Five Shifts Transforming Advisor Growth

Advisor Perspectives

OCTOBER 11, 2023

The financial planning landscape is undergoing a great transformation, driven by emerging trends that have accelerated in recent years.

Advisor Perspectives

OCTOBER 11, 2023

The financial planning landscape is undergoing a great transformation, driven by emerging trends that have accelerated in recent years.

The Big Picture

OCTOBER 20, 2023

“I need the US Dollar to be a store of value between the time I make it until I spend it, invest it, pay my taxes with it, or give it away. It does that splendidly.” 1 Today, we’re going to look at a perennial (un)favorite #chartfail. To be more precise, I want to discuss the type of chart that reflects a fundamental misunderstanding of the nature of money, currency, spending, investing, and taxes.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Big Picture

OCTOBER 2, 2023

We all love to use quotations in our arguments. It’s both an appeal to higher authority as well as social proof ( Hey! I’m not the only one who believes this stuff ). I find it useful occasionally to go back to first principles and reconsider the sources that have influenced my thinmking. Along those lines, here are in chronological order, the thinkers who have helped shape how I view the world view, including how I philosophically think about the economy, markets, and investing.

Wealth Management

OCTOBER 4, 2023

Advisors are overdelivering services such as health care, estate and business planning, while falling short in the areas their clients most desire.

Speaker: Dylan Secrest, Founder of Alamo Innovation and Construction Digital Transformation Consultant

Construction payment workflows are notoriously complex when you consider juggling multiple stakeholders, compliance requirements, and evolving project scopes. Delays in approvals or misaligned data between budgets, lien waivers, and pay applications can grind progress to a halt. The good news? It doesn't have to be this way! Join expert Dylan Secrest to discover how leading contractors are turning payment chaos into clarity using digital workflows, integrated systems, and automation strategies.

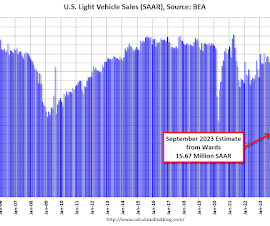

Calculated Risk

OCTOBER 3, 2023

Wards Auto released their estimate of light vehicle sales for September: September U.S. Light-Vehicles Sales Bounce Back Despite Gloomy Conditions (pay site). Hard to say exactly how much but sales could have been slightly stronger in September if not for some lost inventory caused by production cuts related to plant shutdowns from UAW strikes at Ford, General Motors and Stellantis.

Abnormal Returns

OCTOBER 22, 2023

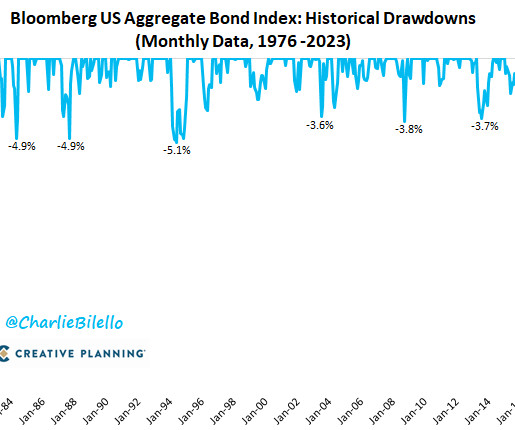

Top clicks this week We are living through the worst bond bear market in history. (awealthofcommonsense.com) Just how expensive are the 'Magnificent Seven' stocks? (blog.validea.com) Why TIPS now merit 'serious consideration.' (morningstar.com) There is no single definitive model for the term premium. (wsj.com) Do investors really understand the return profile of options-writing funds?

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

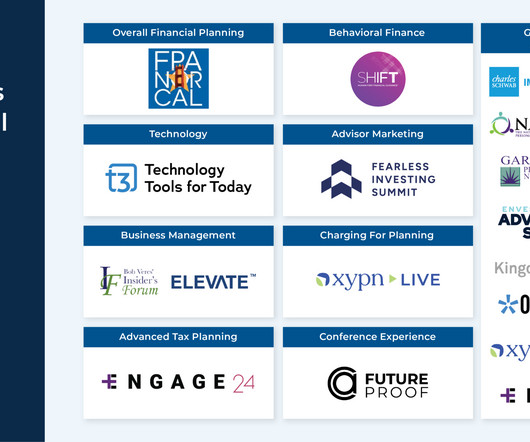

Nerd's Eye View

OCTOBER 30, 2023

After several years of turmoil caused by the pandemic, financial advisor conferences seem to have found a "new [post-pandemic] normal", with events once again growing (some already surpassing their pre-pandemic highs). But that's not to say that the conference landscape was not altered by the pandemic; instead, the pandemic appears to have served as a catalyst that accelerated trends that were already underway, such that financial advisor conferences today look substantively different than they

The Big Picture

OCTOBER 23, 2023

The chart in this morning’s reads shows what it is going to cost to fund the interest payments on the federal debt. It’s gone vertical as rates have moved from effectively 0 to over 5%. When rates were zero all of corporate America refinanced, lowering the cost of their debt to historically low levels. Households did the same; today 61% of homeowners with a mortgage are paying 4% or less in interest.

Wealth Management

OCTOBER 15, 2023

Wealth Management recently asked readers to nominate the investment book that most helped them in their investing careers.

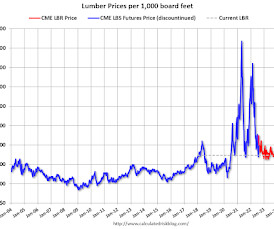

Calculated Risk

OCTOBER 3, 2023

Here is another monthly update on lumber prices. SPECIAL NOTE: The CME group discontinued the Random Length Lumber Futures contract on May 16th. I've now switched to a new physically-delivered Lumber Futures contract that was started in August 2022. Unfortunately, this impacts long term price comparisons since the new contract was priced about 24% higher than the old random length contract for the period both contracts were available.

Advertisement

You wouldn’t keep using a 2009 flip phone - so why settle for outdated close processes? It’s time for an upgrade. SkyStem's Guide to Month-End Close Software walks you through what today’s best tools can do (and what your team shouldn’t have to deal with anymore). Get smart, fast, and a whole lot less stressed when it’s time to close the books.

Abnormal Returns

OCTOBER 29, 2023

Top clicks this week A big regime shift has happened in the economy and financial markets. (ritholtz.com) The bond market bear market is pretty epic. (mrzepczynski.blogspot.com) Byron Wien's 20 rules for investing and life. (ritholtz.com) Why aren't stocks down more? (theirrelevantinvestor.com) Remember the guy who forgot the password for a hard drive with 7,002 Bitcoin on it?

The Reformed Broker

OCTOBER 17, 2023

Join Downtown Josh Brown and Michael Batnick for another round of What Are Your Thoughts? On this week’s episode, Josh and Michael discuss the biggest topics in investing and finance, including: ►Earnings – “Average commercial and consumer loans were both down from the second quarter as higher rates and a slowing economy have weakened loan demand, and we’ve continued to take some credit tighteni.

Nerd's Eye View

OCTOBER 31, 2023

Welcome back to the 357th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Jon Henderson. Jon is the Founder and CIO for Echo45 Advisors, an independent RIA based in Walnut Creek, California, that oversees $163 million in assets under management for more than 180 client households. What's unique about Jon, though, is how he has carefully vetted and curated his advisor tech stack of third-party software to provide a strong "high-tech" client experience… and

The Big Picture

OCTOBER 12, 2023

In August of 2022, I explained how Amazon became ordinary. Today I want to discuss how they have become bad. Since I first discussed the companies that lost my affection during the pandemic nearly two years ago, Amazon continues to stand out as delivering an ever-worsening set of experiences. I wanted to wait until after the (faux retail holiday) Prime Day(s) ended before sharing a few tales of further (to use Cory Doctorow’s phrase) “ Enshittification.” There are many problem

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Wealth Management

OCTOBER 30, 2023

Former rep Sidney Lebental is citing FINRA’s legal sparring match with Alpine Securities to halt disciplinary proceedings against him. Meanwhile, FINRA has responded to Alpine’s allegations.

Calculated Risk

OCTOBER 4, 2023

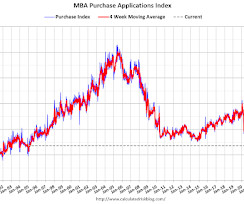

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey Mortgage applications decreased 6.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 29, 2023. The Market Composite Index, a measure of mortgage loan application volume, decreased 6.0 percent on a seasonally adjusted basis from one week earlier.

Abnormal Returns

OCTOBER 1, 2023

Markets The S&P 500 was down 4.77% in September 2023. (on.spdji.com) There's no shortage of stuff to be worried about at the moment. (tker.co) Rates The yield curve is finally steepening. (awealthofcommonsense.com) Higher interest rates mean higher taxes. (marketwatch.com) Closed-end muni funds are trading at big discounts to NAV. (marketwatch.com) Finance Do you really want a private investment targeted to individual investors?

Wealth Management

OCTOBER 9, 2023

This article examines three key use cases where AI can benefit financial advisors: practice management, client engagement and prospecting.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Wealth Management

OCTOBER 4, 2023

Orion Advisor Solutions’ chief behavioral officer explains why advisors should employ “human-first” thinking in their practices at annual Nitrogen conference.

Wealth Management

OCTOBER 6, 2023

Nitrogen’s annual Fearless Investing Conference was a clarion call to advisors for navigating waves of change, with a curated agenda laser-focused on growth through adaptation, agility and optimism.

Wealth Management

OCTOBER 4, 2023

Luis Rosa, founder of Build a Better Financial Future discusses the importance of authenticity in your approach and your business model.

Wealth Management

OCTOBER 4, 2023

The new marketing campaign uses Nitrogen’s “Risk Numbers” to help advisors drive traffic to its “Risk Assessment Questionnaire” and capture leads.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Calculated Risk

OCTOBER 31, 2023

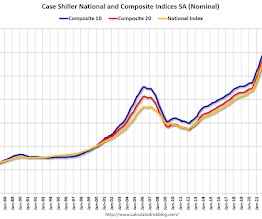

S&P/Case-Shiller released the monthly Home Price Indices for August ("August" is a 3-month average of June, July and August closing prices). This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index. From S&P S&P CoreLogic Case-Shiller Index Continues to Trend Upward in August Click on graph for larger image.

Calculated Risk

OCTOBER 26, 2023

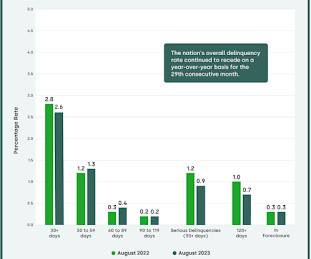

From CoreLogic: US Serious Mortgage Delinquency Rate Drops to All-Time Low in August • The share of U.S. borrowers who were in serious mortgage delinquency (90 days or more late on payments) dropped to 0.9% in August, the lowest recorded since January 1999. • The overall national mortgage delinquency rate (30 days or more late) was at 2.6% in August, also a historic low. • The U.S. foreclosure rate held steady at 0.3% in August, unchanged since early 2022. • Only Idaho and Utah saw slight annual

The Big Picture

OCTOBER 4, 2023

Source: Visual Capitalist Batnick also takes a swing at this: What’s the Stock Market Worth? The post $109 Trillion Global Stock Market appeared first on The Big Picture.

Wealth Management

OCTOBER 16, 2023

It's often a better option, both in terms of dollars and cents and family stress, than passing on a residence to heirs.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Wealth Management

OCTOBER 6, 2023

F2 Strategy's co-founder and CEO provides his take on the most important wealthtech news of the last month.

Calculated Risk

OCTOBER 18, 2023

Today, in the CalculatedRisk Real Estate Newsletter: 30-Year Mortgage Rates Hit 8.0% Excerpt: Mortgage News Daily reports 30-year fixed rate mortgages rose to 8.0% today (for top tier scenarios). This will mostly impact closed sales in November and December, and strongly suggests we will see new cycle lows for existing home sales over the winter. Note: The National Association of Realtors (NAR) is scheduled to release September existing home sales tomorrow, Thursday, October 19th, at 10:00 AM ET

Wealth Management

OCTOBER 16, 2023

Cadre's CEO discusses how the firm uses predictive models and workflow tools to change the real estate investment experience.

Wealth Management

OCTOBER 4, 2023

"If you’re completely adverse to change, you may want to retire real soon.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Let's personalize your content