These Are the Goods

The Irrelevant Investor

MARCH 31, 2019

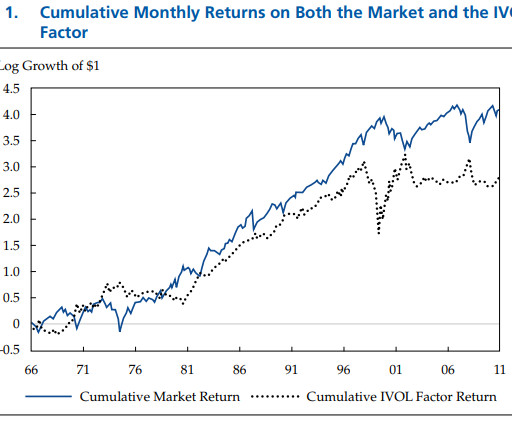

Articles Factor funds underperform their academic factors by about 3% per year By Dan Rasmussen When a measure becomes the target it ceases to be a good measure By Ryan Krueger The people that missed the bubble spent the next eight years ridiculing the people who got sucked into it. By Jared Dillian Permanent information is what teaches you what to do with expiring information By Morgan Housel There are no hard and fast rules.

Let's personalize your content