Navigating the Thrift Savings Plan: Planning Opportunities To Support Federal Employees, Military Servicemembers, And Veterans

Nerd's Eye View

FEBRUARY 8, 2023

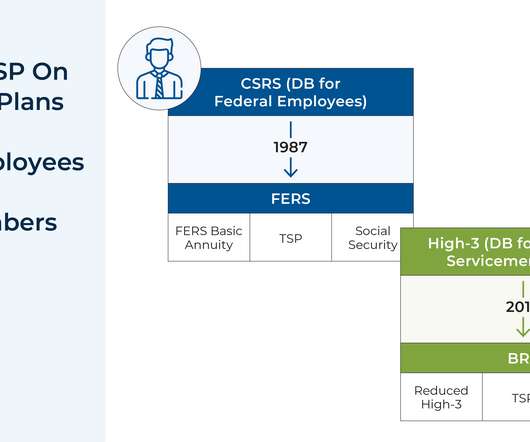

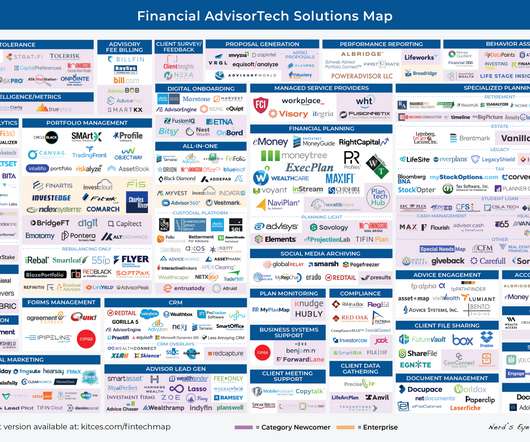

Seasoned financial advisors have likely worked with clients with a wide variety of workplace retirement accounts, which can vary in terms of their investment offerings, fees, and other characteristics. But given that the U.S. government is the largest employer in the country, it can be especially helpful for advisors to be familiar with the ins and outs of (and recent changes to) the Federal government’s own defined contribution plan: the Thrift Savings Plan (TSP).

Let's personalize your content