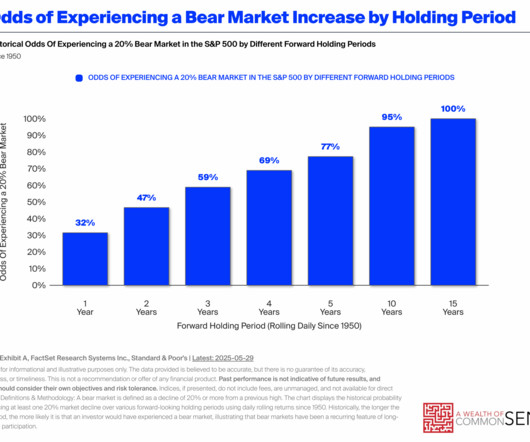

JUNE 1, 2025

I love stock market charts that drive home the benefits of long-term investing. The longer your time horizon, the better your odds have been of experiencing gains in the stock market: This is one of my all-time favorite charts. I use it all the time and I’ll keep using it because it provides a valuable reminder that the long run is your friend as an investor.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Calculated Risk

JUNE 4, 2025

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the May 2025 seasonally adjusted annual sales rate (SAAR) of 446 thousand. Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new record high of 570 thousand SAAR in April 2019.

Wealth Management

JUNE 2, 2025

Private asset manager Partners Group appointed Anastasia Amoroso as managing director and chief investment strategist for private wealth and retirement.

Advisor Perspectives

JUNE 5, 2025

Closed-end funds can offer stable income streams, but also have some benefits over ETFs when it comes to fund structure.

Million Dollar Round Table (MDRT)

JUNE 1, 2025

By Troy Harrison If your prospects or clients are more than 10 years younger than you, there could be a communication disconnect. Society underwent significant cultural and technological changes between the tail end of Generation X and the leading edge of the millennial generation. Those changes greatly impact what millennials want and expect as clients.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

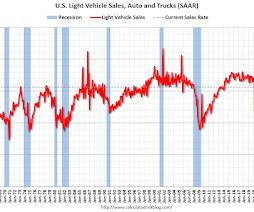

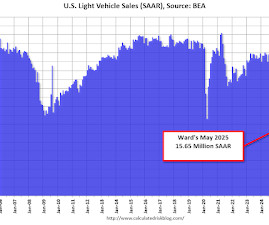

JUNE 3, 2025

Wards Auto released their estimate of light vehicle sales for May: U.S. Light-Vehicle Sales Growth Slows in May After March-April Tariff Surge (pay site). Although sales in May dropped to a level more in line with in fact, slightly below - pre-tariff expectations after spiking above trend in the prior two months due to consumers trying to get ahead of potential tariff-related price increases, part of the cooling off was caused by the drain on inventory from the March-April surge.

Wealth Management

JUNE 4, 2025

Billionaire David Geffen files for divorce from David Armstrong after less than two years, revealing how estate planning can safeguard wealth.

Advisor Perspectives

JUNE 6, 2025

The White House is seriously considering the proposal, at the behest of some of the country’s largest financial firms.

A Wealth of Common Sense

JUNE 3, 2025

I am a middle-aged person so that means I check Zillow regularly. I’m not in the market for a house. I just like checking real estate prices. That’s what you do when you get older. You become interested in real estate. I do it every time I travel somewhere. Our favorite spring break destination these past few years has been Marco Island, FL.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

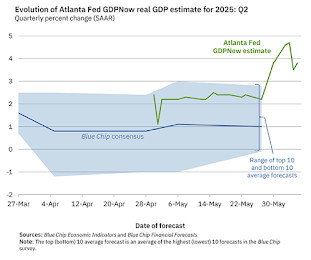

Calculated Risk

JUNE 6, 2025

From BofA: Since our last weekly publication, our 2Q GDP tracking is up to 2.7% q/q saar from 1.8% q/q saar and 1Q GDP is up two-tenths to 0.0% q/q saar. [June 6th estimate] emphasis added From Goldman: The details of the trade balance report indicated that April exports were stronger than our previous GDP tracking assumptions. We boosted our Q2 GDP tracking estimate by 0.4pp to +3.7% (quarter-over-quarter annualized ) and left our Q2 domestic final sales estimate unchanged at -0.5%.

Wealth Management

JUNE 2, 2025

The 11th annual WealthManagement.com Industry Awards, "The Wealthies," will be held in New York City on September 4th.

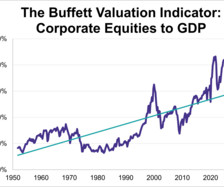

Advisor Perspectives

JUNE 3, 2025

With the Q1 GDP second estimate and the May close data, we now have an updated look at the popular "Buffett Indicator" -- the ratio of corporate equities to GDP. The current reading is 207.8%, down slightly from the previous quarter.

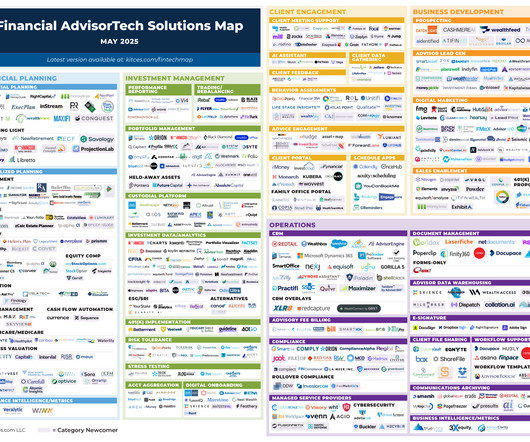

Nerd's Eye View

JUNE 2, 2025

Welcome to the June 2025 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors! This month's edition kicks off with the news that FinmateAI has announced a new integration with PreciseFP, which will allow financial planning data that's collected in advisory meetings (like balance sheet, cash flow, and savings information) to be pu

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Let's personalize your content