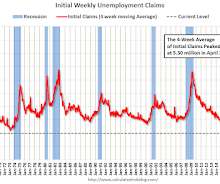

Weekly Initial Unemployment Claims decrease to 186,000

Calculated Risk

JANUARY 26, 2023

The DOL reported : In the week ending January 21, the advance figure for seasonally adjusted initial claims was 186,000 , a decrease of 6,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 190,000 to 192,000. The 4-week moving average was 197,500, a decrease of 9,250 from the previous week's revised average.

Let's personalize your content